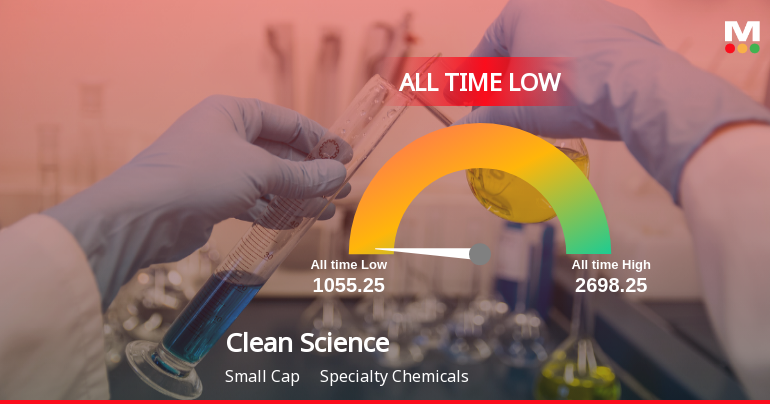

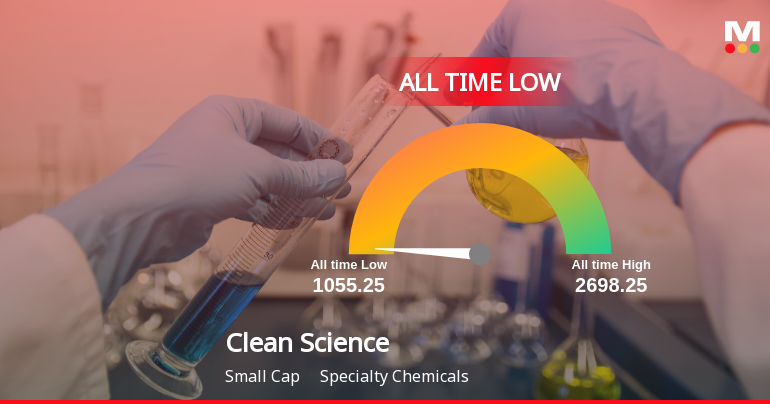

Clean Science & Technology has reached an all-time low on October 7, 2025, reflecting a major downturn in its inventory efficiency. The small-cap specialty chemical compounds firm has been on a downward trajectory, dropping 3.59% over the previous 5 days and 10.35% within the final month. Today’s efficiency noticed a decline of 0.39%, contrasting with a 0.37% achieve within the Sensex.

The inventory is at present buying and selling beneath its 5-day, 20-day, 50-day, 100-day, and 200-day transferring averages, indicating a persistent weak spot in market sentiment. Over the previous yr, Clean Science & Technology has generated a return of -29.25%, considerably underperforming the BSE500 index in every of the final three annual durations.

Despite a reported improve in earnings by 7% over the identical timeframe, the corporate’s working revenue development has been modest at an annual price of 5.88% during the last 5 years. With a return on fairness (ROE) of 18.7 and a price-to-book ratio of 8, the inventory seems to be buying and selling at a premium in contrast to its friends. The firm’s low debt-to-equity ratio and excessive administration effectivity, indicated by a ROE of 24.48%, are notable, but they haven’t translated into optimistic inventory efficiency.