Technicians stand subsequent to an oil rig which is manufactured by Megha Engineering and Infrastructures Limited (MEIL) at an Oil and Natural Gas Corp (ONGC) plant, throughout a media tour of the plant in Dhamasna village in the western state of Gujarat, India, August 26, 2021.

Amit Dave | Reuters

U.S. President Donald Trump added additional stress to India on Wednesday by bumping up tariffs to 50% — however requires India to instantly cease shopping for Russian oil may trigger world crude costs to spike, business sources advised CNBC.

Trump has accused India of “fueling” Russia’s battle machine and stated the nation is “directly or indirectly importing Russian Federation oil.” As a consequence, the U.S. imposed an additional 25% tariff on India, bringing complete levies in opposition to the foremost U.S. buying and selling accomplice to 50%.

India was as soon as encouraged to purchase Russian crude by the United States, and, in contrast to LNG, Russian crude is not sanctioned, however traded below a value cap to restrict Moscow’s potential to revenue from its sale. India is one of many greatest consumers of Russian oil, in accordance with knowledge from Kpler which exhibits complete Russian crude exports quantity to round 3.35 million barrels per day, of which India takes about 1.7 million and China 1.1 million.

In New Delhi, there have to be “confusion,” Bob McNally, president of Rapidan Energy Group and former White House power advisor to former President George W. Bush, advised CNBC.

“Joe Biden went to India after the invasion of Ukraine and begged them to take Russian oil, the Indians hardly imported any Russian oil, and they begged India, ‘please take the oil,’ so that crude prices would remain low, and they did. Now we’re flipping around and saying, ‘why are you taking all this oil,'” McNally added.

Industry sources in the Indian petroleum sector advised CNBC the nation has abided by all worldwide sanctions, and that India is doing the worldwide economic system a “favor” by shopping for Russian oil which in flip, stabilizes costs. The sources did not want to be recognized as a result of sensitivity of the matter.

India has argued that it if it have been to cease shopping for Russian oil, a plan have to be put in place to stabilize power markets, together with a contingency to fill the shortfall in provide if Russian barrels are taken off the market.

“In case India decides to cut Russian oil imports, the refineries likely would try to find alternative barrels from the Middle East, as they used to rely on those barrels until 2022. Likely other buyers would not step in,” Giovanni Staunovo, a commodity analyst at UBS advised CNBC.

Russia is the third largest world crude producer, after the U.S. and Saudi Arabia. Moscow produces practically 11 million barrels of oil per day, in accordance with the U.S. Energy Information Administration. India’s Russian crude oil imports was 38% in each 2023 and 2024 and is at the moment 36% in 2025. Total Indian crude imports are growing every year with rising demand, and in consequence, imports of Russian crude in 2025 are their strongest annual tempo but.

If this provide was to be faraway from the market, costs would skyrocket, in accordance with the business sources in the Indian petroleum sector. “If India were to stop buying Russian crude oil today, global crude prices could jump to over $200 per barrel for all global consumers,” an business supply advised CNBC.

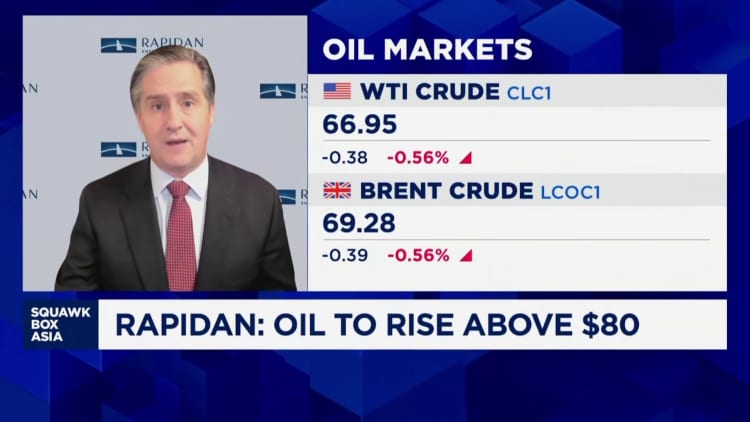

“Very near term, there is a risk of a pop in brent prices to $80 or above,” McNally advised CNBC, signaling that the influence of further tariffs and a possible lower to Russian oil imports could be considerably much less catastrophic.

U-turn

“When they didn’t want India to buy something, they told us,” an business supply in the Indian petroleum sector stated. This was certainly the case when India was as soon as buying Iranian crude, which New Delhi not buys and is now sanctioned as Washington doubles down on its most stress marketing campaign in opposition to the Islamic Republic.

Hardeep Singh Puri, India’s petroleum minister, final month advised CNBC’s Dan Murphy: “The price of oil would have gone up to 130 dollars a barrel. That was a situation in which we were advised, including by our friends in the United States, to please buy Russian oil, but within the price cap.”

Sara Vakhshouri, the founder and president of SVB Energy International, advised CNBC the hefty duties introduced by Trump are a “negotiation tactic,” aimed toward “reclaiming lost U.S. oil market share in India and oil export declines since 2022, and securing equivalent export of other commodity to India.”

“India has always coordinated closely on US oil policy, including sanctions on Iranian oil. At the same time, for the Trump administration, energy security, affordability, and reliability are priorities” Vakhshouri added.

Russian crude has been positioned below a value cap by the European Union since Moscow’s 2022 invasion of Ukraine. That value cap, set at $60 per barrel, permits Russia to export its crude, however at a value decrease than the commodity usually trades. The purpose is to restrict Moscow’s income from oil exports, constricting the nation’s potential to finance its battle in Ukraine. The coverage was carried out by G7 nations, hoping to take care of a secure provide of Russian oil available on the market.

Sources inside the Indian petroleum sector advised CNBC “the price cap is a $1 to $2 difference” and insists New Delhi is not shopping for Russian crude at a significant low cost per barrel.

Even Russian LNG is not “completely under US secondary sanctions, Europe still buys gas from Russia via pipelines and LNG. Only some Russian LNG export terminals (e.g. Artic LNG 2) are under sanctions, but not all LNG exports,” UBS’ Staunovo, advised CNBC.

In 2021, Russia was the most important provider of petroleum to the European Union. After the bloc’s ban on seaborne imports of Russian crude, the share of imports from Moscow fell from 29% to 2% in the 2025. The EU nonetheless imports 19% of its LNG from Russia, in accordance with knowledge from the primary quarter of 2025 from Eurostat.

Russia is a member of OPEC plus, established alongside Saudi Arabia in 2016. The group works to stabilize oil costs, adjusting output primarily based on market fundamentals and developments in provide and demand. A bunch of eight producers simply moved days in the past to boost output in September, absolutely unwinding cuts and serving to calm fears of Russian provide considerations.

“While OPEC+ countries hold spare capacity to tackle supply disruptions, a full drop in Russian crude production/exports would see that spare capacity completely dwindling. The Biden administration was aware of this,” UBS’ Staunovo stated.

The Russian value cap aimed “to reduce the revenues of the Russian government by allowing Russian oil to remain in the markets and to prevent an oil price spike,” Staunovo added, noting that these choices have been made in the run as much as a presidential election in the U.S.

Now, after profitable that very election, Trump means enterprise. Before slapping an extra 25% tariff on India on Wednesday, he advised CNBC that India “hasn’t been a good trading partner.”

It signifies that U.S. ties with New Delhi, a key safety and protection accomplice, might be in danger. India responded sharply to Trump’s criticism on Wednesday, saying it was “unjustified and unreasonable” and that it purchased Russian oil with U.S. help.