Intraday Price Movement and Market Context

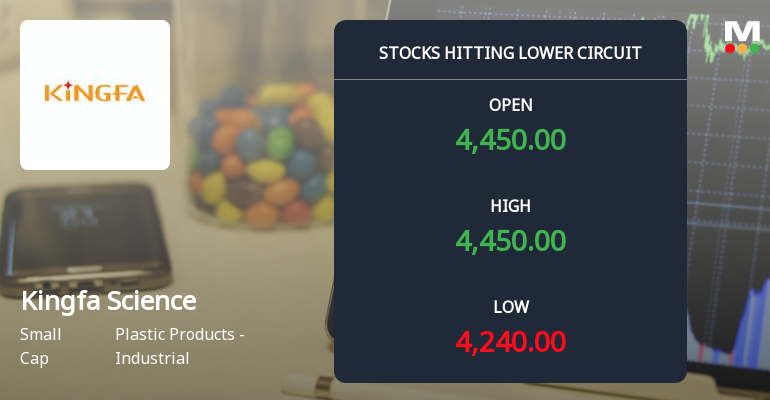

Kingfa Science & Technology (India), a participant within the Plastic Products – Industrial sector, opened the buying and selling session with a niche down of two.81%, signalling instant bearish sentiment. The inventory’s intraday low of ₹4,277.5 represented a 5.0% decline from the earlier shut, triggering the decrease circuit worth band of ₹225.1. This worth band, set at 5%, is designed to curb extreme volatility, however the inventory’s fall to this restrict underscores the severity of promoting strain.

Trading volumes have been notably skinny, with solely 0.01709 lakh shares exchanging arms, leading to a turnover of ₹0.738 crore. The weighted common worth for the day was nearer to the low worth, indicating that the majority trades occurred close to the underside of the day’s vary. This sample usually displays panic promoting or a rush to exit positions amid detrimental sentiment.

Comparison with Sector and Market Performance

Kingfa Science & Technology’s 5.0% decline considerably outpaced the sector’s 0.67% fall and the Sensex’s marginal 0.11% drop on the identical day. This divergence highlights the inventory’s vulnerability relative to its friends and the broader market. The sector, Plastic Products – Industrial, usually confirmed resilience, however Kingfa’s sharp fall suggests company-specific elements or investor considerations weighing closely.

Technical Indicators and Moving Averages

From a technical perspective, the inventory’s final traded worth stays above its 5-day, 100-day, and 200-day transferring averages, signalling some underlying energy over longer intervals. However, it trades under the 20-day and 50-day transferring averages, which can point out short- to medium-term weak point. This combined technical image might be contributing to the present volatility and investor indecision.

Investor Participation and Liquidity

Investor participation has proven indicators of rising curiosity, with supply volumes on 28 Nov 2025 reaching 540 shares, a 98.38% improve in comparison with the five-day common. Despite this, the general traded quantity on 1 Dec was low, suggesting that whereas some traders are actively holding or accumulating, others are exiting positions aggressively. The inventory’s liquidity, measured at 2% of the five-day common traded worth, helps commerce sizes of roughly ₹0.03 crore, which is satisfactory for small to medium traders however could restrict giant institutional trades.

Market Capitalisation and Company Profile

Kingfa Science & Technology (India) is assessed as a small-cap firm with a market capitalisation of roughly ₹5,827 crore. Operating inside the Plastic Products – Industrial sector, the corporate’s inventory efficiency is commonly influenced by industrial demand cycles, uncooked materials worth fluctuations, and broader financial situations affecting manufacturing and infrastructure sectors.

Recent Price Trends and Investor Sentiment

Prior to the present decline, Kingfa Science & Technology’s shares had recorded 4 consecutive days of good points, suggesting a short-term optimistic momentum. The sudden reversal and the decrease circuit hit on 1 Dec point out a shift in market evaluation, presumably pushed by revenue reserving, sector rotation, or rising considerations about firm fundamentals or exterior elements.

The sharp fall and unfilled provide at lower cost ranges level to panic promoting, the place sellers outnumber consumers considerably, pushing the inventory to its each day permissible loss restrict. Such episodes usually mirror heightened uncertainty or response to information, although no particular bulletins have been reported on the day.

Outlook and Considerations for Investors

Investors analysing Kingfa Science & Technology ought to think about the inventory’s current volatility within the context of its technical indicators and sector efficiency. The divergence between short-term weak point and longer-term transferring averages suggests a posh market dynamic. While the decrease circuit hit alerts instant promoting strain, the corporate’s fundamentals and market place inside the plastic merchandise trade stay related elements for medium- to long-term analysis.

Liquidity ranges help buying and selling exercise for retail and small institutional traders, however the low volumes on the day of the decline warning towards aggressive entry or exit with out additional affirmation of development course.

Summary

Kingfa Science & Technology (India) Ltd’s inventory efficiency on 1 Dec 2025 was marked by a major downturn, culminating in a decrease circuit hit at ₹4,277.5. The 5.0% each day loss outpaced sector and market indices, reflecting intense promoting strain and a shift in investor sentiment after a quick rally. Thin buying and selling volumes and a weighted common worth close to the day’s low underscore the dominance of sellers and unfilled provide at lower cost factors.

While the corporate’s market capitalisation and sector affiliation present context for its valuation, the present worth motion suggests warning. Investors ought to monitor upcoming classes for indicators of stabilisation or additional weak point, contemplating each technical alerts and broader market situations earlier than making selections.

Kingfa Science & Technology’s inventory stays a focus for market watchers amid ongoing volatility within the Plastic Products – Industrial sector, highlighting the significance of balanced evaluation and threat administration in small-cap investing.

Get 1 yr of Weekly Picks FREE whenever you subscribe to MojoOne. Offer ends quickly. Start Saving Now →