The Hong Kong University of Science and Technology helps launch 100 spinouts a yr. But the AI rush means it has to get them overseas faster, says its tech switch head.

The Hong Kong University of Science and Technology (HKUST) — well-known for spinning out client drone firm DJI — is wanting to launch extra of its robotics and deep tech spinouts into worldwide markets, by partnering with VC agency Gobi Partners to run its new HK$500m ($64m) fund.

The fund has been arrange to again startups spinning out of the university by means of later funding rounds and to help their entry into overseas markets.

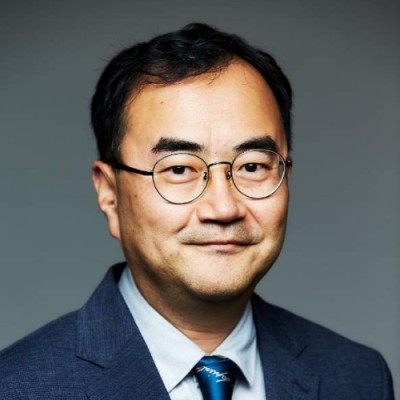

“As time goes on, our startups have moved from seed to series A, series B and series C stage, so the individual companies’ investment needs are increasing,” says Dr Shin Cheul Kim, HKUST’s affiliate vice-president for analysis and growth. “At the same time, the global [reach of the] companies is also increasing.”

HKUST launches about 100 spinout firms a yr and has spun out some 1,900 firms in whole to date.

The Gobi-Redbird Innovation (Gobi-RIF) Fund was launched final month in partnership with enterprise capital agency Gobi Partners and the native authorities-owned Hong Kong Investment Corporation. The fund is the most recent a part of the HK$2bn Redbird Innovation plan framework formed by HKUST in April 2024 to help its spinouts.

Kim (left) says the university launches about 100 spinout firms annually, with between 20% and 30% based by professors and the remainder by college students and alumni. The Redbird programme goals to not solely again these startups in the beginning of their journey, however to help them as they develop, by means of funds shaped with exterior common companions.

The first such car was a biotech fund shaped with well being tech funding agency Shanghai Healthcare Capital (SHC) final yr.

Gobi-RIF however will deal with a lot of areas, together with biotech, fintech, trade 4.0, synthetic intelligence and robotics. Although Gobi doesn’t have the identical in-depth sector experience as Shanghai Healthcare Capital, the agency brings in deep tech expertise and a wealth of worldwide contacts.

“It’s not just the money, they have a network and an expertise and understanding of deep tech startup companies,” Kim says.

“We are looking for a partner that can steer our professors in the startups to establish a proper business setup, which leads to the market and to manufacturing. Gobi has that capability, and Asia network-wise, they are an international fund, it’s not just a local Hong Kong fund. That is another benefit, they can provide entry into other markets.”

Robotics and AI imply huge challenges and maybe greater rewards

Some 1,900 startups have spun out of HKUST, in accordance to Kim, with DJI among the many most well-known. Kim says the university is especially sturdy in mechatronics, a subject of examine that integrates mechanical, electrical and computing know-how in gear reminiscent of drones, and in robotics and AI. Those fields, he provides, are boosted by HKUST’s geographical place in China.

“This area – Hong Kong, Macao, Shenzhen, Guangdong, what we call it the Greater Bay Area – is the best place when we deal with the convergence of robotics and AI,” he says.

Much of the western enterprise funding that has streamed into AI up to now three years has targeting software program, extra particularly the big language fashions (LLMs) underpinning OpenAI and Anthropic’s choices. But in China the main focus has been extra on embodied intelligence – the combination of AI and the bodily world, within the type of clever robotics.

Kim says this can be a far bigger problem. LLMs are an “easy toy” as compared, as a result of they are often educated on knowledge that’s already accessible, whereas embodied intelligence is way extra advanced, counting on fixed interplay with the surface world. You nonetheless can’t ask a robotic to put its metallic hand in your pocket and retrieve the second greatest coin, he provides, since you would wish to a) determine and outline the mandatory datasets, b) set up the precise sensor to discover the cash, after which c) join it to a bodily system able to processing every little thing.

The rewards of robotics investments, nonetheless, are probably massive, Kim says, particularly while you mix it with trade 4.0 know-how that may remodel manufacturing. Robotic arms have lengthy been utilized in automotive meeting strains, however humanoid methods are actually being put in that may carry objects whereas being managed by human operatives.

Add the precise degree of intelligence and prolong the know-how to one thing like hospitals or aged care, and you can have robots that escort sufferers to the toilet and assist them bodily rehabilitate, duties that would show essential in societies with ageing populations and employees shortages in fields like nursing.

These markets are shifting extraordinarily shortly, and this hyperlinks into the rationale that HKUST needs a associate reminiscent of Gobi, which was based in China however operates as a pan-Asian agency with workplaces in 9 nations together with a number of of Asia’s largest markets. The hope is that will probably be ready to assist Gobi-RIF Fund startups to discover native companions and probably traders.

“In many cases, the Chinese market is a wonderful place to test the market because, in terms of manufacturing, the value chain is already established,” Kim says. “So, in case you have an concept, you may make a product, check it within the Chinese market first after which increase to different territories.

“But this mechanism is a little bit traditional, because [with AI technology] we have to get to the market [quickly], because the lifetime of the AI product is short term. So, we try to go into multiple sectors and territories more or less at the same time, and so we need those kinds of network partners.”

There can be different Redbird funds too, Kim says, and that would even imply a company VC associate. The university is eager to hyperlink deep tech startups to company enterprise capital models, as their wants generally is a window into their markets and the wants of consumers, and that may lead to licensing offers or acquisitions. The solely remit for future companions, he provides, is that they align with HKUST’s mission.

If you spend money on university spinouts, we might love your enter in GUV’s University Venture Funds survey.

Gain helpful insights into the efficiency of university-affiliated funds globally. Compare your fund’s construction and efficiency together with your friends. Take the survey here.