You can’t accuse CNBC anchor David Faber of ignoring his guardian firm’s fast-sliding debut on Wall Street.

Faber on Wednesday reported on Versant’s IPO, which has been a dud to this point after shares of the Comcast spinoff firm have dropped 26% since hitting the Nasdaq initially of the week. Versant is house to numerous cable channels past CNBC, together with USA Network, MS NOW, E!, and the Golf Channel.

“My parent company is now pubic, Versant. It hasn’t gone well the last two days,” Faber stated.

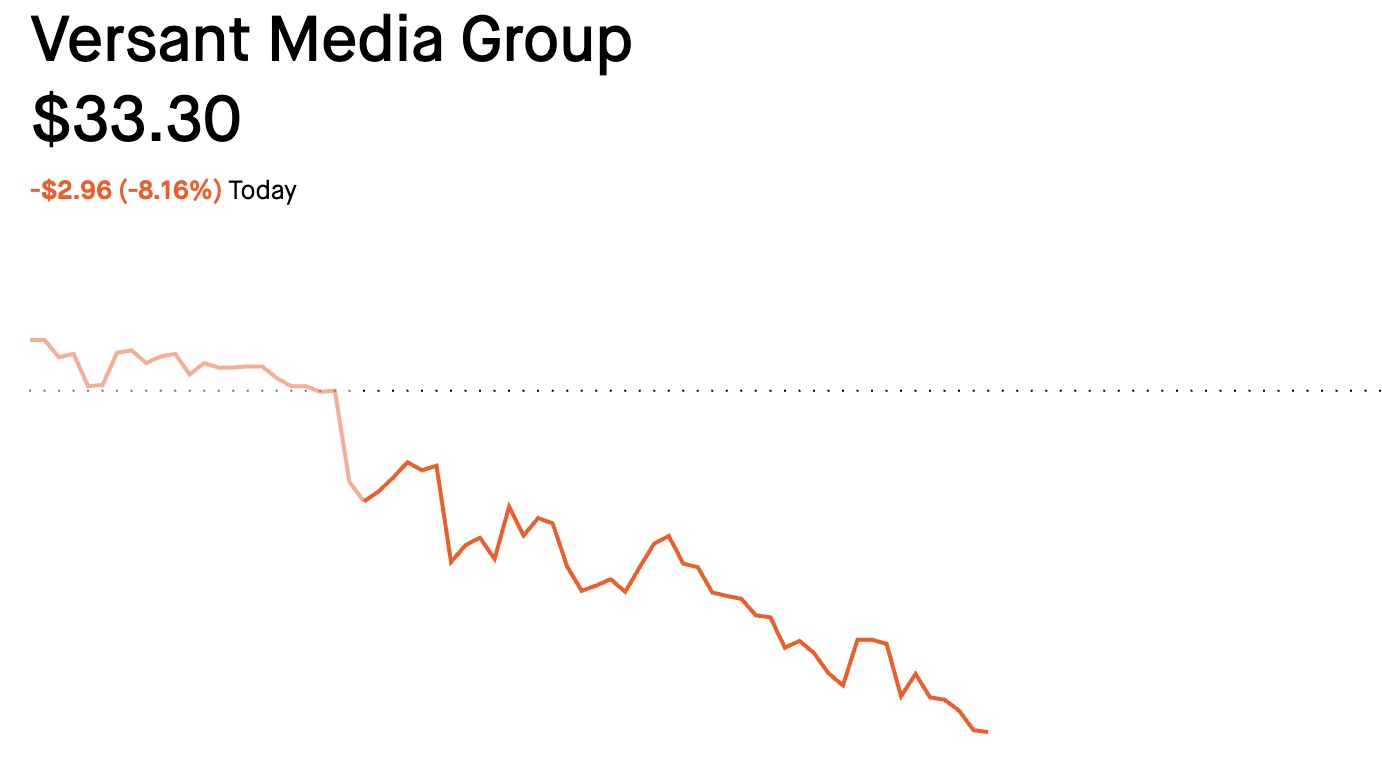

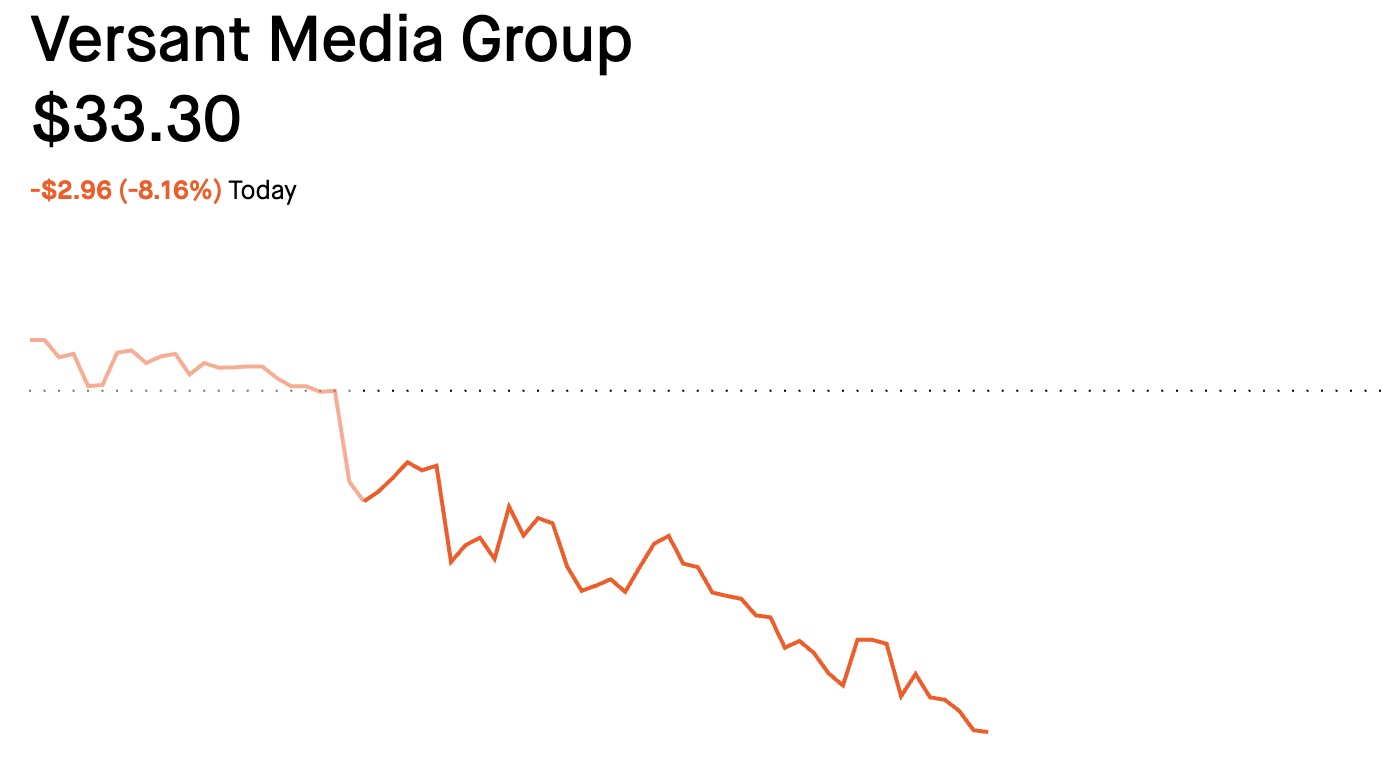

Versant opened at $45.17 per share on Monday earlier than closing the day down 13%; that slide has continued because the week has gone on, with shares down 8.16% to $33.30 by noon Wednesday.

(Photo Credit: Robinhood)

Faber made the remark whereas interviewing Warner Bros. Discovery Chairman Samuel Di Piazza.

Netflix and Paramount Skydance are both vying to acquire WB Discovery proper now, and Faber stated Versant’s tough week could possibly be unhealthy information for WBD.

“Global networks [are] not worth much of anything if you assume a Versant multiple,” he stated.

Di Piazza politely stated he believed WBD’s world networks — which embody TNT, NCS, and the Discovery Channel — are way more enticing than Versant’s package deal.

“Well, with all due respect to CNBC and all due respect to Versant — which are both great brands and great companies, and Versant is going through the natural transition from a cable-dominated shareholder base to a new shareholder base — Discovery Global is different,” Di Piazza stated. “t has a lot more scale.”

“It has a lot more debt too, Sam,” Faber shot again.

“It does have a lot of debt. But a lot of that debt can be discounted and bought back,” Di Piazza replied. “It is long-tenured debt, it has more cash flow, it is a different company.”

WBD’s inventory value is buying and selling for $28.60 on Wednesday — up almost 20% from a month in the past.

Watch above.