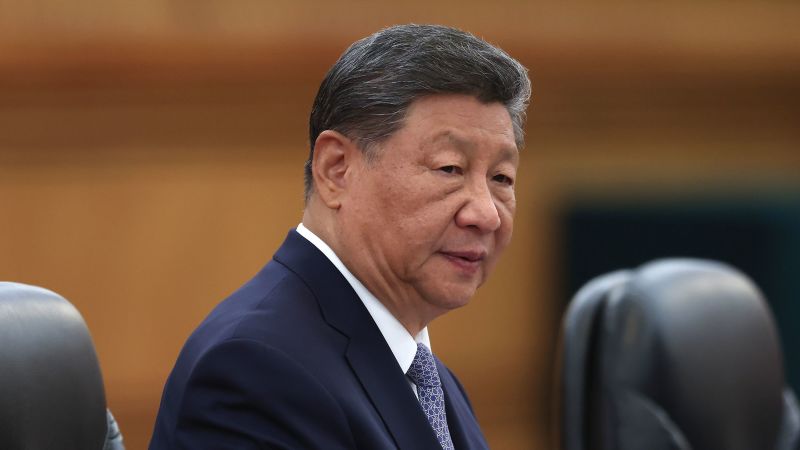

President Donald Trump blasted Chinese chief Xi Jinping on social media over China’s ramped-up efforts to impose export controls on critical rare earths, threatening economic retaliation and saying he not sees any purpose to satisfy with Xi throughout a scheduled go to to the area later this month.

“Some very strange things are happening in China! They are becoming very hostile, and sending letters to Countries throughout the World, that they want to impose Export Controls on each and every element of production having to do with Rare Earths, and virtually anything else they can think of, even if it’s not manufactured in China,” Trump wrote in a post on Truth Social. “Nobody has ever seen anything like this but, essentially, it would ‘clog’ the Markets, and make life difficult for virtually every Country in the World, especially for China.”

Trump additionally threatened economic penalties towards China, warning, “Dependent on what China says about the hostile ‘order’ that they have just put out, I will be forced, as President of the United States of America, to financially counter their move.”

“For every Element that they have been able to monopolize, we have two,” he added.

Beijing ramped up sweeping restrictions on rare earth exports on Thursday, increasing the checklist of minerals beneath management and lengthening controls concentrating on their manufacturing applied sciences and their abroad use, together with for army and semiconductor purposes. The actions focused an acute vulnerability for the US – one which has pushed a big Trump administration effort in current months to determine, and quickly scale up, mining and manufacturing capability. And it instantly set off alarm bells contained in the Trump administration, based on a number of administration officers.

The transfer got here as Beijing has sought to spice up its leverage in commerce talks with the United States and forward of an anticipated assembly between Xi and Trump on the sidelines of the APEC summit in South Korea later this month. Some administration officers noticed it as a transparent effort by Xi to safe leverage forward of his deliberate face-to-face assembly with Trump, whereas others pointed to US export management actions which will have triggered a Chinese response.

NCS has reached out to the White House for readability on if the president’s assembly with Xi is formally canceled.

“I have not spoken to President Xi because there was no reason to do so,” Trump wrote. “This was a real surprise, not only to me, but to all the Leaders of the Free World. I was to meet President Xi in two weeks, at APEC, in South Korea, but now there seems to be no reason to do so.”

White House officers considered China’s transfer this week as a dramatic escalation that would threaten the assembly even earlier than Trump took to social media to publicly make the menace, based on a senior administration official and a supply conversant in the matter. But there are additionally non-public frustrations on the White House after the US Commerce Department expanded the variety of Chinese corporations on an export controls backlist late final month that would have pissed off China, sources stated.

China had invited Trump to go to Beijing whereas he was on his journey to Asia later this month however with none clear deliverables the Trump administration turned down the invitation, based on the senior administration official. They had agreed to work towards a gathering on the sidelines of the economic summit.

Trump on Friday additionally slammed China for selecting to announce the steps Thursday, suggesting doing so minimized his makes an attempt to safe a peace deal between Israel and Hamas.

“The Chinese letters were especially inappropriate in that this was the Day that, after three thousand years of bedlam and fighting, there is PEACE IN THE MIDDLE EAST,” he wrote. “I wonder if that timing was coincidental?”

Trump’s feedback underscore the clear nervousness tied to Xi’s maintain over a market critical to the nationwide safety of the US and its Western allies.

Top Trump officers have convened expertise and rare earth firm executives of their push to speed up growth up and down the provision chain vital for home manufacturing, officers stated.

The message delivered – in conferences and rounds of cellphone calls all through the summer season – was centered on the pressing have to mollify the dangers uncovered by China’s actions within the spring.

The administration’s efforts included the announcement of a $400 million fairness stake in MP Materials Corp, the one US rare earth producer, and a government-backed worth flooring to bolster its operations.

But US officers have acknowledged that the general effort will nonetheless take time and, because of this, depart the nation and its allies weak to Xi’s strategic whims within the close to time period.

That actuality has served as the premise for a number of rounds of US-China commerce talks in current months, and has been a central focus of Trump’s strategy to Xi within the lead as much as their deliberate assembly.

China’s dominance has lengthy been a priority after the nation’s hammer-lock on the market was laid naked throughout a 2010 maritime dispute with Japan.

But Trump’s determination to threaten escalating commerce battle with the nation, on the identical time the US has actively sought to restrict western expertise critical to China’s nationwide and economic safety, sparked Xi’s most aggressive strikes to leverage that market dominance so far.

“It was a real eye-opening moment for the entire world,” a senior US official advised NCS of China’s actions within the spring. “A seismic-level geopolitical moment where everyone realized the scale of the vulnerability.”

Although only a menace at this stage, Wall Street buyers have been taking Trump severely. Stocks sank after the president’s social media submit. The Dow fell 550 factors, or 1.2%. The S&P 500 was down 1.5%, and the tech-heavy Nasdaq tumbled 2%.

Tariff nervousness was at its highest within the spring when tit-for-tat tariffs pushed taxes on Chinese imports as much as a minimal of 145%. Stocks practically entered a bear market in April, and fears solely began to ease up later that month when the Trump administration exempted smartphones and electronics from Chinese tariffs – a big concession that represented the primary signal of a possible breakthrough in what was an efficient embargo on all Chinese items within the US. In May, each China and the United States considerably lowered tariffs, and the markets have since risen to new report highs.

Although Trump finally raised tariffs on dozens of nations’ exports to the United States, tariffs on China had remained comparatively low, retaining economic angst to a relative minimal.

That’s why shares are sinking Friday: The market had largely been ignoring Trump’s tariffs, as a result of China’s commerce dispute had successfully been a sleeping large. Negotiations have been slow-going however had managed to maintain larger tariffs at bay. Now that the enormous could have been woken up, buyers are getting “Liberation Day” fears all over once more. And for a purpose: Trade with China is essential for the US economic system, notably forward of the vacation season (that’s why Amazon and Target’s shares are sinking) and as AI heats up (tech shares are among the many hardest hit Friday).

Tensions have been effervescent for a lot of months: Both China and the US have just lately tightened export controls on key exports, together with rare-earths and AI chips. They’ve launched investigations into every nation’s main corporations and imposed excessive port charges in current months. The US threatened to dam scholar visas and in addition imposed export controls for software program instruments, aerospace gear and the sale of ethane, a serious petroleum byproduct for China.

A US official stated these choices – and extra – at the moment are again on the desk consistent with Trump’s social media warning posted Friday morning.

This is a creating story and will probably be up to date.