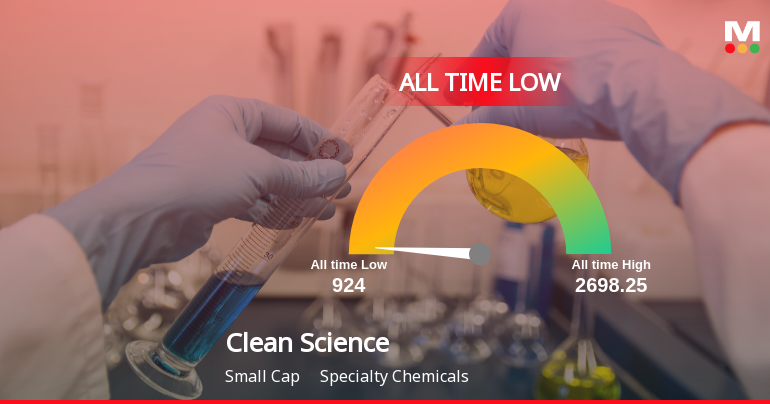

Clean Science & Technology has reached an all-time low, marking a big second for the small-cap specialty chemical compounds firm. As of November 11, 2025, the inventory’s efficiency has been notably poor, with a decline of 1.45% at this time, underperforming the Sensex, which fell by solely 0.37%. Over the previous month, Clean Science has seen a considerable drop of 13.60%, and its year-to-date efficiency stands at a decline of 34.94%.

The firm’s monetary metrics reveal a regarding pattern, with a current PAT of Rs 55.43 crore reflecting a 17.4% lower in contrast to the earlier quarter’s common. Additionally, the working revenue to internet gross sales ratio has reached its lowest level at 35.61%. Promoter confidence seems to be waning, as they’ve decreased their stake by 24% within the final quarter, now holding 50.97% of the corporate.

Clean Science’s inventory is buying and selling under its transferring averages throughout varied time frames, indicating a constant underperformance towards the benchmark indices over the previous three years. With a return of -33.62% during the last yr and a excessive PEG ratio of 12.7, the corporate faces challenges in regaining market traction.