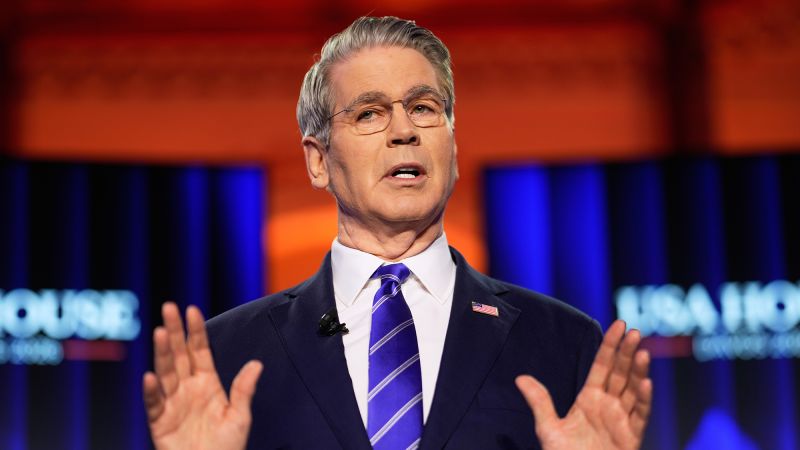

Treasury Secretary Scott Bessent on Wednesday supplied some biting phrases about Denmark, which maintains territorial management over Greenland, after the European nation’s pension fund introduced it could unwind its investment in US authorities bonds.

Bessent stated in response that Denmark and its investment in the United States have been “irrelevant.”

“Denmark’s investment in US Treasury bonds – like Denmark itself – is irrelevant,” Bessent informed reporters at the World Economic Forum in Davos, Switzerland, when requested how involved he’s about institutional buyers in Europe probably pulling out of Treasuries.

“It is less than $100 million. They’ve been selling Treasuries. They have for years,” Bessent continued, including, “I’m not concerned at all.”

Bessent was referring to AkademikerPension, the Danish pension operator, which stated this week it was dumping its $100 million value of US Treasury holdings due to “poor government finances.”

The $100 million makes up a really small portion of the $30.8 trillion US Treasury market however Denmark itself holds just under $10 billion value of US bonds. As Bessent famous, that investment has been on the decline for a number of years – the nation held slightly below $18 billion of US Treasuries as just lately as 2021.

The European Union collectively owns $8 trillion of America’s Treasuries, making it the largest financer of US debt.

Bessent’s feedback come as President Donald Trump has set his sight on buying Greenland and has threatened to slap significant new tariffs on any ally that opposes his efforts.

European international locations have criticized Trump’s plan, and a number of NATO members have deployed small numbers of military personnel to Greenland to take part in joint workouts with Denmark.

A Deutsche Bank analyst this week warned that Trump’s actions in Greenland risked the EU unloading US debt, a transfer that would have vital impacts, together with elevating borrowing prices and exacerbating price of dwelling issues. Bessent on Wednesday criticized that evaluation.

“This notion that Europeans would be selling US assets came from a single analyst at Deutsche Bank. Of course, the fake news media, led by the Financial Times, amplified it,” Bessent informed reporters. “And the CEO of Deutsche Bank called to say that Deutsche Bank does not stand by that analyst’s report.”

Throughout Trump’s tariff saga and different disputes between the US and different international locations, Wall Street analysts have theorized that America’s largest debt holders, together with Japan ($1.2 trillion), China ($682 billion) and Canada ($472 billion), might start to unwind their US Treasury holdings, stopping Congress from elevating cash to fund the large debt. But that hasn’t come to move – demand for US Treasuries has remained excessive, affording Trump and Congress the skill to pay for his home coverage agenda and tax cuts, which added to the nation’s already excessive debt load.

On Tuesday, Trump steered that if courts block his skill to make use of tariffs – a case the Supreme Court is contemplating – he might use tools beyond tariffs to acquire Greenland. He has but to rule out a navy pursuit.

As world elites collect in Davos this week, prime European officers are planning to use the summit to deescalate tensions, three individuals acquainted with the discussions informed NCS.