U.S. President Donald Trump indicators the sweeping spending and tax laws, generally known as the “One Big Beautiful Bill Act,” on the White House in Washington, D.C., U.S., July 4, 2025.

Ken Cedeno | Reuters

Roth particular person retirement account conversions have grow to be a preferred approach for traders to reduce lifetime taxes. But for some excessive earners, the technique could damage eligibility for the state and local tax deduction, generally known as SALT.

President Donald Trump‘s “big beautiful bill” briefly increased the SALT deduction cap from $10,000 to $40,000 beginning in 2025. The restrict will increase by 1% yearly via 2029 and reverts to $10,000 in 2030.

Roth conversions switch pretax or nondeductible IRA funds to a Roth IRA, which kickstarts future tax-free development. The trade-off is incurring regular income through the 12 months of conversion.

Extra earnings can influence tax breaks — together with the $40,000 SALT cap — attributable to phaseouts, or profit reductions, as soon as earnings exceed sure thresholds, specialists say.

More from Personal Finance:

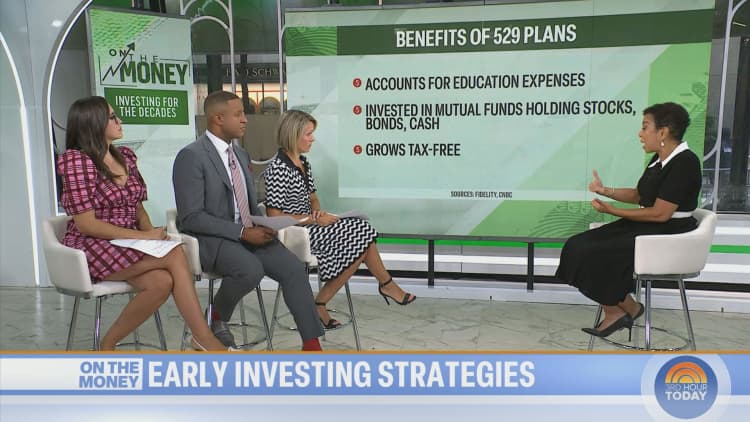

Trump’s ‘big beautiful bill’ brings more ways to use 529 savings plans

The key to being confident in an uncertain market: ‘Always be calibrating’

Trump to ‘prevent benefits’ for some under Public Service Loan Forgiveness

The $40,000 SALT deduction restrict begins to lower as soon as modified adjusted gross earnings exceeds $500,000, and phases out utterly to $10,000 when MAGI reaches $600,000.

That creates what some tax specialists are calling a “SALT torpedo,” or artificially greater tax fee of 45.5%, between these earnings thresholds.

If you are making Roth conversions with earnings close to that vary, the phaseout could create a “tax bomb,” stated licensed monetary planner Kevin Brady, senior vice chairman at Wealthspire Advisors in New York.

How the SALT deduction works

Taxpayers declare the better of the usual deduction or itemized tax breaks on returns yearly. If you itemize, you may declare as much as $40,000 for SALT in 2025, which incorporates state and native earnings and property taxes.

However, the overwhelming majority of filers — roughly 90%, in line with the newest IRS knowledge — use the usual deduction and do not profit from itemized tax breaks.

Raising the SALT deduction cap is anticipated to primarily benefit higher earners, in line with a May evaluation from the Tax Foundation.

The change “helps some high-tax-state clients, but it also phases out at higher incomes,” stated Jared Gagne, a CFP with Claro Advisors in Boston.

There are a number of components to contemplate when making Roth conversions, together with long-term monetary and legacy planning objectives, specialists say.

When making Roth conversions, Gagne weighs shoppers’ present tax brackets and different deduction phaseouts. He additionally considers income-related month-to-month adjustment quantities, or IRMAA, for Medicare Part B and Part D premiums, together with the earnings thresholds for net investment income tax.

Plus, the objective of Roth conversions is to cut back your lifetime taxes. In many instances, advisors run multi-year projections to resolve whether or not it is sensible to forgo a current-year tax break to safe long-term tax-free development.