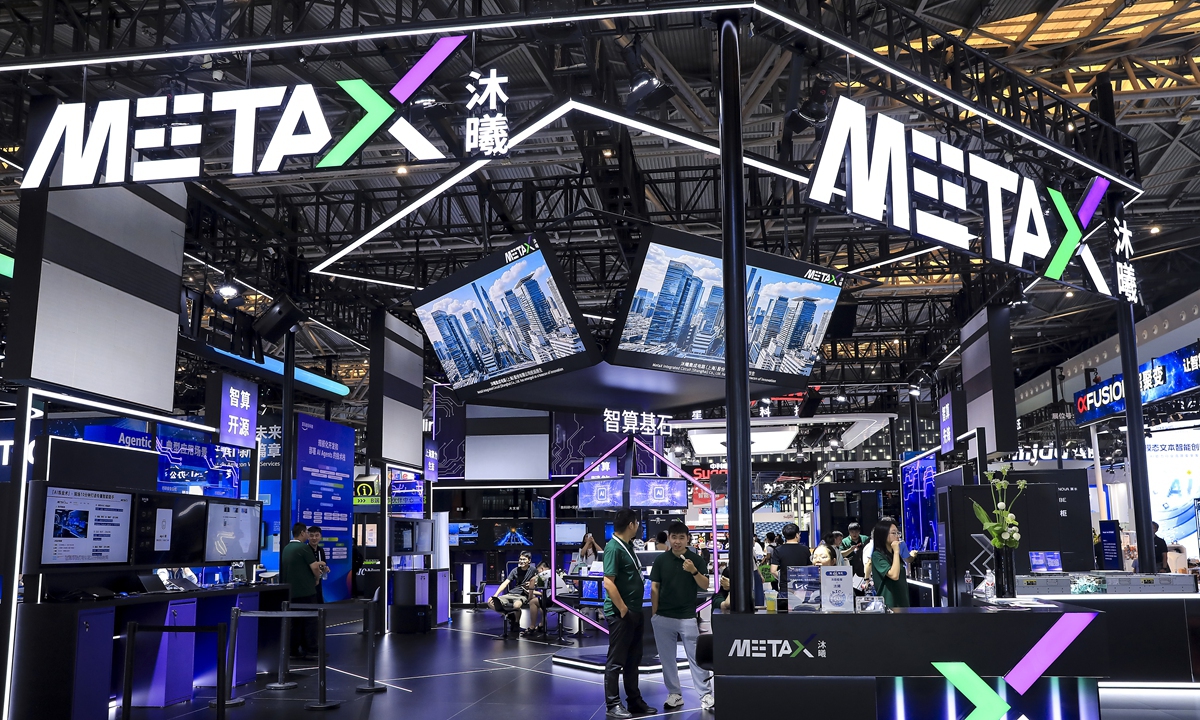

A sales space of MetaX throughout World Artificial Intelligence Conference 2025 in Shanghai on July 29, 2025. Photo: VCG

Chinese graphics processing unit (GPU) developer MetaX noticed its share worth surge 692.95 p.c to shut at 829.90 yuan ($117.85) on Wednesday because it made its debut on the Shanghai Stock Exchange’s STAR Market, China’s Nasdaq-style Science and Technology Innovation Board.

This spectacular rally follows one other blockbuster itemizing earlier this month, when shares of Moore Threads Technology Co, one other Chinese GPU developer, soared by greater than 400 p.c on its debut in Shanghai.

These staggering figures are a strong monetary endorsement, reflecting investor confidence within the development potential embedded in China’s push to develop home GPU expertise firms, the huge alternatives within the home business, and the R&D breakthroughs of home firms.

For starters, the strategic crucial for nurturing home high-end chip sector is a major driver. In the more and more fierce international tech competitors, GPUs have emerged as a core computing power engine in key fields comparable to synthetic intelligence (AI), massive knowledge, and high-performance computing. Amid some nations’ restrictions on superior AI chip exports, reaching technological self-sufficiency has turn into a precedence for China.

From top-level design to implementation, a collection of insurance policies supporting the built-in circuit and AI industries have been intensively launched, establishing a complete assist system masking fiscal and tax incentives, R&D assist and market promotion, creating an unprecedented growth atmosphere for home GPU firms.

Beyond coverage assist, the immense and sustained demand emanating from China’s digital financial system additionally offers a stable basis and robust momentum for the event of home GPUs. China boasts the world’s largest digital financial system and extremely dynamic digital utility eventualities. Whether it’s the widespread utility of AI, the speedy enlargement of information facilities, or the exploration of cutting-edge fields comparable to autonomous driving, metaverse and industrial simulation, there’s a sturdy demand for high-performance computing power.

IDC predicts that China’s accelerated computing market will preserve speedy development, and the general scale is predicted to exceed $100 billion by 2029. Such sure and sustained rising demand offers home GPU builders with clear growth alternatives.

Furthermore, the investor enthusiasm is more and more fueled by technological progress of Chinese chipmakers. Although Chinese chipmakers began late and nonetheless have to strengthen their basis, Chinese scientists and researchers are regularly making breakthroughs in a number of points via steady and high-intensity R&D funding and technological endeavors.

In February, Chinese scientists have achieved a significant breakthrough in built-in photonic quantum chips by demonstrating the primary “continuous-variable” quantum multipartite entanglement and cluster states on the chip; in November, three newly-developed Chinese chips have been unveiled on the Spatial Computing Summit 2025, marking a big step ahead when it comes to the nation’s development in spatial computing, in line with Xinhua.

Moore Threads will maintain its first MUSA Developer Conference on December 20-21 (Saturday to Sunday) in Beijing, which is predicted to stipulate the corporate’s full-stack technique and long-term imaginative and prescient centered on MUSA, unveil a next-generation GPU structure, and roll out a complete lineup masking merchandise, core applied sciences and business options, in line with the corporate’s official Weibo account.

These developments collectively persuade the market that technological self-reliance is an accelerating actuality. Each development enhances competitiveness and strengthens the narrative that China’s semiconductor business can regularly overcome exterior constraints.

In conclusion, the capital market’s curiosity in home GPU firms is a monetary echo of the nationwide strategic will for technological independence, a market-driven response to industrial upgrading and provide chain safety wants. This signifies that China’s high-end chip sector is transitioning right into a extra mature, multi-engine growth part, powered by the mixture of coverage, market demand, capital, and technological progress.

While short-term market actions might be influenced by sentiment, and the long-term journey faces vital challenges, the present inflow of economic assist is injecting very important sources and dynamism into the business, additional accelerating the sector’s journey towards impartial innovation and sustainable development.