A model of this story appeared in NCS Business’ Nightcap publication. To get it in your inbox, join free here.

New York

—

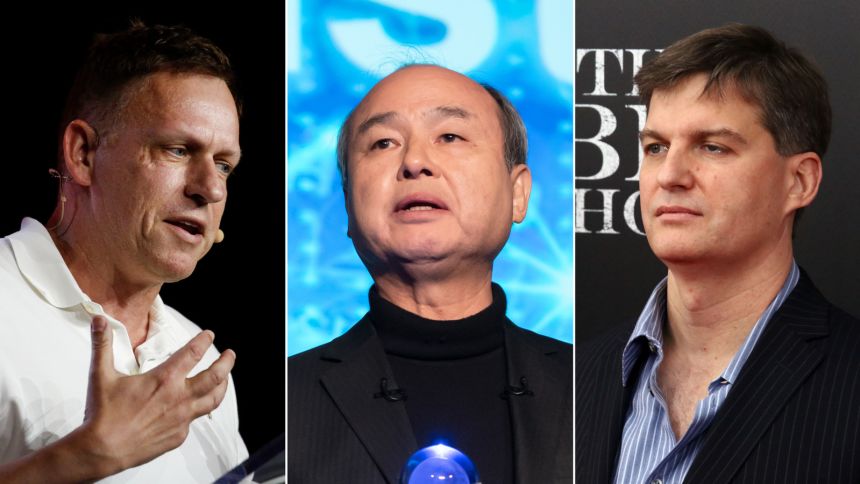

Three outstanding investors with nearly nothing in widespread are dumping their shares of Nvidia, the laptop chip juggernaut that went from relative obscurity to the world’s first $5 trillion valuation in simply three years.

It’s arduous to overstate Nvidia’s superlatives. On its personal it makes up 8% of the complete worth of the S&P 500. Its annual internet revenue grew greater than 580% between 2023 and 2024. It’s turn out to be nearly a joke on Wall Street that the firm constantly blows previous expectations, notching quarter after quarter of monetary good points, due to seemingly bottomless demand for Nvidia’s subtle chips, which are key to constructing synthetic intelligence fashions like OpenAI’s ChatGPT or Anthropic’s Claude.

So why promote now? Isn’t betting towards Nvidia now a bit like betting towards the 1995 Bulls? (As in, you’d be out of your thoughts to take action)?

Maybe not. There are any quantity of the explanation why investors would promote Nvidia, however the timing of these current strikes is fueling considerations that the firm — and by extension, the complete AI trade — is a component of a speculative bubble that’s certain to burst.

On Monday, a regulatory submitting confirmed tech billionaire Peter Thiel’s hedge fund had, someday in the three months ending in September, bought its complete stake in Nvidia — all 537,742 shares, which might be price about $100 million as of September 30, the final day of the quarter. The disclosure, three days forward of Nvidia’s upcoming earnings launch, rattled investors, who are already nervous about when, or whether or not, they’ll see a return on their AI investments.

Thiel’s revelation got here days after Japanese conglomerate SoftBank mentioned it had bought all of its Nvidia holdings for $5.8 billion. And earlier this month, Michael Burry — the “Big Short” investor who anticipated the housing market’s collapse in 2008 — disclosed that his hedge fund had purchased greater than $1 billion in “put” choices towards Nvidia and Palantir, one other AI darling, primarily wagering that their shares will fall.

What do Thiel, Burry and SoftBank learn about Nvidia that the relaxation of us don’t? What are they seeing that the relaxation of Wall Street can’t (or doesn’t need to) see?

To make certain, these of us all had their causes, and never all of them are instantly betting towards Nvidia or AI.

SoftBank and its CEO, Masayoshi Son, stay absolutely aboard the AI hype wagon. But in addition they wanted to gin up a bunch of money quickly to finish a virtually $23 billion funding in OpenAI, prompting them to take their Nvidia earnings.

Burry’s place is a way more skeptical one. In a publish on X, Burry wrote that he believes Big Tech corporations are “understating depreciation” round Nvidia’s core product — primarily, they’ll quickly be sitting on a bunch of gear that’s out of date, and so they’re undervaluing how a lot that can damage their backside line.

Representatives for Thiel, a co-founder of surveillance software program large Palantir and a man who reportedly believes that strictly regulating AI tech will hasten the arrival of the Antichrist, didn’t reply to a request for remark. Thiel has beforehand staked out a reasonably conservative place on AI, telling the New York Times’ Ross Douthat that the know-how is “more than a nothing burger” however “less than the total transformation of our society.”

The timing of these strikes — coming the similar quarter that Nvidia hit $5 trillion in market worth (it’s now again all the way down to a measly $4.5 trillion) — could also be purely coincidental. But they’re not serving to soothe any nerves on Wall Street.

“I don’t read a lot into people’s timing with respect to this stuff,” Paul Kedrosky, a accomplice at SK Ventures, advised NCS. “But I do think that there’s been a kind of Gestalt shift in terms of how people think about this entire area and what are reasonable assumptions about future growth.”

Nvidia sank 2% Monday, whilst analysts anticipated the firm to as soon as once more ship a stable earnings report on Wednesday. Other tech shares and crypto adopted, dragging the broader market down. Wall Street’s worry gauge, the VIX, jumped 13%. NCS’s Fear and Greed index traded in “extreme fear” and hit its lowest degree since early April.

“I think we’re at a tipping point of this bubble,” Mike O’Rourke, chief market atrategist at JonesTrading, advised NCS Monday. “And then you have all these other things that were just massively speculative this year,” he added, citing the crypto rally and the growth of digital asset treasury companies. “Now you’ve seen that very speculative aspect start to unwind, and I wouldn’t be surprised if it bleeds over and people get a little more cautious.”