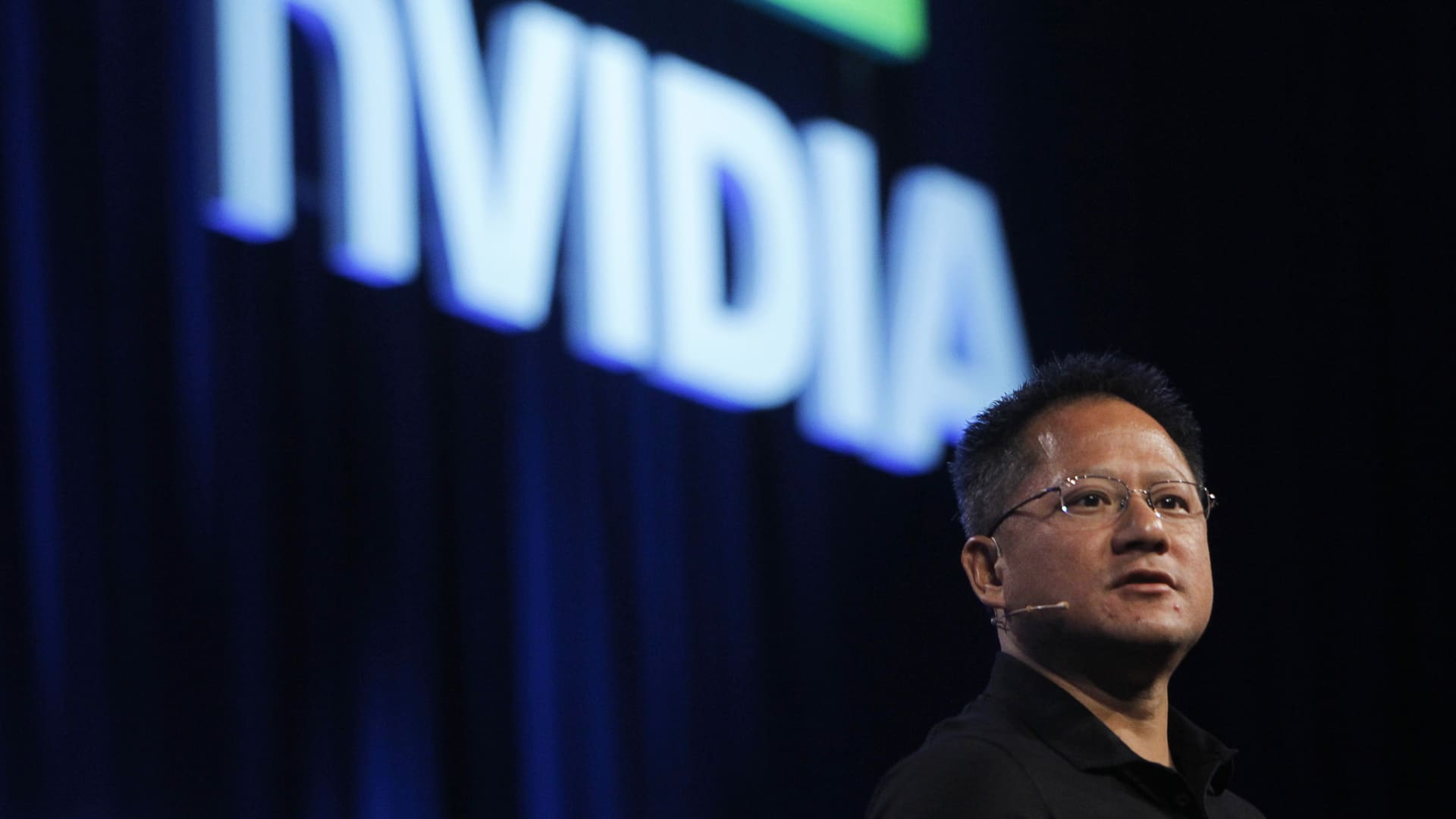

Here are Wednesday’s largest calls on Wall Street: Wells Fargo reiterates Dell as obese Wells stated shares of Dell have extra room to run. “We continue to see Dell as best-positioned AI server momentum story.” Goldman Sachs reiterates Broadcom as purchase Goldman raised its worth goal on Broadcom to $340 per share from $315 forward of earnings on Sept. 4. “We believe expectations are elevated heading into the quarter, but many investors are positioned cautiously given elevated valuation, Street numbers which incorporate healthy growth in 2026, and few near-term catalysts.” Cantor Fitzgerald initiates Travelers as obese Cantor stated it is bullish on shares of the insurance coverage firm. “The pricing cycle is clearly at a transition point, and in our experience, 1) transition points tend to be tricky, 2) stockpicking opportunities are ample, and 3) the big themes matter – in this case, business/client mix. As a result, we prefer Hartford (OW), Travelers (OW), and WR Berkley (OW), which are geared toward smaller customers and underweight more competitive property lines.” Deutsche Bank upgrades Palo Alto Networks to purchase from maintain Deutsche raised its worth goal on the inventory to $220 per share from $200. “We upgrade shares of Palo Alto Networks to a Buy rating and raise our DCF-derived TP to $220 given our thoughts on the health of the business, quality of its leadership, and forward prospects for the announced acquisition of CyberArk.” JPMorgan reiterates CoreWeave as obese JPMorgan stated it is sticking with CoreWeave following earnings on Tuesday. “Despite the reality of lumpiness and volatility in business model, the fundamental drivers and business trends remain very solid, with the company speaking to strong demand that is outstripping supply and conveying robust pipeline momentum.” Goldman Sachs upgrades CACI to purchase from promote Goldman stated the federal government IT firm is beneficiary of the Trump administration “Since the change in administration, and related change in end-market dynamics, CACI increasingly looks like the best positioned company in the space…” Piper Sandler reiterates Nvidia as obese Piper raised its worth goal to $225 per share from $180 forward of earnings later this month. “We are expecting another positive quarter from NVDA and see upside to numbers for both the July and October quarters.” Read extra. Morgan Stanley upgrades AvalonBay to obese from equal weight The agency stated traders can buy the dip in the actual property funding belief. “Upgrade AVB to OW: Worst-performing apartment YTD, but we see best-in-class earnings growth in ’25-’27; we think the market is underestimating development NOI [net operating income].” Morgan Stanley reiterates Nio as obese Morgan Stanley stated in a observe to purchasers that it discovered a number of attainable causes for Nio’s selloff however that it is sticking with the China EV firm. “As most EV startups are not yet in self-funding positions, investors are concerned that strong stock outperformance could lead to potential fundraising activity.” JPMorgan upgrades SailPoint Technologies to obese from impartial JPMorgan referred to as the identification entry administration firm “best of breed.” “SAIL stock has been under pressure ahead of its IPO-related lockup, which expired on August 12, and we see an opportunity with SAIL to own a best-of-breed vendor at a discount as Identity continues to move up the priority stack.” Read extra. Barclays upgrades CF Industries and Corteva to obese from equal weight Barclays upgraded the agribusiness corporations following earnings. “We upgrad e CF and CTVA to OW (from EW) following 2Q results.” Barclays downgrades KinderCare to equal weight from obese Barclays downgraded the kid care firm following its disappointing earnings report on Tuesday. “KLC’s poor start as a public company is evident in its -45% YTD performance; and unfortunately 2Q25 last night was no different.” Jefferies downgrades On Holding to underperform from maintain Jefferies stated the shoe firm’s valuation is just too excessive. “We believe ’25 will mark the peak in ONON’s sales growth rate as U.S. door count expansion slows and sell-in moderates in ’26 as retailer orders flow back to Nike.” Citi initiates Progressive as purchase Citi stated the auto insurance coverage firm has pricing energy. “While the focus of the market is on decelerating top-line, we are focused on how durable Progressive’s margins tend to be following periods of pricing power.” Bank of America upgrades V2X to purchase from impartial Bank of America stated it sees accelerating development for the protection firm. ” V2X’ s strategy to provide a full lifecycle support to increasingly complex military operations has a strong competitive advantage, particularly considering that incumbents have overlooked at these end-markets.” JPMorgan upgrades Capri to obese from impartial JPMorgan upgraded the proprietor of manufacturers like Michael Kors and says the inventory is just too engaging to disregard. “We see CPRI on a path of multi-year sequential revenue. gross, and operating margin improvement, led by a brand reinvigoration strategy at the Michael Kors brand.” Bank of America reiterates Cava as purchase Bank of America stated it is sticking with the Mediterranean restaurant chain following earnings. “We believe CAVA’s growth runway extends well beyond its 1,000 domestic restaurant target, as evidenced by upwardly revised unit economic targets.” Oppenheimer reiterates Walmart as outperform The agency raised its worth goal on Walmart forward of earnings on Aug. 21 to $115 per share from $110. “Following a more difficult backdrop to start the year due to unexpected tariff and expense headwinds, we believe a positive guidance revision cycle could again materialize soon.”