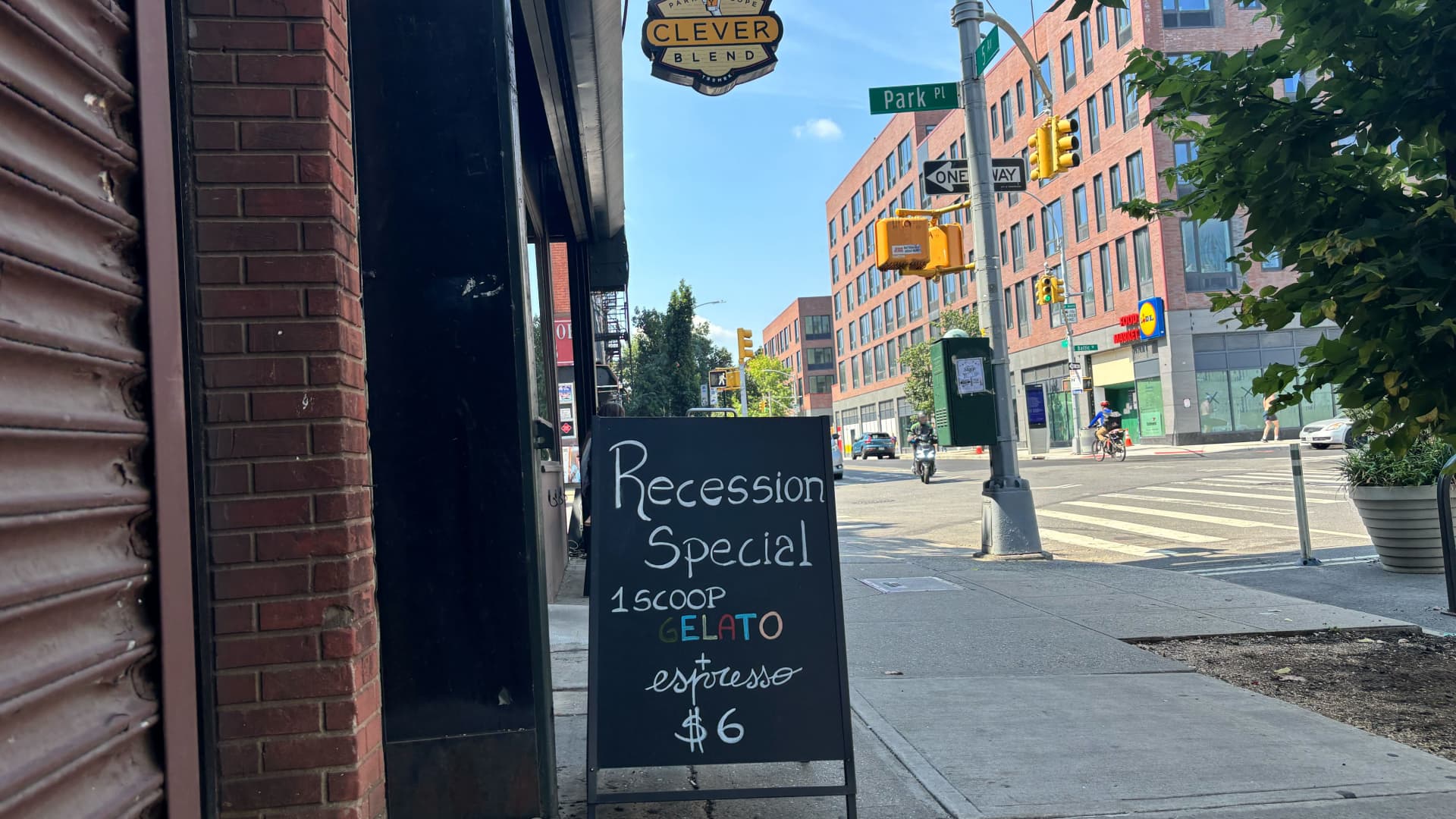

A sign exterior Brooklyn espresso store Clever Blend presents a $6 gelato and espresso “recession special.”

Lisa Kailai Han | CNBC

As fears of a slowing economic system lurk in the background, some companies are taking discover and bringing again so-called recession specials.

Look up the time period “recession specials” by Google’s search engine, and the listing of outcomes will embrace entries from the Great Recession almost 20 years in the past.

Consider this Grub Street article from 2008 slugged “Recession Specials: Your Definitive Guide.” Or this 2009 story from The New York Times, which particulars the mealtime recession specials eating places throughout New York provided as an act of survival.

Fast-forward to 2025 and a crop of institutions are as soon as extra hinting at a looming financial downturn.

When ‘recession’ returns as a promoting level

Recession fears had been heating up this spring as President Donald Trump rolled out a slate of tariffs in early April. The time period “recession indicator” entered the vernacular of social media customers as a tongue-in-cheek manner of gauging a possible financial slowdown.

Businesses are actually getting in on the joke as nicely. For occasion, Brooklyn, New York espresso store Clever Blend advertises a $6 gelato and espresso “recession special.”

Wicked Willy’s, a bar in Manhattan, bought on board by providing a “Recession Pop Party” earlier this month, with one caption on an Instagram post declaring: “The recession is BACK! Get ready to dance and party all night long!”

Market Hotel, a Brooklyn live performance venue, marketed an analogous occasion. “From The Fame to Animal, Circus to Rated R, we’re serving economic anxiety with a side of electro-pop, bloghaus, and auto-tuned glam,” an Instagram caption for the occasion learn. “Dress like rent’s due and you’re dancing through it.”

But the pattern does not simply cease in New York. Super Duper, a burger chain with 18 places throughout the San Francisco Bay Area, tapped in earlier this 12 months with its personal “Recession Burger,” a seasonal particular launched in the summer season.

“THE ONE THING THAT DIDN’T GET THE INFLATION MEMO: Meet the Recession Combo, our new Seasonal Special,” a post from Super Duper’s Instagram reads. The meal features a “Recession Burger,” fries and a beverage for $10.

An Instagram publish from Super Duper Burgers advertises its summer season “Recession Combo” particular.

Courtesy: Super Duper Burgers by way of Instagram

The thought for the burger’s identify did not essentially come from a need to money in on the buzzword, mentioned Ed Onas, Super Duper’s vice chairman of operations. Instead, he mentioned, the moniker was derived from the Depression-era origins of the Oklahoma-style smash burger, which aimed to stretch floor beef by including tons of sliced onions.

But as soon as Super Duper established the burger’s identify, the chain determined to supply a reduced “Recession Combo” for $10. This would save clients $5 from the regular worth of the add-ons, Onas mentioned.

“That’s kind of where the name of the burger plays in … And we figured, we’re calling it the ‘Recession Combo,’ why don’t we just offer a deal that makes it a really good value for our guests?” Onas advised CNBC in an interview. “Inflation has kind of been going on, and we figured it’s a nice offer for a short amount of time for our guests.”

This extra-value combo meal was an exception for Super Duper, which usually does not supply such offers. The burger went viral in an area San Francisco subreddit, with a post gaining 1,400 upvotes and 170 feedback.

“Obviously, we were happy about it. We didn’t realize that it was going to get as much attention as it did,” Onas mentioned. “We were happy, and our guests were happy, and at the end of the day, that’s what it’s all about.”

As a testomony to the burger’s overwhelming success, Onas advised CNBC that Super Duper will be including it onto its menu as a everlasting fixture going ahead.

Shedding gentle on waning consumer sentiment

These small companies getting in on the pattern could be a broader response to waning consumer confidence. Consider that the University of Michigan’s consumer sentiment index got here in at 58.6 in August, down from a studying of 61.7 in July and reflecting a 13.7% change on a year-over-year foundation.

This souring in sentiment has been pushed primarily by considerations over commerce coverage, mentioned Joanne Hsu, director of the surveys of customers at the University of Michigan.

“What’s very clear from the consumer sentiment data is that consumers are broadly bracing for a slowdown in the economy and a deterioration — not just with inflation, expecting inflation to get worse — but they’re also expecting businesses conditions to deteriorate,” she mentioned. “They’re expecting labor markets to weaken and unemployment rates to go up. And what you’re seeing with these businesses could be a reaction to that.”

A scarcity of consumer confidence — and belief in revenue reliability — will in the end result in a pullback in spending, Hsu added.

“Young people are feeling just as bad about the economy as older folks, and in some months they feel even worse than older folks,” she mentioned. “Across the age distribution, people agree that the trajectory of the economy has soured.”