CNBC’s Jim Cramer instructed traders on Thursday how to pick a solid retail stock for his or her portfolios, itemizing six elements to think about earlier than investing.

“I want to spend some time tonight on what it means to buy the stock of a great franchise into weakness, not some software as a service company or a red-hot semiconductor equipment stock or the life sciences business, all of which are endless ragers until they aren’t,” he stated. “But of a really, very good growth retailer that we all know, with a terrific reputation that can take a licking and keep on ticking.”

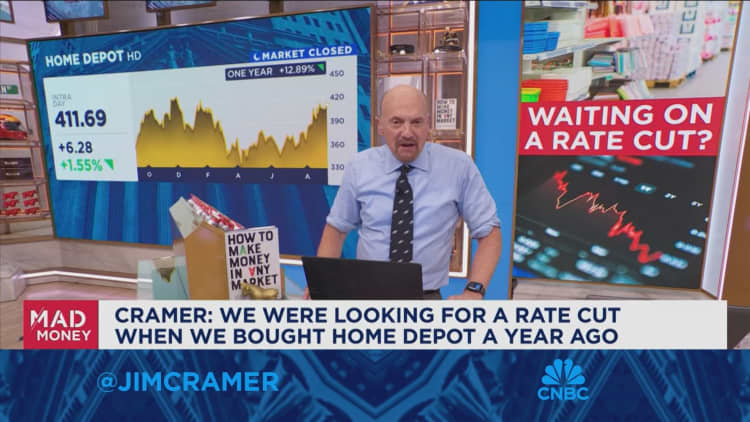

Growth can are available in many kinds, Cramer stated, and one among them is retail. He stated he seems for secure, well-managed corporations that may carry out effectively in numerous environments — even when their success shouldn’t be quick. He named Home Depot particularly, saying that the house enchancment retailer suits his framework for a firm to personal for the long run. He famous that the stock weathered losses however has just lately seen success.

To Cramer, it is vital that traders really store at a firm’s shops — and just like the merchandise — earlier than they purchase shares. A wholesome steadiness sheet can also be important, Cramer continued. Since retail is a cyclical enterprise, the businesses cannot afford to have weak steadiness sheets, he stated.

A very good retailer’s administration crew should not be the sort “that refuses to sit still and wait,” Cramer added. For instance, when Home Depot noticed the weak point of the housing market, administration tried to broaden its attain past customers, he stated. The firm determined to purchase companies that work effectively with skilled contractors, Cramer continued.

Company scale can also be important to a retail stock’s success, in accordance to Cramer. He stated scale offers corporations energy to “have such a large footprint that you can manhandle your suppliers – they all need your shelf space — and not vice-versa.” He indicated that Home Depot is positioned effectively to take care of developments like tariffs due to its measurement and attain.

A powerful retail stock additionally has to have a good yield, Cramer continued, saying if an investor decides to “buy quality, you can let it compound for the rest of your life.” These sorts of shares additionally should not want decrease rates of interest to succeed, Cramer added. But he famous that charge cuts from the Federal Reserve often increase the retail sector broadly.

“When the Fed starts cutting, your slow-growing retailer stock gets turbocharged as all the so-called smart money comes flying in,” he stated.

Sign up now for the CNBC Investing Club to observe Jim Cramer’s each transfer available in the market.

Disclaimer The CNBC Investing Club Charitable Trust owns shares of Home Depot.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer’s world? Hit him up!

Mad Money Twitter – Jim Cramer Twitter – Facebook – Instagram

Questions, feedback, ideas for the “Mad Money” web site? [email protected]