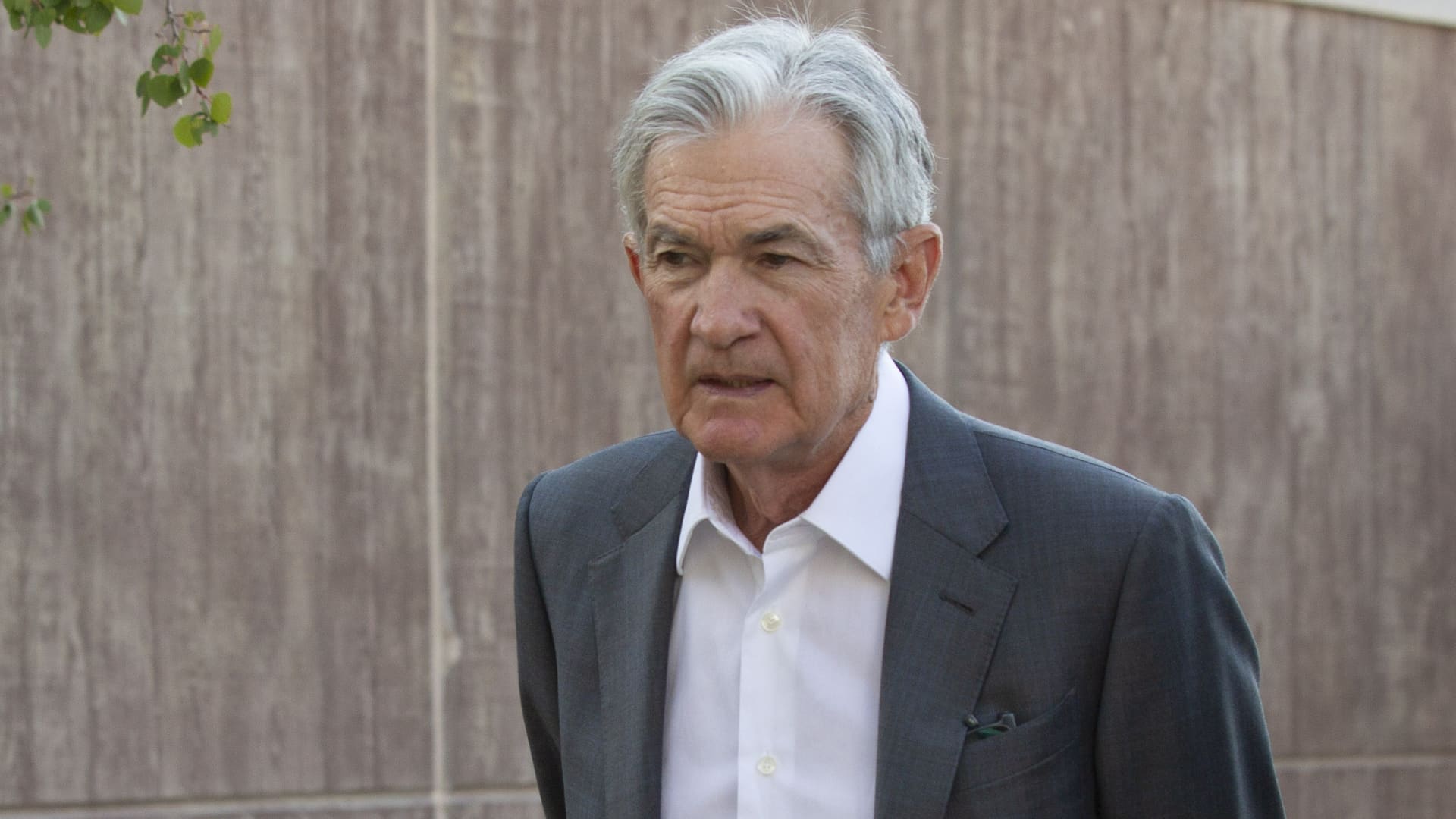

Whatever is the long run path of financial coverage may resolve what occurs next for a inventory market that is struggling to broaden out and prolong management past the businesses which have labored to date in 2025. Central financial institution officers from across the globe will convene next week in Jackson Hole, Wyoming for the Federal Reserve’s annual financial symposium , an occasion that might be intently watched for any clues from Fed Chair Jerome Powell as to what is going to occur at its remaining coverage conferences this 12 months, in September, October and December. This week, the prospect of extra rate of interest cuts — doubtlessly even a supersized half level next month — drove up elements of the market which have been left behind. The Russell 2000 rallied greater than 3%. The equal weight S & P 500 outperformed. Health care, this 12 months’s laggard, was the best-performing S & P 500 sector , climbing virtually 5% this week. So lengthy as fee cuts are coming — and not using a slowing economic system or rise in inflation — the reversal in fortunes for the market’s former laggards might proceed. That could be a boon for an overvalued market that has once more relied on a handful of its greatest winners for this 12 months’s positive factors. “Will small-, mid-caps outperform large caps? That’s the question,” mentioned Brian Leonard, portfolio supervisor at Keeley Gabelli Funds. “We think there’s a possibility they do.” Potentially, Fed Chair Powell may throw chilly water on the market if he takes a extra hawkish stance than anticipated at Jackson Hole next week, particularly as macroeconomic issues persist. But many market observers are sure that the sometimes staid Fed chief will do his greatest not to present his playing cards. Leonard, for one, mentioned he is cautiously optimistic on the broader fairness market. On Friday, the major averages closed out a profitable week, with the Dow Jones Industrial Average greater by about 2%, and the S & P 500 and Nasdaq Composite every up roughly 1%. Future of the Fed The Fed will come underneath the highlight next week at a essential time. The Trump administration is actively looking out for the next Fed chief to succeed Powell when his time period ends next May, a race that is elevating questions on Fed independence. This week, it was revealed there are 11 potential candidates , together with Jefferies Chief Market Strategist David Zervos, former Fed Governor Larry Lindsey and BlackRock chief funding officer for world mounted earnings Rick Rieder. Many of the candidates, together with Zervos and Rieder, have publicly known as for aggressive rate of interest cuts. It’s a possible prerequisite for President Donald Trump, whose rising hostility towards Powell has hinged on the Fed having but to decrease rates of interest this 12 months. Trump has unleashed a barrage of barbs, calling Powell — who Trump nominated as Fed chair in late 2017 — “TOO LATE,” and “stupid,” amongst different epithets. Yet, economists anticipate that Powell is extra seemingly to use his time on the rostrum in Wyoming to handle how financial coverage may change within the years forward. He’s scheduled to communicate at 10 a.m. ET next Friday, Aug. 22. This week, Sarah House, senior economist at Wells Fargo Economics, wrote that the Fed will seemingly define an method that abandons a coverage of permitting inflation to typically run a bit above 2% to make up for durations when inflation was decrease than 2%, and as an alternative goal “a simple 2% inflation target, where it does not try to make up for past misses.” Other modifications may embrace tying its most employment goal extra straight to its inflation objective, House mentioned. “We’ll find out what Mr. Powell says next week at the Jackson Hole symposium — if there is a likelihood of a cut or not, and we’ll see what his commentary is,” Leonard, the portfolio supervisor, mentioned. Fed minutes next week may additionally illustrate the present dynamic on the central financial institution, on condition that the final assembly had two policymakers dissenting from the group and voting in favor of decrease rates of interest. It was probably the most significant dissent since late 1993. Caution and optimism The inventory market continues to carry out terribly nicely this 12 months, defiant of macroeconomic and geopolitical issues. Yet, with August and September each months that present seasonally weaker costs, and traders persevering with to scan for indicators of the tariff impression on enterprise, Wall Street is bracing for continued, near-term choppiness. Next week Target and Walmart report earnings outcomes. The massive field retailers are seemingly to present essential commentary on the state of client spending in the course of the essential back-to-school season. Week forward calendar All instances ET. *2025 Federal Reserve Bank of Kansas City’s Economic Policy Symposium in Jackson Hole, Wyoming on “Labor Markets in Transition: Demographics, Productivity, and Macroeconomic Policy” takes place Aug. 21-23 Monday, Aug. 18 10:00 a.m. NAHB Housing Market Index (August) Earnings: Palo Alto Networks Tuesday, Aug. 19 8:30 a.m. Building Permits preliminary (July) 8:30 a.m. Housing Starts (July) Earnings: Keysight Technologies , Jack Henry & Associates , Home Depot Wednesday, Aug. 20 2:00 p.m. FOMC Minutes Earnings: TJX , Analog Devices , Estee Lauder Companies , Target , Lowe’s Companies Thursday, Aug. 21 8:30 a.m. Continuing Jobless Claims (08/09) 8:30 a.m. Initial Claims (08/16) 8:30 a.m. Philadelphia Fed Index (August) 9:45 a.m. PMI Composite preliminary (August) 9:45 a.m. S & P PMI Manufacturing preliminary (August) 9:45 a.m. S & P PMI Services preliminary (August) 10:00 a.m. Existing Home Sales (July) 10:00 a.m. Leading Indicators (July) Earnings: Workday , Ross Stores , Intuit , Walmart Friday, Aug. 22