President Donald Trump mentioned Tuesday that the 2 largest American banks beforehand rejected him as a customer, reviving claims that conservative shoppers have been being unfairly denied accounts.

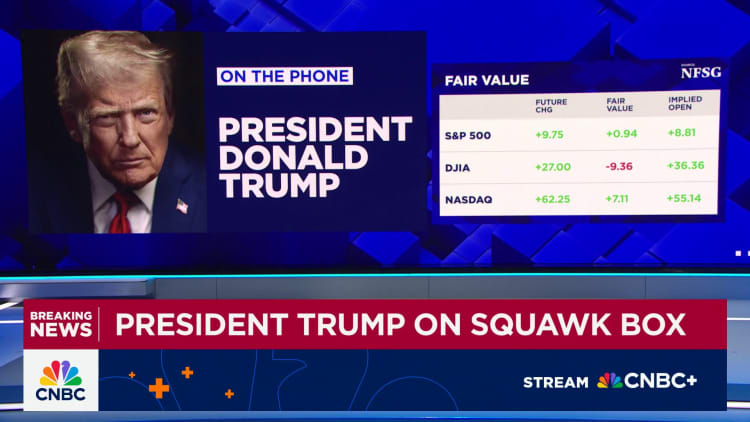

Trump instructed CNBC’s “Squawk Box” in a wide-ranging interview that JPMorgan Chase knowledgeable him he had 20 days to maneuver “hundreds of millions of dollars in cash” to a different financial institution. He did not say when this occurred.

The president mentioned he then approached Bank of America to “deposit a billion dollars-plus” and was instructed the financial institution could not present him an account, Trump mentioned.

“[Bank of America CEO Brian Moynihan] said, ‘We can’t do it,'” Trump mentioned. “So I went to another one, another one, another one. I ended up going to small banks all over the place. I mean, I was putting $10 million here, $10 million there.”

Shares of the 2 banks dipped greater than 1% in afternoon buying and selling.

Some conservatives, crypto executives and spiritual organizations have claimed to be unfairly “de-banked” by massive U.S. monetary establishments. Banks usually deny rejecting clientele primarily based on political or non secular beliefs, however say they’re required to adjust to federal legal guidelines aimed toward stopping monetary crimes, together with the 1970 Bank Secrecy Act, and have confronted regulatory stress associated to crypto and different industries which can be thought-about larger threat for cash laundering or fraud.

The matter came up again in January, when Trump accused Moynihan of denying providers to conservative prospects.

Banks in a bind

The situation places banks in a bind; the businesses threat additional angering the president as he airs grievances that resonate along with his supporters. At the identical time, banks have been a main beneficiary of the Trump administration’s efforts to roll again Biden-era regulatory guidelines throughout a huge swath of monetary actions.

The Trump administration is getting ready an government order that threatens the trade with fines in the event that they drop prospects on political grounds, The Wall Street Journal reported on Monday. A draft model of the order asks regulators to research whether or not banks violated legal guidelines, in accordance with the Journal.

A commerce group for large banks mentioned that “regulatory overreach” was the foundation trigger of the de-banking drawback.

“Banking agencies have already taken steps to address issues like reputational risk, and we’re hopeful that any forthcoming executive order will reinforce this progress by directing regulators to confront the flawed regulatory framework that gave rise to these concerns,” the Bank Policy Institute instructed CNBC.

While Trump on Tuesday talked about his enterprise, probably referring to his actual property and hospitality conglomerate, it wasn’t clear if the occasions he described have been in reference to non-public or enterprise accounts, or each.

Trump mentioned that he believes banks rejected him and his supporters as a result of regulators in the course of the Biden administration utilized stress to the businesses.

In a March lawsuit filed in opposition to Capital One, the president’s firm alleged that the financial institution improperly closed greater than 300 accounts a few months after the Jan. 6, 2021, assault on the U.S. Capitol. The financial institution denied the accusations.

JPMorgan denied concentrating on conservatives or Trump supporters for de-banking.

“We don’t close accounts for political reasons, and we agree with President Trump that regulatory change is desperately needed,” a JPMorgan spokeswoman mentioned Tuesday. “We commend the White House for addressing this issue and look forward to working with them to get this right.”

In a broadcast interview later Tuesday, Moynihan instructed CNBC that Trump was “after the right thing” in phrases of criticizing an trade that’s beholden to a net of laws.

“We bank everybody, but the reality is, we want to make sure that the rules and regulations don’t cause decisions we make that then are looked at in the aftermath” and questioned, Moynihan mentioned.