Buying shares in the greatest companies can construct significant wealth for you and your loved ones. And we have seen some really superb good points over the years. Don’t consider it? Then take a look at the Kingfa Science & Technology (India) Limited (NSE:KINGFA) share value. It’s 898% increased than it was 5 years in the past. If that does not get you excited about long run investing, we do not know what is going to. Also pleasing for shareholders was the 53% acquire in the final three months. We love blissful tales like this one. The firm must be actually happy with that efficiency!

On the again of a strong 7-day efficiency, let’s test what position the company’s fundamentals have performed in driving long run shareholder returns.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share costs don’t all the time rationally replicate the worth of a enterprise. One imperfect however easy approach to think about how the market notion of an organization has shifted is to check the change in the earnings per share (EPS) with the share value motion.

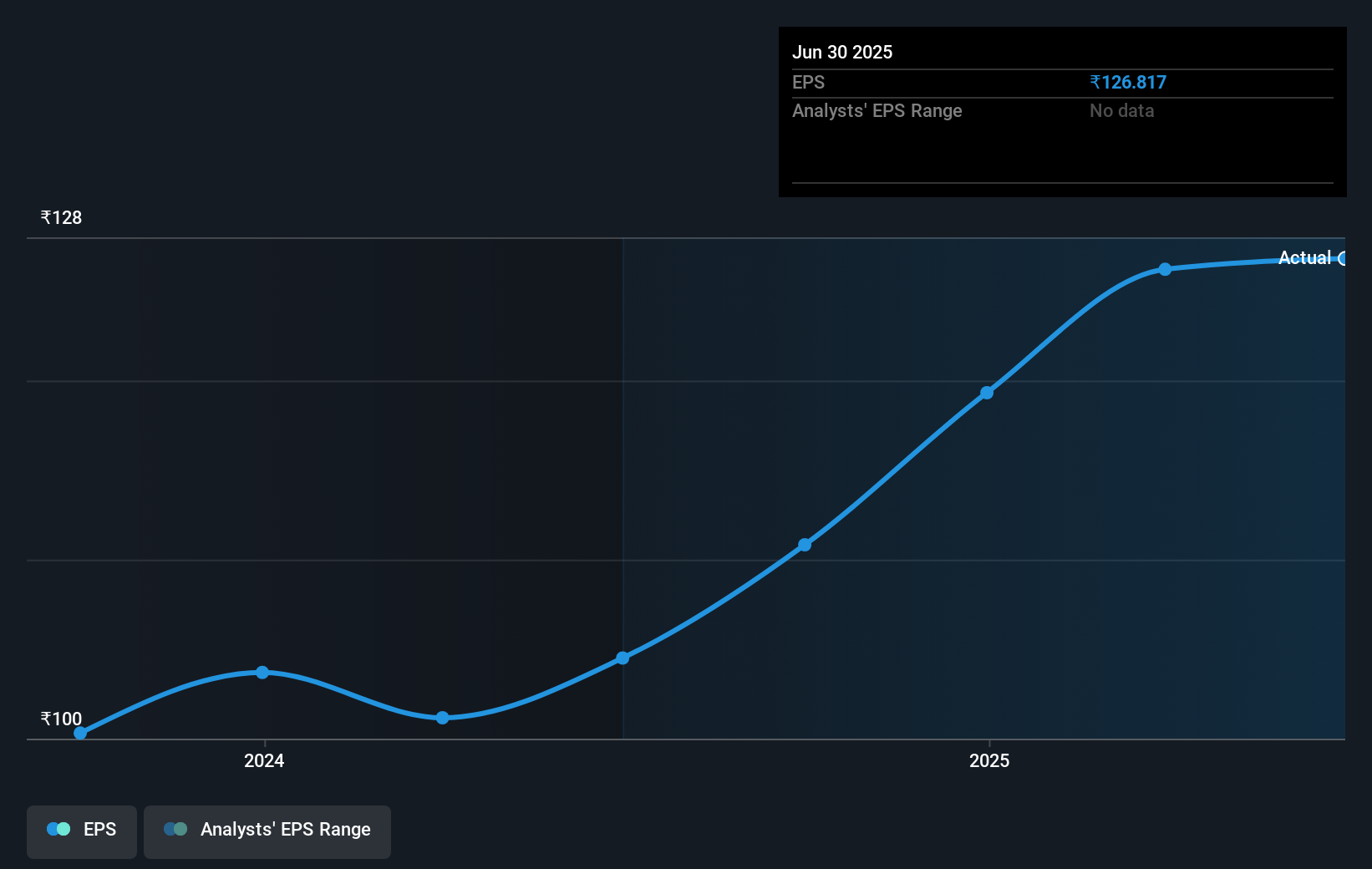

Over half a decade, Kingfa Science & Technology (India) managed to develop its earnings per share at 64% a 12 months. This EPS growth in all fairness near the 58% common annual enhance in the share value. This signifies that investor sentiment in direction of the firm has not modified an excellent deal. In truth, the share value appears to largely replicate the EPS growth.

You can see under how EPS has modified over time (uncover the precise values by clicking on the picture).

Dive deeper into Kingfa Science & Technology (India)’s key metrics by checking this interactive graph of Kingfa Science & Technology (India)’s earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

Investors ought to notice that there is a distinction between Kingfa Science & Technology (India)’s complete shareholder return (TSR) and its share value change, which we have lined above. Arguably the TSR is a extra full return calculation as a result of it accounts for the worth of dividends (as in the event that they have been reinvested), together with the hypothetical worth of any discounted capital which were provided to shareholders. Dividends have been actually useful for Kingfa Science & Technology (India) shareholders, and that money payout contributed to why its TSR of 901%, over the final 5 years, is healthier than the share value return.

A Different Perspective

It’s good to see that Kingfa Science & Technology (India) has rewarded shareholders with a complete shareholder return of 37% in the final twelve months. However, the TSR over 5 years, coming in at 59% per 12 months, is much more spectacular. The pessimistic view can be that be that the inventory has its greatest days behind it, however on the different hand the value may merely be moderating whereas the enterprise itself continues to execute. While it’s effectively price contemplating the totally different impacts that market circumstances can have on the share value, there are different elements which can be much more necessary. Consider as an example, the ever-present spectre of funding danger. We’ve identified 1 warning sign with Kingfa Science & Technology (India) , and understanding them must be a part of your funding course of.

Of course Kingfa Science & Technology (India) is probably not the greatest inventory to purchase. So it’s possible you’ll want to see this free collection of growth stocks.

Please notice, the market returns quoted on this article replicate the market weighted common returns of shares that presently commerce on Indian exchanges.

Valuation is complicated, however we’re right here to simplify it.

Discover if Kingfa Science & Technology (India) may be undervalued or overvalued with our detailed evaluation, that includes truthful worth estimates, potential dangers, dividends, insider trades, and its monetary situation.

Have suggestions on this text? Concerned about the content material? Get in touch with us instantly. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is basic in nature. We present commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles should not meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We intention to convey you long-term targeted evaluation pushed by basic information. Note that our evaluation might not consider the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.