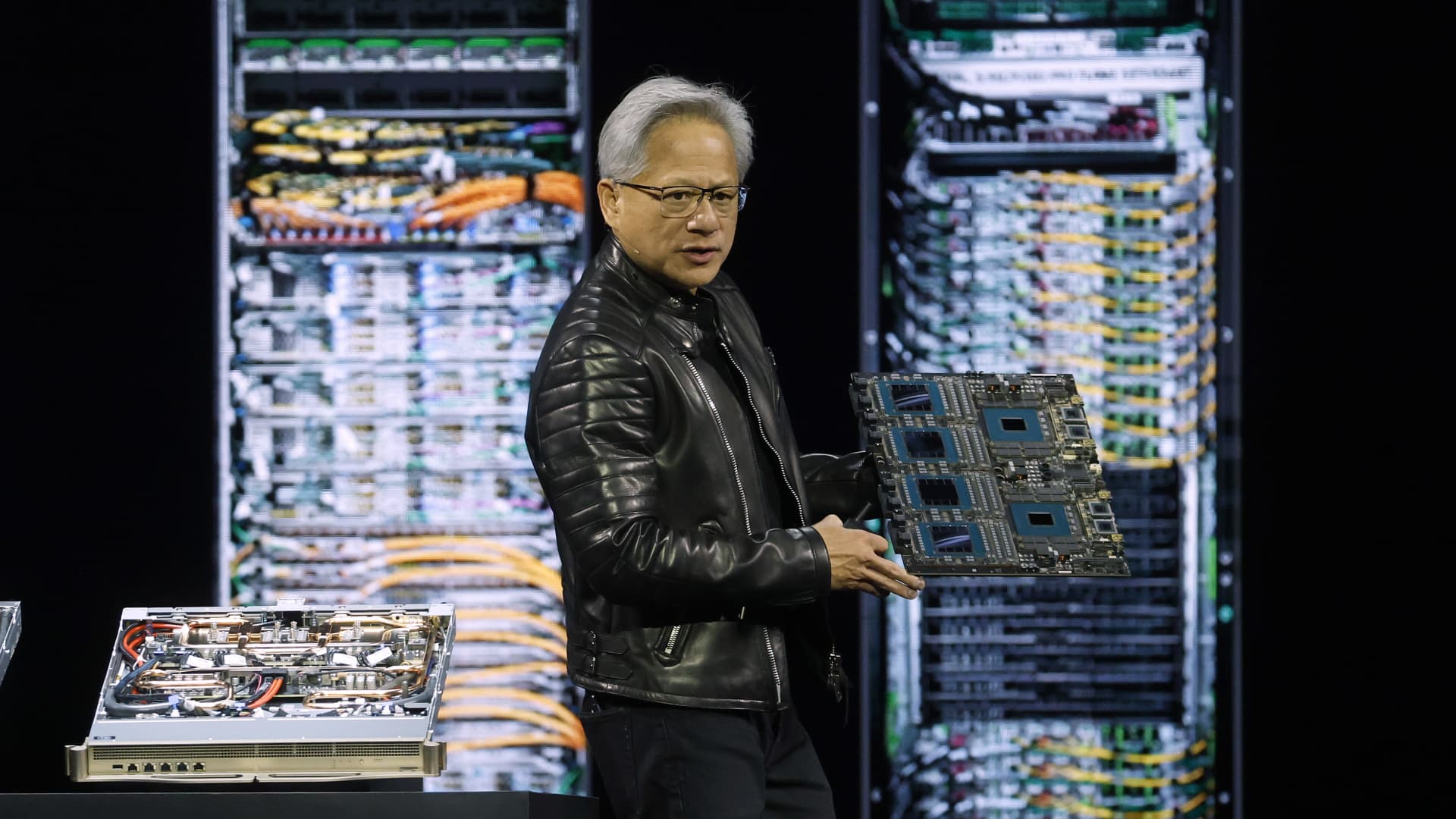

For happening three years now, a once-scrappy firm primarily based in Santa Clara, California, has been the heart of the Wall Street universe. That’s unlikely to vary anytime quickly — most definitely not in the week ahead, when its earnings report is the market’s largest occasion. On Wednesday evening, Nvidia is ready to launch its outcomes for the three months ended in July, in what’s develop into the most anticipated earnings report of the season throughout the generative AI increase. The hype has gotten out of hand earlier than — bear in mind the time a New York City bar held a watch get together for the chipmaker’s earnings? Nevertheless, for higher or for worse, all the different quarterly releases and convention calls crescendo to this one. At some stage, it is smart. The AI gold rush has lifted the market for some two and a half years, and Nvidia’s premier picks and shovels allow it. Let us not overlook that different corporations exist, together with fellow Club holding CrowdStrike , which is one among the main suppliers of one other important expertise for our period in cybersecurity. It can also be scheduled to announce outcomes Wednesday night. Historically, the market has additionally paid consideration to financial stories that include probably market-moving knowledge. One of these will drop Friday morning, when Federal Reserve’s most popular inflation gauge for July is due out. Here’s a better have a look at what we’re anticipating when Nvidia and CrowdStrike report, and the implications of Friday’s inflation knowledge, which can be one week after Fed Chairman Jerome Powell’s tacit rate of interest reduce sign despatched the stock market hovering . 1. Nvidia earnings: An fascinating wrinkle to Nvidia’s earnings stories is that its largest clients — the likes of Alphabet and fellow Club names Microsoft and Meta Platforms — supply main clues about demand for its chips after they issued their very own outcomes in the previous weeks. When these so-called hyperscalers signaled they’re nonetheless spending tens of billions of {dollars} on capital expenditures, as they did once more this earnings season, buyers know a major quantity of that cash ultimately makes its method into Nvidia’s coffers. Remarks from executives on their earnings calls additionally carry implications for Nvidia, as analysts at Morgan Stanley identified in a latest be aware to shoppers. (*3*) the agency wrote. “That’s still the case, but more recent comments emphasize a surge in inference demand that’s making it more challenging to install capacity to meet it – a very good signal for the durability of Nvidia’s revenue growth even as Blackwell begins to ship in greater size.” Indeed, proper now it’s the provide of Blackwell technology chips that finally determines simply how a lot income Nvidia’s knowledge heart enterprise rings up in a given quarter; all indicators nonetheless point out demand is not the limiting issue. Blackwell is Nvidia’s most superior model of AI chips, and it started delivery to clients in small portions late final 12 months and ramping up from there. It succeeded the Hopper technology chips that entered mass manufacturing just a few months earlier than ChatGPT launched in late 2022. The consensus estimate requires Nvidia’s quarterly income to be $45.89 billion, with adjusted earnings per share (EPS) of $1.00. NVDA YTD mountain Nvidia YTD As strong as demand for Nvidia’s expertise could also be, the market is a forward-looking machine with a proclivity to be exhausting to please — particularly for a high-flying stock like Nvidia. As a consequence, buyers have to be ready for a variety of stock reactions. Nvidia may probably ship better-than-expected outcomes with above-consensus gross sales steerage, just for shares to fall anyway as a result of the steerage “beat” wasn’t big sufficient. This dynamic damage the stock in February. On the different hand, Nvidia shares rallied after earnings in May as a result of its outlook would’ve surpassed expectations if not for U.S. authorities curbing its potential to promote chips to China. China is as soon as once more a big variable, however for the precise reverse cause. With the Trump administration granting Nvidia export licenses for China in alternate for 15% of income, the firm ought to ultimately begin to resume reserving income from that sizable market. It’s only a matter of how a lot, at what revenue margin given the 15% reduce, and when. Hanging over all of it is the Chinese authorities discouraging purchases of Nvidia made-for-China H20 chips in favor of homegrown options — is that why Nvidia reportedly advised provider Foxconn to cease work on the H2? Or is that as a result of Nvidia is engaged on a Blackwell-based model for China as a substitute? Investors can be seeking to the convention name with CEO Jensen Huang and CFO Colette Kress for solutions on these questions. Some sell-side analysts, whose estimates type the foundation of the Wall Street consensus, proceed to exclude China in their projections. So, if the firm consists of some China contributions in its steerage, that might consequence in an upside shock to the tune of $2 billion to $3 billion, in keeping with analysts at KeyBanc Capital Markets. However, the analysts anticipate Nvidia will “guide conservatively” round China, identical to peer Advanced Micro Devices did. Morgan Stanley shares that view. Here’s what the Street expects Nvidia to report for the July quarter: 2. CrowdStrike earnings: The cybersecurity firm’s quarterly outcomes Wednesday evening will supply some counter programming to Nvidia. Big image, there’s been no change to our perception that buyers want publicity to cybersecurity corporations as a result of their clients can’t afford to chop again on defending their delicate knowledge, company networks and units. It’s such a big theme that we personal each CrowdStrike and peer Palo Alto Networks , which final week reported robust outcomes and better-than-expected steerage. With CrowdStrike’s stock liable to volatility round earnings, maintaining that 30,000-foot view in thoughts can assist buyers determine shopping for alternatives when shares dump on, say, good-but-not-great numbers. In addition to income and earnings, the big metrics to observe for CrowdStrike are annual recurring income (ARR), which is a key metric for corporations promoting software program subscriptions; remaining efficiency obligation (RPO), which is a measure of contracted income that has but to be booked; and free money stream (FCF) margin, which has skilled some stress on account of bills tied to final 12 months’s international IT outage. The hope is, as that incident strikes additional into the rearview, CrowdStrike’s FCF margin can get again to pre-outage ranges. CRWD YTD mountain CrowdStrike YTD It’s been powerful sledding for shares of CrowdStrike since early July, which theoretically ought to maintain investor expectations in examine relative to an organization reporting with a stock close to its highs. Then once more, CrowdStrike was additionally overwhelmed up into its early March earnings report and nonetheless ended up tumbling in response to the print. A couple of days later, although, the stock bottomed out — simply as we purchased the dip — and commenced a fierce rally. While nobody is aware of if historical past will repeat itself this time round, we’re ready for all potentialities. Here’s what Wall Street expects on the prime and backside traces: Revenue of $1.15 billion and adjusted EPS of 83 cents. 3. Inflation: The private consumption expenditures (PCE) index for month of July is due out earlier than the opening bell Friday, and it lands on the heels of Powell’s Jackson Hole speech. At the central financial institution’s annual confab, Powell hinted that the Fed may have to chop charges on account of weakening labor market circumstances — one aspect of the Fed’s twin mandate to foster most employment and steady costs. While nonetheless expressing some concern about tariff-driven inflation, Powell mentioned he now believes it unlikely that tariffs may spark a chronic interval of inflation and would extra probably be a one-time step up in the value stage. Powell did take somewhat little bit of the intrigue out of Friday’s PCE, saying: “The latest available data indicate that total PCE prices rose 2.6 percent over the 12 months ending in July. Excluding the volatile food and energy categories, core PCE prices rose 2.9 percent, above their level a year ago.” Powell’s numbers are probably primarily based on info contained in a pair of different inflation stories: the shopper value index (CPI) and producer value index (PPI), which we have already gotten for the month of July. While the CPI is the best-known measure of inflation, the Fed prefers the composition of the PCE as a result of it measures expenditures by each customers and companies. Among the key variations between the two gauges are how well being care and housing prices are calculated. What issues most for buyers proper now, not less than, is how tariff pressures are exhibiting up in the numbers and the implications for Fed coverage. But as Powell’s speech at Jackson Hole made clear, the Fed sees better draw back threat in the jobs market. Week ahead Monday, Aug. 25 Census Bureau’s new dwelling gross sales report at 10 a.m. ET Before the bell earnings: Pinduoduo (PDD) After the bell: Semtech (SMTC), HEICO (CEI) Tuesday, Aug. 26 Census Bureau’s new orders for manufactured sturdy items at 8:30 a.m. ET FHFA’s dwelling value index at 9 a.m. ET Conference Board’s month-to-month shopper confidence survey at 10 a.m. ET Before the bell: Bank of Montreal (BMO), Bank of Nova Scotia (BNX), KE Holdings (BEKE) After the bell: Okta (OKTA), MongoDB (MDB), PVH (PVH), JOYY (JOYY) Wednesday, Aug. 27 Before the bell: Kohl’s (KSS), Abercrombie & Fitch (ANF), JM Smucker (SJM), Williams-Sonoma (WSM), Royal Bank of Canada (RY) After the shut: Nvidia (NVDA), CrowdStrike (CRWD), Snowflake (SNOW), HP Inc (HPQ), Nutanix (NTNX), Urban Outfitters (URBN), Pure Storage (PSTG), Five Below (FIVE), Agilent (A), Trip.com (TRIP) Thursday, Aug. 28 Initial jobless claims at 8:30 a.m. ET U.S. second-quarter GDP (second estimate) at 8:30 a.m. ET National Association of Realtor’s pending dwelling gross sales index at 10 a.m. ET Before the bell: Best Buy (BBY), Dollar General (DG), Bath & Body Works (BBWI), Brown-Forman (BF), Dick’s Sporting Goods (DKS) After the bell: Marvell Tech (MRVL), Dell Tech (DELL), SentinelOne (S), ULTA Beauty (ULTA), Affirm (AFRM), Gap (GAP), Petco (WOOF), Autodesk (ADSK), Webull (BULL) Friday, Aug. 29 Personal consumption expenditures (PCE) index at 8:30 a.m. ET Census Bureau’s wholesale inventories report at 8:30 a.m. ET University of Michigan’s shopper sentiment survey (closing studying) at 10 a.m. ET Before the bell: Alibaba (BABA) (Jim Cramer’s Charitable Trust is lengthy NVDA, CRWD. See right here for a full checklist of the shares.) As a subscriber to the CNBC Investing Club with Jim Cramer, you’ll obtain a commerce alert earlier than Jim makes a commerce. Jim waits 45 minutes after sending a commerce alert earlier than shopping for or promoting a stock in his charitable belief’s portfolio. If Jim has talked a couple of stock on CNBC TV, he waits 72 hours after issuing the commerce alert earlier than executing the commerce. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.