Investors had been disenchanted with the weak earnings posted by Wuxi Sunlit Science and Technology Company Limited (HKG:1289 ). While the headline numbers had been comfortable, we consider that traders is perhaps lacking some encouraging elements.

A Closer Look At Wuxi Sunlit Science and Technology’s Earnings

Many traders have not heard of the accrual ratio from cashflow, however it’s truly a helpful measure of how nicely an organization’s revenue is backed up by free money stream (FCF) throughout a given interval. To get the accrual ratio we first subtract FCF from revenue for a interval, and then divide that quantity by the common working property for the interval. This ratio tells us how a lot of an organization’s revenue shouldn’t be backed by free cashflow.

Therefore, it is truly thought-about an excellent factor when an organization has a detrimental accrual ratio, however a foul factor if its accrual ratio is optimistic. While having an accrual ratio above zero is of little concern, we do suppose it is value noting when an organization has a comparatively excessive accrual ratio. That’s as a result of some educational research have prompt that prime accruals ratios are likely to result in decrease revenue or much less revenue development.

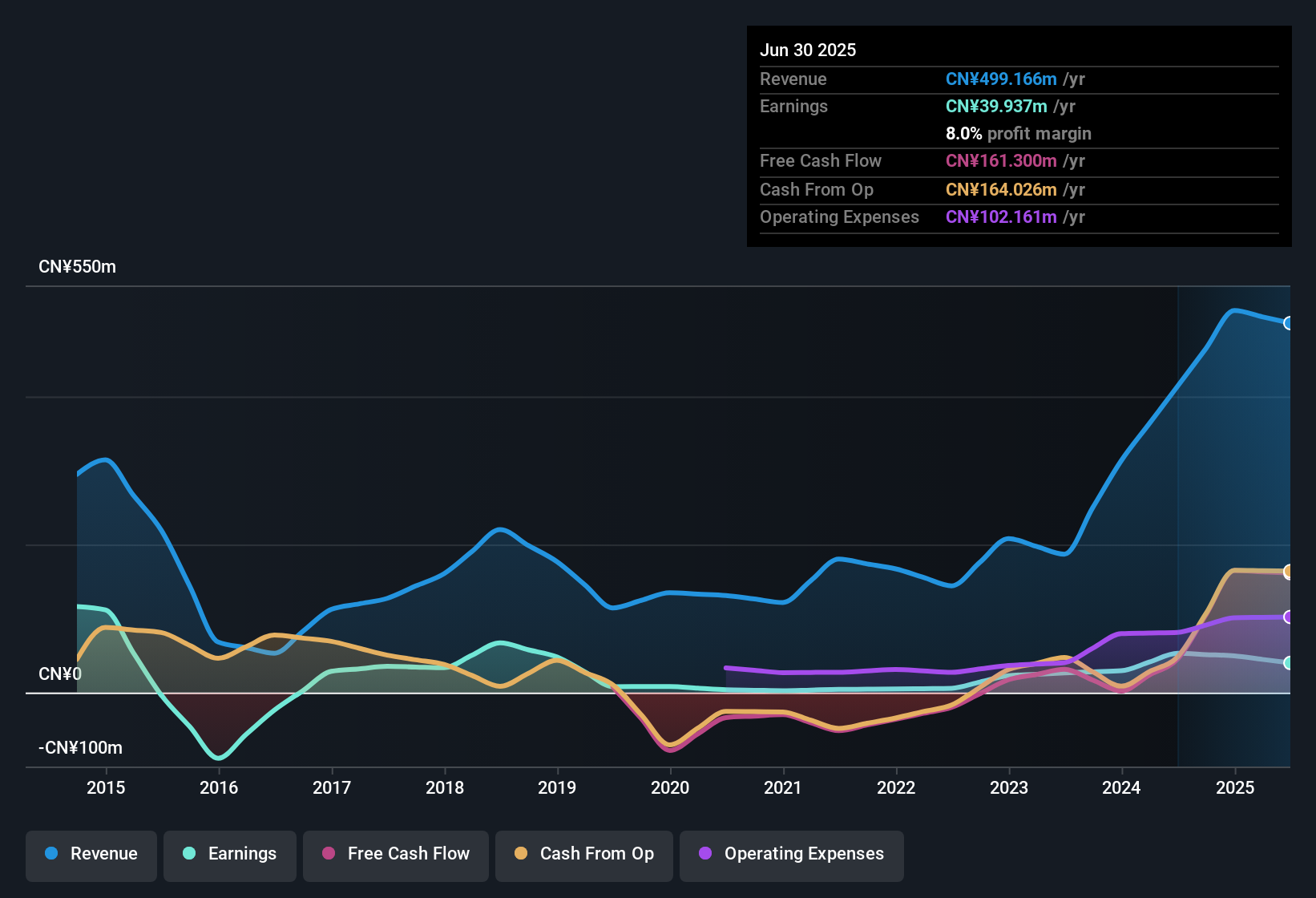

For the yr to June 2025, Wuxi Sunlit Science and Technology had an accrual ratio of -0.32. That signifies that its free money stream fairly considerably exceeded its statutory revenue. Indeed, within the final twelve months it reported free money stream of CN¥161m, nicely over the CN¥39.9m it reported in revenue. Wuxi Sunlit Science and Technology shareholders are little question happy that free money stream improved during the last twelve months. However, that is not all there may be to think about. We can see that uncommon gadgets have impacted its statutory revenue, and subsequently the accrual ratio.

View our latest analysis for Wuxi Sunlit Science and Technology

Note: we all the time advocate traders examine stability sheet power. Click here to be taken to our balance sheet analysis of Wuxi Sunlit Science and Technology.

How Do Unusual Items Influence Profit?

On high of the noteworthy accrual ratio and the spike in non-operating income, we are able to additionally see that Wuxi Sunlit Science and Technology benefitted from uncommon gadgets value CN¥4.3m within the final twelve months. While it is all the time good to have increased revenue, a big contribution from uncommon gadgets typically dampens our enthusiasm. When we crunched the numbers on 1000’s of publicly listed corporations, we discovered {that a} enhance from uncommon gadgets in a given yr is commonly not repeated the following yr. Which is hardly shocking, given the title. Assuming these uncommon gadgets do not present up once more within the present yr, we might thus anticipate revenue to be weaker subsequent yr (within the absence of enterprise development, that’s).

Our Take On Wuxi Sunlit Science and Technology’s Profit Performance

Wuxi Sunlit Science and Technology’s income obtained a lift from uncommon gadgets, which signifies they won’t be sustained and but its accrual ratio nonetheless indicated strong money conversion, which is promising. Based on these elements, we expect that Wuxi Sunlit Science and Technology’s income are a fairly conservative information to its underlying profitability. In gentle of this, if you would like to do extra evaluation on the corporate, it is important to learn of the dangers concerned. Every firm has dangers, and we have noticed 3 warning signs for Wuxi Sunlit Science and Technology it’s best to learn about.

Our examination of Wuxi Sunlit Science and Technology has focussed on sure elements that may make its earnings look higher than they’re. But there are many different methods to tell your opinion of an organization. Some folks contemplate a excessive return on fairness to be an excellent signal of a high quality enterprise. While it would take some research in your behalf, you could discover this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be helpful.

Valuation is advanced, however we’re right here to simplify it.

Discover if Wuxi Sunlit Science and Technology is perhaps undervalued or overvalued with our detailed evaluation, that includes truthful worth estimates, potential dangers, dividends, insider trades, and its monetary situation.

Have suggestions on this text? Concerned concerning the content material? Get in touch with us straight. Alternatively, e mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is basic in nature. We present commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We goal to convey you long-term centered evaluation pushed by basic information. Note that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.