XRP slipped to $2.18 after failing at $2.28, tempering the token’s early-2026 run that’s been sturdy sufficient to earn the “new crypto darling” label in a CNBC phase — and reminding merchants that even crowded narratives nonetheless should clear provide at main resistance.

News background

- XRP’s sturdy begin to 2026 has pushed it again into the highlight, with CNBC this week calling the token the “new cryptocurrency darling” after it outperformed bitcoin and ether within the first week of the 12 months.

- The framing has helped reinforce the concept that probably the most crowded crypto trades could also be shifting, with XRP drawing consideration as a comparatively under-owned large-cap various as bitcoin holds range-bound and ether struggles to regain momentum.

- The transfer has additionally been supported by regular institutional demand via U.S.-listed spot XRP ETFs.

- Market information trackers present the merchandise have continued to absorb web inflows into early January, extending a streak that has stood out towards stop-start flows seen in bitcoin and ether ETFs.

- The identical interval has seen a pickup in bullish social sentiment and bettering community exercise, whereas change reserves have drifted decrease — a dynamic that merchants typically learn as diminished instantly obtainable provide.

- Still, the “darling” label comes with a well-recognized threat for momentum trades: inflows and sentiment can flip shortly if the broader market weakens or if value begins to stall at main resistance.

- That stress is displaying up within the tape now, with XRP failing to carry above key ranges even as the narrative stays supportive.

Technical evaluation

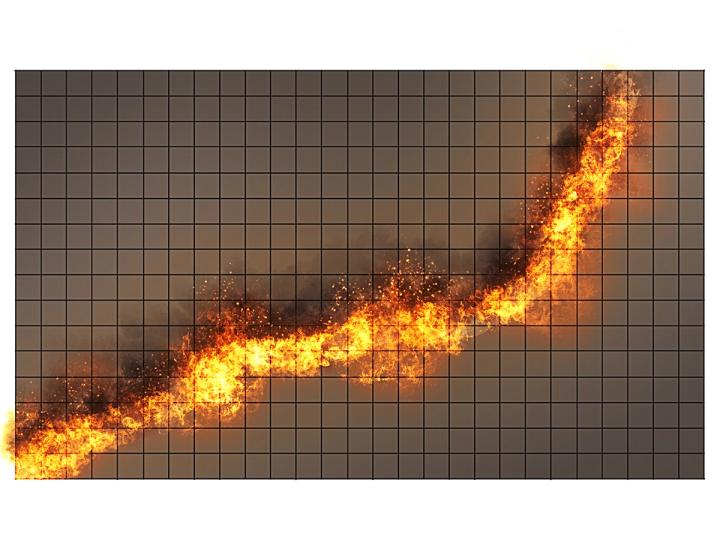

XRP fell 4.4% over the 24-hour interval ending Jan. 8, sliding from $2.28 to $2.18 after repeated failures on the $2.28 space was a decisive selloff. The key inflection level got here round 15:00 UTC on Jan. 7, when quantity spiked to 133.8 million — roughly 121% above the 24-hour common — as value rolled over and broke via successive helps.

The tape reads like promoting into rallies, not a low-liquidity drift. Volume stayed elevated into the decline, and the session construction printed a clear sequence of decrease highs and decrease lows as XRP slid towards $2.15, the place dip demand lastly confirmed up.

On the 60-minute chart, the bounce that adopted regarded constructive however nonetheless early. XRP based mostly close to $2.173–$2.174 (the session low space), printed a better low, and recovered again into $2.18–$2.19 with bettering participation. That places the market in a well-recognized setup: short-term rebound momentum inside a broader construction that also has to reclaim overhead provide.

The greatest degree is simple: $2.28 stays the road. Until XRP can retake that zone and maintain it, rallies are prone to preserve operating into actual presents. Conversely, as lengthy as $2.15 holds, the pullback can nonetheless be interpreted as digestion inside a robust early-year pattern quite than a broader reversal.

Price motion abstract

- XRP slid from $2.28 to $2.18, with the steepest leg decrease triggered by a 121% above-average quantity spike

- The decline pushed value to the $2.15 demand space, the place bids confirmed up and prevented additional extension

- A brief-term base fashioned round $2.173–$2.174, adopted by a rebound again towards $2.19

- The session stays outlined by overhead provide close to $2.20–$2.28 and demand round $2.15

What merchants ought to know

This is a story vs tape market.

The narrative stays supportive: ETF flows, bullish sentiment, and declining change reserves preserve the bigger-picture case intact. But the tape is sending a transparent message: $2.28 remains to be a distribution zone, and the market will not be but prepared to pay via it with out stronger follow-through.

The ranges are clear:

- If XRP can reclaim $2.20 and then retake $2.28, momentum merchants will deal with it as a reset larger, opening a path again into the following provide zone round $2.30–$2.32 and doubtlessly the higher band of the broader vary.

- If $2.15 fails, the market probably rotates into the following demand pocket round $2.10, with $2.00 again in view as a psychological magnet if threat urge for food softens throughout majors.

- The near-term inform is whether or not rebounds proceed to occur on rising quantity (actual demand) or whether or not quantity fades into resistance once more (rally-selling).

Bottom line: XRP remains to be main the year-to-date scoreboard, however this session reveals that outperformance doesn’t take away resistance — it simply shifts the place the market checks conviction.