Stock Performance Overview

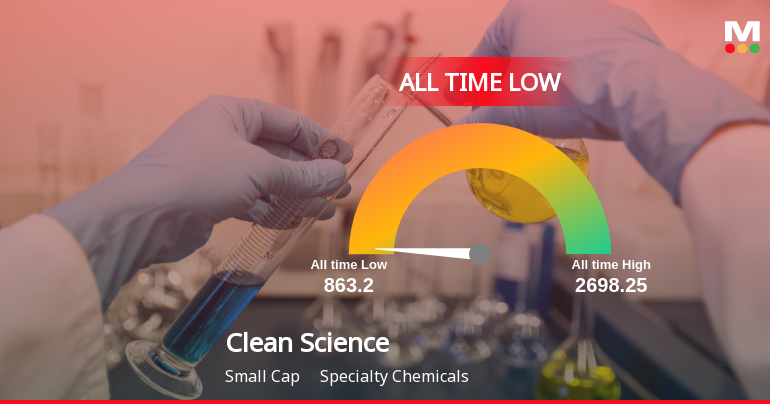

On 1 Jan 2026, Clean Science & Technology Ltd closed simply 0.15% above its 52-week low of ₹863.2, marking a recent nadir in its buying and selling historical past. The inventory has underperformed the Specialty Chemicals sector by 1.57% on the day, persevering with a two-day shedding streak that has resulted in a cumulative decline of two.29%. This downward momentum is additional emphasised by the inventory buying and selling under all key transferring averages, together with the 5-day, 20-day, 50-day, 100-day, and 200-day averages, signalling persistent bearish sentiment.

Comparatively, the benchmark Sensex recorded a marginal acquire of 0.03% on the identical day, highlighting the inventory’s relative weak point. Over longer time frames, Clean Science & Technology Ltd’s efficiency has been notably subdued: a 3-month return of -21.26% contrasts sharply with the Sensex’s 5.27% acquire, whereas the one-year return of -43.95% starkly underperforms the Sensex’s 8.59% appreciation. The three-year efficiency additional illustrates this pattern, with the inventory down 42.00% in opposition to a strong 40.12% rise within the Sensex.

Financial Metrics and Valuation

Despite the inventory’s decline, Clean Science & Technology Ltd maintains a excessive return on fairness (ROE) of 17.7%, indicative of environment friendly capital utilisation. However, that is accompanied by a steep price-to-book (P/B) ratio of 6.2, suggesting that the inventory stays expensively valued relative to its ebook worth. The firm’s PEG ratio stands at 11.9, reflecting a disconnect between value and earnings progress, as income have solely risen by 3% over the previous yr regardless of the numerous share value depreciation.

Quarterly monetary outcomes for September 2025 reveal additional pressures. Profit earlier than tax excluding different revenue (PBT much less OI) declined by 14.9% to ₹68.19 crores in comparison with the earlier four-quarter common. Similarly, revenue after tax (PAT) fell by 17.4% to ₹55.43 crores, whereas revenue earlier than depreciation, curiosity, and tax (PBDIT) reached a low of ₹87.09 crores. These figures spotlight a contraction in profitability in the course of the latest quarter.

Shareholding and Market Sentiment

Promoter confidence seems to be waning, as evidenced by a 24% discount in promoter stake over the earlier quarter. Currently, promoters maintain 50.97% of the corporate’s fairness. Such a lower in promoter holding could also be interpreted as a cautious stance concerning the corporate’s near-term prospects.

Long-Term Growth and Market Position

Over the final 5 years, Clean Science & Technology Ltd’s working revenue has grown at an annualised charge of simply 5.93%, a modest tempo that has not translated into sustained share value appreciation. The inventory’s constant underperformance in opposition to the BSE500 benchmark over the previous three years, coupled with damaging returns in every of the final three annual durations, underscores the challenges confronted in delivering shareholder worth.

On a constructive word, the corporate advantages from a low common debt-to-equity ratio of zero, indicating a conservative capital construction with minimal leverage. Additionally, administration effectivity stays excessive, with an ROE of twenty-two.95% reported, reflecting efficient utilisation of fairness capital regardless of the broader market pressures.

Mojo Score and Market Capitalisation

Clean Science & Technology Ltd at present holds a Mojo Score of 28.0, categorised as a Strong Sell. This represents a downgrade from its earlier Sell ranking as of 4 Aug 2025. The firm’s market capitalisation grade is rated at 3, reflecting its mid-tier measurement throughout the specialty chemical compounds sector.

Sector and Market Context

The specialty chemical compounds sector has skilled blended efficiency, with Clean Science & Technology Ltd’s returns lagging considerably behind sector averages. The inventory’s underperformance relative to the Sensex and sector friends over a number of time horizons highlights the extent of its valuation and efficiency challenges.

Summary of Key Performance Indicators

To summarise, the inventory’s key efficiency indicators reveal a fancy image: whereas administration effectivity and capital construction stay sound, the corporate faces stress from declining quarterly income, lowered promoter stake, and a valuation that continues to be excessive regardless of the share value decline. The persistent underperformance in opposition to benchmarks and the latest all-time low value underscore the tough atmosphere during which the corporate is working.

Conclusion

Clean Science & Technology Ltd’s fall to an all-time low marks a major milestone in its latest buying and selling historical past. The inventory’s efficiency displays a mixture of subdued revenue progress, valuation considerations, and shifting shareholder confidence. These elements collectively contribute to the present market valuation and place of the corporate throughout the specialty chemical compounds sector.

Only Rs. 9,999 – Get MojoOne + Stock of the Week for 1 Year (MRP = Rs. 34,999) Start Saving Now →