You know that cliché in films when the digital camera zooms in on a character who says, “It’s coming,” earlier than another person dramatically replies, “It’s already here”? Prediction markets are a bit like that in the sporting world, each coming quickly and already right here.

Established sports betting corporations like Fanatics, DraftKings and FanDuel launched prediction market merchandise earlier this month. Meanwhile, corporations like Kalshi and Polymarket have been in the house for a number of years however have change into far more aggressive about advertising and marketing to shoppers given what they see as a ripe alternative with the present state of federal regulation.

So, what are prediction markets and why are they such a big deal in the sports betting house?

What are prediction markets?

Broadly, prediction markets are exchanges, like inventory markets, the place folks guess on the outcomes of future occasions. Any occasion you can think about may probably be added to the market, together with elections, financial indicators, sporting occasions, the Academy Awards, which coach a workforce will rent, and so on.

How do they work?

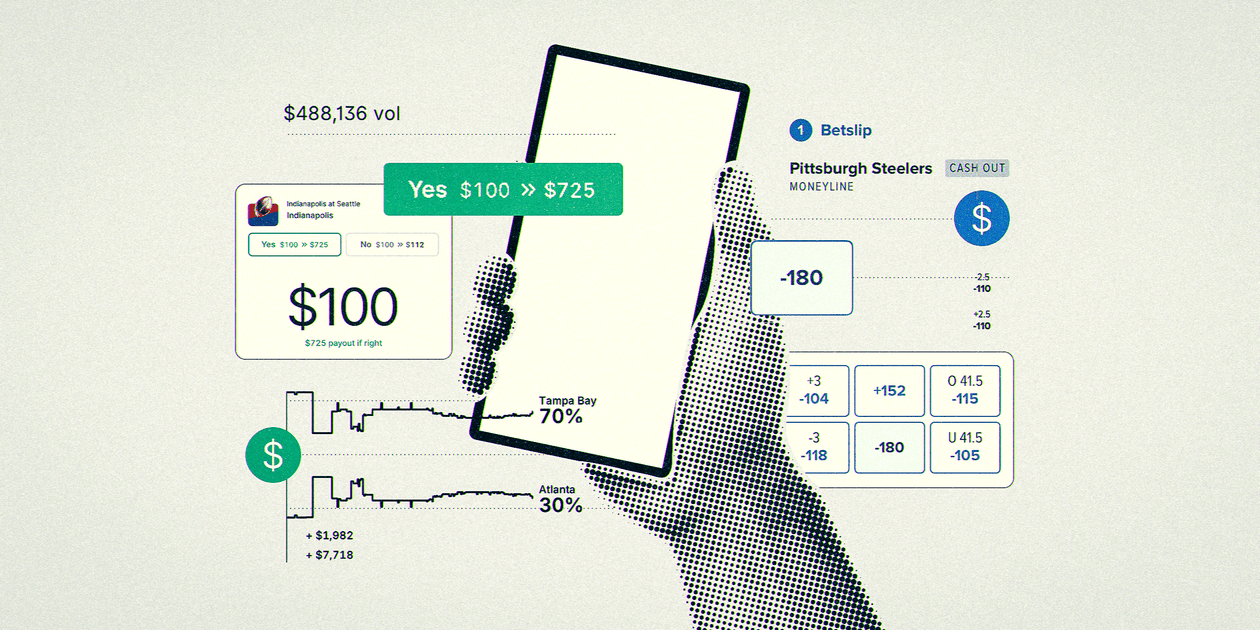

They create binary “yes” or “no” contracts that may be purchased and offered by customers. An instance could possibly be “Will the Buffalo Bills win the Super Bowl?” with “Yes” or “No” because the choices to purchase. The worth of every contract strikes based mostly on what folks are keen to pay, reflecting the market’s collective perception concerning the likelihood of an occasion occurring, with $1 representing a one hundred pc likelihood and $0 representing a 0 % likelihood. For instance, a contract promoting for $0.20 signifies a 20 % likelihood of that occasion occurring — at the least, in accordance to what folks are keen to pay for it.

Prices change recurrently, relying on the motion, information or hypothesis round a particular occasion.

Contracts that have been appropriate as predicted (the Bills win the Super Bowl in our instance above) will money out for the complete greenback quantity, with ensuing funds (your preliminary funding plus revenue) credited to your stability. If the market worth rises earlier than the occasion, merchants can promote their contracts for a revenue, like a inventory.

Who is concerned?

In a prediction market, you are placing up cash towards one other market participant on the opposite aspect, reasonably than betting towards “the house” as in conventional sports betting. That different market participant could possibly be a skilled or an odd particular person. The exchanges present a market between patrons and sellers and, together with a clearing home, make sure the legitimacy of each events and oversee the payout of the contract.

While the consumer received’t discover any main variations from sports betting on the entrance finish, this implies {the marketplace} itself (i.e., corporations like Kalshi or Polymarket) is just not on the opposite aspect of the contract. The corporations earn money by way of commissions and transaction charges, which implies they are motivated to see a greater quantity of trades, however shouldn’t have a vested curiosity in the end result of an occasion. Sportsbooks, alternatively, can lose cash on the end result of an occasion.

Are these kind of markets new?

This kind of contract has been round for greater than a century. Unlike state-regulated sports-betting companies, prediction markets are regulated by the Commodity Futures Trading Commission (CFTC), a federal company that oversees futures contracts. Futures have sometimes been in issues like commodities, so an instance could possibly be: “Will the average price of a gallon of gas in the United States be above $3?”

Entrepreneurs just like the founders of Kalshi and Polymarket acknowledged that any occasion, together with sports, could possibly be purchased and offered in the identical means and controlled by the CFTC. The two corporations gained wider awareness for permitting folks to put cash down predicting presidential elections, however sports predictions have been essential to their development and to the variety of corporations getting into the house.

Kalshi was based in 2018 and acquired CFTC approval in 2020 to function as a regulated trade. Polymarket was based in 2020.

How are particular markets chosen?

Any contract listed on a prediction market has to be licensed by the CFTC first. Let’s use Kalshi’s course of for example.

“The first step in the process is suggestions,” Jack Such, head of media at Kalshi, informed The Athletic. “We source suggestions from a tool on the site called Market Builder, where people can suggest markets; we source them from our Discord channel; we source them from Twitter; we source them from employees. So we get a huge pool of suggested markets, and then we have a dedicated team called the Markets Team that takes this big pool of suggestions and evaluates what should go from suggestion to actual listed market.

“There are a couple of criteria we use for this. The first is just demand: Are people going to trade this? The second is kind of the utility of the information. Even if it’s not going to be the highest-volume market or highest revenue-producing market, if we think there is interesting or pertinent information to be gleaned from it, we’ll list it. For example, we have a market on ‘Will the world meet its climate goals by 2050?’ That’s pretty important, so we’ll go ahead and list that anyway.”

From there, every kind of proposed market is submitted to the CFTC to be licensed, after which as soon as licensed, the markets can go stay.

It doesn’t all the time undergo. Before Kalshi rose to prominence with election markets, it sued the CFTC for blocking election contracts.

How are prediction markets completely different from conventional sports betting?

Regulation and relationships

For shoppers, you can be forgiven for noting that the important consumer expertise of prediction market platforms, with respect to sports contracts, bears a very sturdy resemblance to the sports playing apps you are acquainted with.

If you confirmed two screenshots to the common sports fan, they might have a exhausting time telling the distinction. Some of that’s by design.

It’s talked about above, however an necessary distinction is how they are regulated. Prediction markets are regulated on the federal degree reasonably than on a state-by-state foundation like sportsbooks.

That federal regulation has been important to the sudden development of prediction markets as a result of meaning they’ll go stay in all states, together with these the place conventional cell sports betting stays unlawful, resembling California and Texas.

People in states with out authorized sports betting can and have turned to prediction markets in rising numbers.

Sportsbooks have additionally had extra time to develop relationships with state regulators {and professional} leagues. The NHL is presently the one main league with partnerships with Kalshi and Polymarket.

Where they’re accessible

Kalshi and Polymarket are accessible in all states. But for sportsbooks, entering into prediction markets means attempting to rigorously navigate their relationships with state regulators.

Fanatics, which, in addition to its huge sports merchandise enterprise, owns a sportsbook, launched Fanatics Markets on Dec. 3 in 24 states, avoiding states the place sports betting is authorized.

“I think it’s an extension of the road that we’ve navigated with regulators for the last seven years,” Matt King, CEO of Fanatics Betting & Gaming, stated. “You think about most gaming regulators when sports betting happened; they had never regulated an online product, they had never regulated sports betting. All of these things come with a collaborative conversation about where concerns are, how do we protect consumers, how do we protect the integrity of the state laws. I think it’s going to continue to be an ongoing conversation because obviously there are a lot of open legal questions and challenges.”

DraftKings selected a extra complicated method. DraftKings Predictions launched on Dec. 19 in 39 states, however completely different states have completely different merchandise accessible. All markets are accessible in 17 states, together with California, Texas and Florida. Another 20 states have all markets besides for sports. Pennsylvania and Connecticut can solely commerce monetary markets. There are 11 states the place no markets are accessible.

“Some states have engaged in some litigation,” Jeanine Hightower-Sellitto, SVP and basic supervisor of predictions markets at DraftKings, stated. “That’s really informed how we’ve decided this multi-colored map of where we’re going to offer sport products, where we’re going to offer all of our products, where we’re going to offer financial products or where we’re going to offer no products. Nevada is a good example of where we’re not going to offer any products.

“I expect that map may change over time as there are different views in terms of this business.”

FanDuel launched its prediction markets product, FanDuel Predicts, on Dec. 22 in 5 states (Alabama, Alaska, North Dakota, South Carolina, South Dakota) the place FanDuel doesn’t have a sports betting license. FanDuel Predicts is predicted to increase to different states in 2026, however did say in a press release that “As new states legalize online sports betting, FanDuel will cease offering sports event contracts in those states.”

The mechanics on the again finish

While the front-facing expertise could also be comparable in some ways (you can put cash down on the Eagles -2.5 or to win the Super Bowl at each), the mechanics of how that occurs are very completely different.

As talked about above, these exchanges pair folks on either side of a contract. In a sportsbook, if the Eagles are provided by the e book as a 2.5-point favourite, you merely have to select the guess, choose the quantity you need to wager and it’s accepted. In a prediction market, somebody has to take the Eagles’ opponent at +2.5 to make the contract occur. In well-liked markets, that ought to be seamless, however the truth that that’s occurring on the again finish may be very completely different.

Types of choices

Prediction markets even have some limitations and a few additional freedoms in their choices in contrast to sportsbooks.

Prediction markets are largely free to provide any kind of contract so long as the reply is binary. Will the Milwaukee Bucks commerce Giannis Antetokounmpo earlier than the commerce deadline? Yes or no. Will LeBron James announce his retirement this season? Yes or no. It’s uncommon to see that kind of hypothesis on a sportsbook due to the chance (to the sportsbook) that somebody will discover out inside data whereas the guess remains to be stay.

Because the businesses operating the prediction markets don’t care who wins, the businesses aren’t uncovered to the chance of customers beating them to information and data. That duty falls to the consumer.

You received’t see bonus bets or revenue boosts on prediction markets in the identical means that sportsbooks provide them. Also, parlays aren’t as seamless or extensively accessible as on sportsbooks, though Robinhood is attempting to fight this with its upcoming launch of “combos.”

How prevalent are sports in prediction markets?

Kalshi studies that 90 % of its quantity is on sports.

“Sports make up more of our volume because there are just more sports events happening in the world,” Elisabeth Diana, head of communications at Kalshi, stated.

But in phrases of motion on a person occasion, Such stated that the largest occasions are monetary ones, and leisure is a rising space.

“The largest ever football game we’ve done was about $62 or $63 million in volume, and the most recent Federal Reserve decision was $90 million,” Such stated. “The ‘Dancing with the Stars’ finale did about $6 million with almost zero advertising spend.”

What corporations are concerned in prediction markets?

Kalshi and Polymarket have been the disruptors, however sports betting corporations and even fantasy sports corporations are becoming a member of in, in addition to funding apps like Robinhood.

Beyond Fanatics, DraftKings and FanDuel from the sportsbook world, locations like PrizePicks, Underdog and Sleeper, which are all in the fantasy sports house, are additionally making strikes to get in on the prediction market craze.

BetMGM and Caesars, notable sportsbooks that are additionally beneath father or mother corporations with huge brick-and-mortar on line casino companies, haven’t but entered prediction markets. Caesars CEO Tom Reeg defined why on a Q3 2025 earnings call.

“We will not put any of our licenses at risk,” Reeg stated. “We believe what’s happening in prediction markets is sports gambling. If there’s a path that develops where we can participate in a way that doesn’t put licenses at risk, you should expect we would be prepared to go down that path, but we’re watching it the same as you are.”

FanDuel, DraftKings and Fanatics are far much less susceptible to the ire of state governments as a result of they don’t depend on income from state-regulated brick-and-mortar casinos. All three left the American Gaming Association (AGA) late this 12 months.

The AGA, which is the main playing trade affiliation with membership spanning casinos, sportsbooks and tribal teams, has publicly argued against prediction markets, saying such markets threaten the integrity and regulation of sports betting.

“While prediction platforms have tried to characterize these contracts as financial investing, in practice, when it includes sports contests and outcomes, these markets are effectively gambling platforms with little oversight and regulation,” the AGA’s president and CEO Bill Miller stated in a assertion.

Why are so many corporations attempting to get into prediction markets?

The “why” is clear: Money, addressable markets. The “why now” is about change in regulation.

The Biden administration had banned Polymarket in the United States in 2022, with that administration taking a narrower regulatory view of prediction markets than the Trump administration, which meant it was fraught for any firm to launch too aggressively in the U.S.

Polymarket relaunched its app in the U.S. earlier this month. Donald Trump Jr. has been a strategic advisor for Kalshi since January 2025, and his VC agency invested in Polymarket in August. He additionally joined Polymarket’s advisory board.

With optimism that prediction markets will stay federally authorized in their present type, loads of corporations are becoming a member of the house.

In quick, the power to attain extra prospects and thus make more cash is why corporations are making this push. They are all speeding to not be late to the occasion, whereas prediction markets are nonetheless new, and even unknown, to so many individuals.