Americans are more and more involved about their monetary state of affairs amid expectations that inflation might decide up, in response to a New York Federal Reserve survey launched Tuesday.

The central financial institution’s month-to-month Survey of Consumer Expectations discovered that buyers anticipate inflation to be increased within the 12 months forward, and fewer anticipate their households’ monetary conditions to be higher off a 12 months from now.

Household spending progress expectations additionally declined, the New York Fed’s survey discovered.

More from Personal Finance:

Consumers’ top pain points: groceries and gas

How a government shutdown may affect your money

How workers can prepare financially for a government shutdown

While many Americans have expressed worries about rising costs and the impact of President Donald Trump’s tariff insurance policies, few have modified their spending habits but. Up till now, specialists say, that’s what has helped the U.S. keep away from a major financial slowdown.

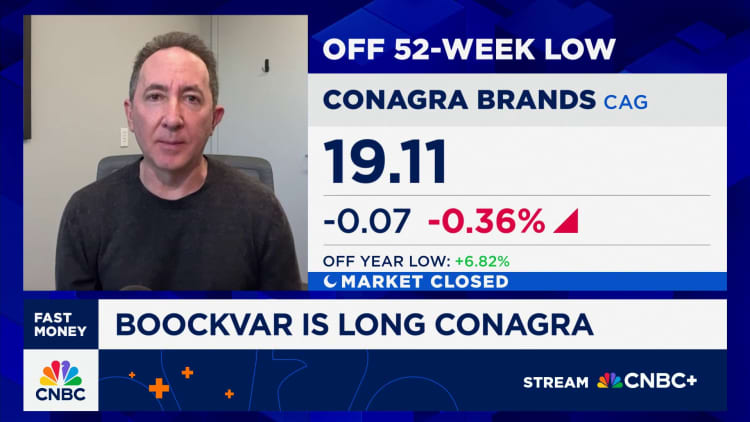

But Americans are having a more durable time maintaining, other research shows. High meals prices, specifically, make it tougher to cowl bills in a typical month. Grocery costs rose by 2.7% in August from a 12 months earlier, the quickest annual tempo since August 2023, in response to the most recent consumer price index.

“Few things drive Americans’ perception of the economy more than grocery prices,” mentioned Matt Schulz, chief credit score analyst at LendingTree. “If people are convinced that those are just going to keep rising, it stands to reason that fewer people would think that their own household’s financial situation would be better off a year from now.”

‘A fancy set of uncertainties’

Despite the cautious Fed outlook, a separate report by KPMG exhibits client spending is about to extend heading into the height procuring season on the finish of the 12 months.

“The consumer is spending like a poker player with a small chip stack,” Duleep Rodrigo, KPMG’s U.S. client and retail chief, mentioned in an announcement.

“They know they can’t play every hand but are willing to go ‘all in’ on a promising hand with a high emotional payoff,” he mentioned of projections that vacation spending will enhance in comparison with final 12 months.

“There’s also a psychological element where the consumer is managing a complex set of uncertainties,” Rodrigo mentioned.