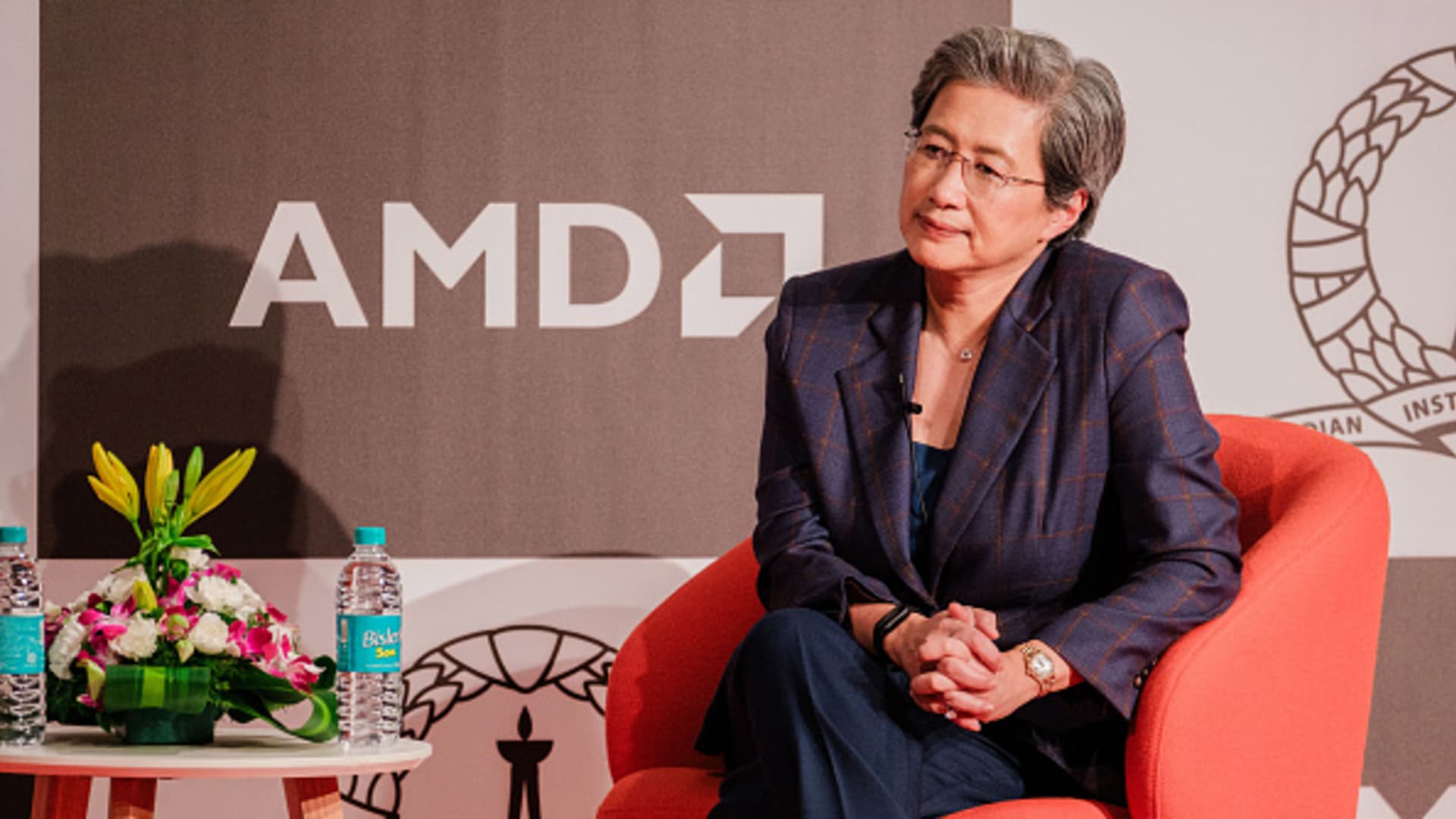

A cash-covered put technique, often known as a unadorned put or just a lined put in some contexts, includes promoting (writing) a put possibility on an underlying inventory whereas concurrently setting apart adequate money in the account to buy the underlying shares if the choice is exercised (assigned). This strategy generates revenue from the premium obtained for promoting the put, whereas positioning the investor to probably purchase the inventory at a reduced efficient worth. The “cash-covered” designation distinguishes it from a “naked” put, the place no collateral is reserved. To execute the technique: Select the underlying asset: Identify a inventory the investor is in proudly owning, sometimes one with reasonable to excessive implied volatility, to maximize premium revenue. Sell the put possibility: Write one put contract (protecting 100 shares) with a strike worth at or under the present market worth (typically out-of-the-money for decrease project likelihood). The premium is credited to the account upfront. Reserve money collateral: Deposit money equal to the strike worth multiplied by the contract multiplier (often 100 shares), making certain the place stays absolutely secured. Monitor expiration: If the inventory worth stays above the strike at expiration, the put expires nugatory, and the investor retains the total premium as revenue. If the inventory falls under the strike, project happens, obligating the acquisition of shares on the strike worth; the efficient price foundation is then decreased by the premium (e.g., a $50 strike with $2 premium yields a $48 web price). If the investor is utilizing “cash-settled” options, no precise project will happen; as a substitute, the account can be debited by the “intrinsic value” of the choice at expiration, if any. For instance, if one bought an SPX 6500 strike put possibility and SPX settled at 6400 at expiration, the account could be debited by $100 multiplied by the contract multiplier, in this case 100. 100 x $100 = $10,000. This technique yields a return profile that features the premium as revenue, with breakeven on the strike minus the premium. Maximum revenue is proscribed to the premium, whereas most loss happens if the inventory declines to zero (offset partially by the premium). Suitability and optimum circumstances The cash-covered put is best suited for buyers with a impartial to reasonably bullish outlook on the underlying inventory, notably these searching for to enter a protracted place at a cheaper price than the present market worth. It appeals to income-oriented portfolios the place the investor is ready to personal the shares if the market dips, viewing the premium as compensation for the danger. Key situations embody: Sideways or mildly declining markets: The technique thrives when the inventory stays steady or experiences restricted draw back, permitting premium retention with out project. Elevated implied volatility: Higher volatility inflates put premiums, enhancing yield (e.g., 1–5% month-to-month returns in unstable environments). Stocks desired for possession: Ideal for essentially robust equities buying and selling at premiums to intrinsic worth, the place the investor anticipates long-term appreciation however is keen to purchase on weakness. Risks embody the chance price of tied-up money and full publicity to draw back past the premium (although much less extreme than bare places). It is much less acceptable in sharply bearish markets, the place project could lead on to important unrealized losses on the acquired shares. Investors might want a cash-covered put over a buy-write (lined name) beneath particular circumstances, as each methods generate premium revenue however differ in entry necessities, threat profiles, and market convictions: In essence, the cash-covered put fits proactive entry methods, whereas the buy-write enhances yields on current holdings. Selection depends upon portfolio goals, with the previous favoring potential accumulation and the latter favoring retention and revenue enhancement. In some ways, the factors for appropriate shares for cash-covered places are related to these for buy-writes (lined calls). The major distinction is that cash-covered places apply to circumstances the place one is trying to purchase shares at a reduction to the prevailing market worth, whereas lined calls contain current holdings. Naturally, each rational investor’s choice is to personal shares at a reduction, however the tradeoff is that present holders have the potential for acquire, whereas these in cash-covered places don’t. Advanced Micro Devices (AMD) AMD’s long-term progress driver is, like many semiconductor firms, the big AI buildout. The firm’s AI income forecast suggests This autumn 2026 knowledge middle income might attain ~$6.23 billion, up from just below $4 billion in This autumn 2024. At simply over 29x ahead earnings estimates, AMD is buying and selling inside 10% of the imply valuation for semis extra broadly. One might discover in the five-year chart under that the 50-day shifting common, whereas imperfect, has been a fairly efficient indicator, and it’s under that indicator now. In truth, a number of indicators recommend that AMD might see some additional weakness even when and because the elementary backdrop for the corporate stays engaging. These are setups that could be fascinating for a cash-covered put. One can look to gather some premium or probably purchase the shares at an extra low cost in the occasion the newest weakness persists in the approaching days and weeks. The following commerce yields $525 in premium or ~ 3.3% of the present inventory worth (recall that every contract represents 100 shares). If one is assigned, the efficient buy worth of the shares (price foundation) would be the strike of $147 much less the premium collected, $147 – $5.25 = $141.75/share x 100 shares, which represents a reduction of greater than 10% to the closing worth on Friday, Sept. 12. DISCLOSURES: None. ( Learn the most effective 2026 methods from contained in the NYSE with Josh Brown and others at CNBC PRO Live. Tickets and data right here . ) All opinions expressed by the CNBC Pro contributors are solely their opinions and don’t mirror the opinions of CNBC, NBC UNIVERSAL, their mum or dad firm or associates, and will have been beforehand disseminated by them on tv, radio, web or one other medium. THE ABOVE CONTENT IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY . THIS CONTENT IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY AND DOES NOT CONSITUTE FINANCIAL, INVESTMENT, TAX OR LEGAL ADVICE OR A RECOMMENDATION TO BUY ANY SECURITY OR OTHER FINANCIAL ASSET. THE CONTENT IS GENERAL IN NATURE AND DOES NOT REFLECT ANY INDIVIDUAL’S UNIQUE PERSONAL CIRCUMSTANCES. THE ABOVE CONTENT MIGHT NOT BE SUITABLE FOR YOUR PARTICULAR CIRCUMSTANCES. BEFORE MAKING ANY FINANCIAL DECISIONS, YOU SHOULD STRONGLY CONSIDER SEEKING ADVICE FROM YOUR OWN FINANCIAL OR INVESTMENT ADVISOR. Click right here for the total disclaimer.