Editor’s Note: Sign up for NCS’s Meanwhile in China newsletter which explores what you want to learn about the nation’s rise and the way it impacts the world.

NCS

—

The US authorities has imposed contemporary export controls on the sale of high tech memory chips utilized in synthetic intelligence (AI) functions to China.

The guidelines apply to US-made high bandwidth memory (HBM) expertise in addition to foreign-produced ones.

Here’s all the pieces you want to learn about these cutting-edge semiconductors, which have seen demand soar together with the international frenzy for AI.

What is high bandwidth memory?

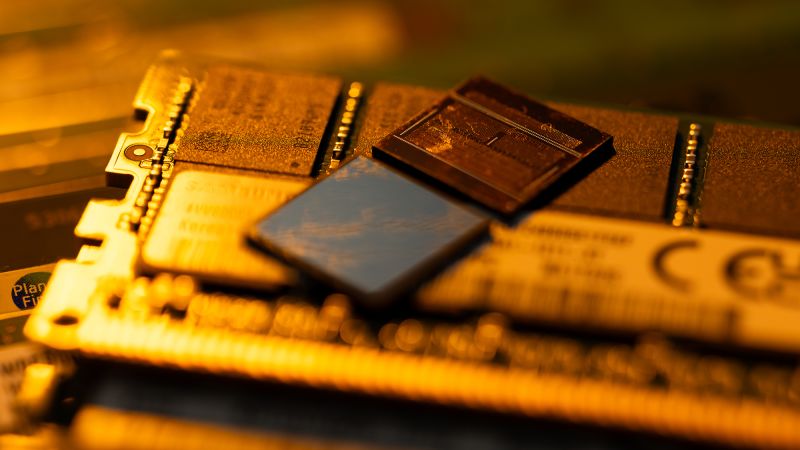

High bandwidth memory (HBM) are principally a stack of memory chips, small elements that retailer knowledge. They can retailer extra data and transmit knowledge extra rapidly than the older expertise, known as DRAM (dynamic random access memory).

HBM chips are generally utilized in graphic playing cards, high-performance computing methods, knowledge facilities and autonomous automobiles.

Most importantly, they’re indispensable to operating more and more well-liked AI functions, together with generative AI, that are powered by AI processors, reminiscent of the graphic processing models (GPU) produced by Nvidia (NVDA) and Advanced Micro Devices (AMD).

“The processor and the memory are two essential components to AI. Without the memory, it’s like having a brain with logic but not having any memory,” G Dan Hutcheson, vice chair of TechInsights, a analysis group specializing in chips, informed NCS.

The newest set of export restrictions, introduced on December 2, observe two earlier rounds of curbs on superior chips introduced by the Biden administration over three years years, with a view to blocking China’s access to essential expertise that might give it a army edge.

As retaliation, Beijing hit again by imposing contemporary curbs on exports of germanium and gallium and different supplies parts important for making semiconductors and different high tech gear.

Experts say the newest export restrictions will sluggish China’s improvement of AI chips and, at most stall, its access to HBM. While China’s capacity to produce HBM at present lags South Korea’s SK Hynix and Samsung and America’s Micron (MU), it is creating its personal capabilities in the space.

“What the US export restrictions would do is cut China’s access to HBM of better quality in the short run,” stated Jeffery Chiu, CEO of Ansforce, an professional community consultancy specializing in tech, informed NCS. “In the long run though, China will still be able to produce them independently, albeit with less advanced technologies.”

In China, Yangtze Memory Technologies and Changxin Memory Technologies are the main producers of memory chips. They are purportedly ramping up capability to construct HBM manufacturing strains to fulfill its strategic aim of tech self-sufficiency.

What makes HBM chips so highly effective is primarily their bigger cupboard space and a lot quicker pace of passing alongside knowledge, in contrast to standard memory chips.

Because AI functions require loads of advanced computing, such traits be sure that these functions run easily, with out delays or glitches.

Larger cupboard space means extra knowledge might be saved, transmitted and processed, which reinforces the efficiency of AI functions as the giant language fashions (LLM) allow them to have extra parameters to prepare on.

Think of the quicker pace of sending over knowledge, or greater bandwidth in chips parlance, as a freeway. The extra lanes a freeway has, the much less doubtless there can be a bottleneck and thus the extra automobiles it could actually accommodate.

“It’s like the difference between a two-lane highway and a hundred-lane highway. You just don’t get traffic jams,” stated Hutcheson.

Currently, simply three firms dominate the international market of HBM.

As of 2022, Hynix accounted for 50% of the complete market share for HBM, adopted by Samsung at 40% and Micron at 10%, in accordance to a research note printed by Taipei-based market analysis company TrendForce. Both South Korean corporations are anticipated to tackle comparable shares in the HBM market in 2023 and 2024, collectively commanding round 95%.

As for Micron, the firm goals to grow its HBM market share to someplace between 20% and 25% by 2025, Taiwan’s official Central News Agency reported, citing Praveen Vaidyanatha, a senior govt at Micron.

The high worth of HBM has led to all producers dedicating a good portion of its manufacturing capability in the direction of the extra superior memory chip. According to TrendForce’s Senior Research Vice President Avril Wu, HBM is expected to account for greater than 20% of the complete marketplace for commonplace memory chips by worth beginning in 2024 and doubtlessly exceeding 30% by subsequent yr.

Imagine stacking a number of commonplace memory chips in layers like a hamburger. That is primarily the construction of HBM.

On the floor it sounds easy sufficient, however it is no straightforward feat to pull off, a lot in order that it displays on the worth. The unit gross sales worth of HBM is a number of occasions greater than that of a standard memory chip.

That is as a result of the top of an HBM is roughly that of six strands of hair, which suggests every layer of these commonplace memory chips which can be stacked collectively want to be extraordinarily skinny as nicely, a feat that requires top-notch manufacturing experience often known as superior packaging.

“Each of those memory chips need to be ground to as thin as the height of half a strand of hair before they are stacked together, something very difficult to pull off,” stated Chiu.

In addition, holes are drilled on these memory chips earlier than they’re mounted on high of one another for electrical wires to move by, and the place and dimension of those holes want to be extraordinarily exact.

“You have a lot more failure points when you try to make these devices. It’s almost like building a house of cards,” Hutcheson stated.