In a stunning reversal of the United States’ years-long know-how restrictions on China, President Donald Trump final month allowed Nvidia to resume sales of a key AI chip designed particularly for the Chinese market.

Yet moderately than celebrating, Beijing’s response has been noticeably lukewarm, regardless of having lengthy urged Washington to ease the stringent export controls. In the weeks since the coverage U-turn, Beijing has known as the chip a security risk, summoned Nvidia for explanations and discouraged its firms from utilizing it.

The less-than-welcoming sentiment displays Beijing’s drive to construct a self-sufficient semiconductor provide chain – and its confidence in the progress its quickly advancing chip trade has made.

But the chilly shoulder may characterize some political posturing. Despite important advances in its semiconductor sector, China nonetheless wants America’s chips and know-how. Experts stated China’s nationwide champion Huawei has developed chips with efficiency akin to — and in some instances surpassing — the newly accredited Nvidia chip. However, China nonetheless desires the extra superior AI processors that stay blocked below US export controls.

In the years since Trump first imposed tech restrictions on Huawei throughout his first time period, China’s chip know-how has made important strides, spurred by the frustration that mounted as Washington piled on export controls, stated Xiang Ligang, director-general of a Beijing-based know-how trade group and an advisor to the Ministry of Industry and Information Technology.

“We have this capability, it’s not as they imagine – that if China is blocked, China won’t be able to function, or that China will be finished,” he stated.

To him, the coverage about-face solely displays the significance of getting a completely homegrown chip provide chain.

“For Chinese companies, we may only have one choice if we wish to ensure a relatively secure supply of chips – that means relying on our own domestically produced chips,” Xiang stated.

That could also be China’s objective, but in the high-stakes AI race, with all its nationwide safety implications, the US stays the chief, no less than for now.

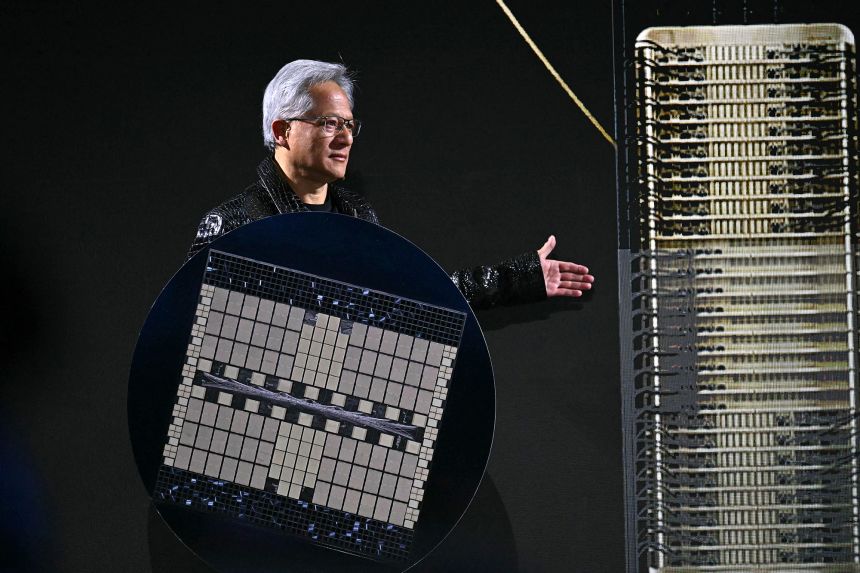

The chip in focus is Nvidia’s H20, which was launched by the AI chip chief final yr to keep up entry to the Chinese market following strict export controls put in place below the Biden administration that stopped the export of chips with excessive processing energy.

Last month, Trump greenlit the gross sales of the chip to China after banning it in April as the US commerce frictions with China deepened.

Trump has justified his determination by calling the chip “obsolete,” as it lags behind the firm’s cutting-edge AI processors like Blackwell or H100, from which H20 is derived. He and his officers appeared to have embraced a view lengthy promoted by Nvidia’s CEO Jensen Huang – that US can preserve its tech management solely via guaranteeing its chips stay the international customary.

“You want to sell the Chinese enough that their developers get addicted to the American technology stack,” Commerce Secretary Howard Lutnick stated final month.

But the dramatic reversal has fueled questions on Trump’s transactional strategy to nationwide safety – as soon as thought-about off-limits to bargaining.

China, on the different hand, is alarmed by the alleged security risks of Nvidia’s H20s like “tracking and positioning” and “remote shutdown” options, capabilities that some US lawmakers have known as for but Nvidia denies it has positioned in its chips.

China’s our on-line world watchdog and trade ministry have since summoned the American chip large over the safety issues and urged companies to keep away from H20 chips, a improvement which was beforehand reported by Bloomberg.

One main Chinese tech firm which has developed its AI fashions has obtained discover from the authorities urging it to train warning in the use of H20s, and advising it to not buy them, an organization insider stated on the situation of anonymity.

NCS has reached out to the ministry and the our on-line world authorities for remark.

An Nvidia spokesperson advised NCS that NVIDIA “does not have ‘backdoors’ in our chips that would give anyone a remote way to access or control them.”

“Banning the sale of H20 in China would only harm US economic and technology leadership with zero national security benefit,” the spokesperson added.

But China believes the US isn’t enjoying pretty, Xiang stated.

“What we actually want, you refuse to sell us. For the things you already consider obsolete, you still want to dump them into our market and occupy our market. Do you really think we’re that naive?” he stated.

Despite Beijing’s issues and the H20’s decreased efficiency, the chips stay extremely wanted by Chinese firms.

Equity analysis agency Bernstein estimated that cargo of the chips to China this yr would have reached 1.5 million items, or about 23 billion in income, with out Trump’s export restrictions. Major patrons embody Chinese tech giants akin to TikTookay proprietor ByteDance, Alibaba and Tencent.

While Huawei’s prime AI chips excel in computing energy – certainly one of the key measures in evaluating processors’ efficiency – compared with H20, they fall brief by way of reminiscence bandwidth, which determines how a lot knowledge can transfer between a chip’s reminiscence and computing unit.

That bandwidth will depend on a know-how referred to as High Bandwidth Memory (HBM) utilized in AI chips to make sure environment friendly knowledge transmission in AI mannequin coaching.

China’s prime HBM maker CXMT, or ChangXin Memory Technologies, continues to be about three to 4 years behind trade leaders like South Korea’s SK Hynix and Samsung, and American Micron, in line with MS Hwang, analysis director at Counterpoint Research, a analysis agency.

Last yr, the Biden administration additional tightened export controls on China, together with restrictions on HBM gross sales, forcing Chinese firms to depend on present stockpiles.

Beijing has requested Washington to raise restrictions on HBM as a part of the commerce deal negotiations, Financial Times reported this week.

Key attraction of H20 for Chinese firms additionally lies in Huawei’s restricted manufacturing capability and Nvidia’s well-established ecosystem, stated Qingyuan Lin, senior analyst at Bernstein focusing China’s semiconductor trade.

“Even when you want to completely replace the H20 demand with the local guys, they’re not able to deliver the amount of chips that’s needed,” he stated.

The provide bottlenecks stem from constraints in scaling up manufacturing of each the manufacturing of computing items of the AI chips and the integration of varied elements in them, a know-how referred to as superior packaging in the trade, Lin stated.

Bernstein estimated that Huawei’s shipments of its superior AI chips in 2025 would quantity to round 700,000 items, nonetheless far in need of the demand in the nation.

NCS has reached out to Huawei for remark.

Meanwhile, Nvidia’s highly effective ecosystem, which integrates its chips with its software program platform, has created what consultants name a “moat,” making it troublesome and dear for AI builders who prepare fashions on its software program to modify to alternate options.

“The H20 comes with a complete ecosystem covering both hardware and software support, ensuring better compatibility and ease of integration,” stated Brady Wang, affiliate director at Counterpoint. “This ecosystem maturity is still a challenge for many Chinese-developed chips, making the H20 more attractive despite its cost disadvantage.”

Still, consultants stated China’s speedy progress in semiconductor know-how shouldn’t be underestimated. Years of tightening export controls have injected each urgency and alternative into Beijing’s push for self-sufficiency, Lin stated.

While chipmaking know-how appeared to stall after Huawei’s 2023 flagship smartphone showcased superior chips that American officers had deemed extraordinarily troublesome to provide, home chipmaking tools firms have been steadily gaining floor, he stated.

“The local guys actually had very little chance to gain share from the global players because of the technology gap, but export controls created a market that didn’t exist before and accelerated the domestic substitution,” he stated.

Bernstein tasks that the share of selfmade AI chips in China will surge from 17% in 2023 to 55% by 2027, whereas American suppliers like Nvidia and AMD will shrink to 45% from 83%.

In April, Huang of Nvidia met with Trump in Washington, urging the administration to loosen export controls on chips and saying that the diffusion of American AI know-how round the world must be accelerated.

“There’s no question that Huawei is one of the most formidable technology companies in the world…they made enormous progress in the last several years,” he stated.

“China is right behind us. We’re very, very close.”