Stock Performance and Market Context

On 1 Feb 2026, Clean Science & Technology Ltd recorded a day decline of 0.53%, underperforming the Sensex which fell marginally by 0.02%. The inventory’s underperformance extends past a single day, with a one-week lack of 2.77% in comparison with the Sensex’s achieve of 0.88%. Over the previous month, the inventory declined by 3.35%, barely worse than the Sensex’s 2.86% fall. The disparity turns into extra pronounced over longer intervals: a three-month drop of 17.71% versus the Sensex’s 2.54% decline, and a one-year plunge of 42.00% whereas the Sensex gained 7.16%. Year-to-date, the inventory has fallen 5.37%, lagging behind the Sensex’s 3.48% lower.

Notably, Clean Science & Technology Ltd has did not generate constructive returns over the past three and 5 years, with a three-year lack of 39.66% contrasting sharply with the Sensex’s 38.25% achieve and a five-year flat efficiency in opposition to the Sensex’s 77.71% rise. Over a decade, the inventory has remained stagnant, whereas the Sensex surged by 230.74%.

The inventory’s volatility has been exceptionally excessive, with an intraday volatility of 112.89% calculated from the weighted common value, indicating vital value swings inside buying and selling classes. Additionally, Clean Science is buying and selling under all key shifting averages – 5-day, 20-day, 50-day, 100-day, and 200-day – signalling sustained downward momentum.

Financial Metrics and Valuation

The firm’s current quarterly outcomes spotlight a number of areas of concern. Net gross sales for the quarter stood at Rs.219.67 crores, the bottom recorded in current intervals. Profit after tax (PAT) declined sharply by 30.8% to Rs.45.88 crores in comparison with the earlier four-quarter common. Return on capital employed (ROCE) additionally reached a low of 23.61%, indicating lowered effectivity in producing returns from capital investments.

Despite these setbacks, Clean Science & Technology Ltd maintains a comparatively excessive return on fairness (ROE) of twenty-two.95%, reflecting administration’s capability to generate earnings from shareholders’ fairness. However, this has not translated into constructive inventory efficiency or valuation uplift.

The inventory’s valuation stays elevated with a price-to-book (P/B) ratio of 6.1, suggesting that the market costs the corporate at a premium relative to its e-book worth. This premium is notable given the corporate’s current monetary efficiency and contrasts with its friends’ common historic valuations, the place Clean Science trades at a reduction.

Further, the corporate’s price-to-earnings-to-growth (PEG) ratio stands at 11.7, signalling a excessive valuation relative to earnings development, which has been modest at an annual charge of 5.93% over the previous 5 years.

Long-Term Growth and Market Position

Over the final 5 years, Clean Science & Technology Ltd’s working revenue has grown at a compounded annual charge of simply 5.93%, reflecting subdued growth in its core enterprise. This gradual development trajectory has contributed to the inventory’s incapacity to maintain tempo with broader market indices and sector friends.

The firm’s market capitalisation grade is rated at 3, indicating a mid-tier market cap standing inside its sector. Institutional traders maintain a big 29.77% stake, suggesting that entities with superior analytical capabilities preserve publicity regardless of the inventory’s current efficiency.

Debt ranges stay minimal, with a median debt-to-equity ratio of zero, underscoring a conservative capital construction that limits monetary threat however has not been enough to offset different efficiency pressures.

Comparative Performance and Ratings

Clean Science & Technology Ltd’s efficiency has persistently lagged behind the benchmark BSE500 index, underperforming in every of the final three annual intervals. This development is mirrored within the inventory’s Mojo Score of 28.0, which corresponds to a Strong Sell grade as of 4 Aug 2025, an improve from a earlier Sell ranking. This grading displays the corporate’s deteriorated monetary metrics and market efficiency.

Sector-wise, the specialty chemical compounds trade has seen various performances, however Clean Science’s returns have been notably weaker than sector averages. The inventory underperformed its sector by 1.29% on the newest buying and selling day, additional emphasising its relative weak point.

Despite the challenges, the corporate’s low leverage and excessive administration effectivity, as indicated by its ROE, stay constructive attributes. However, these elements haven’t been enough to arrest the inventory’s decline or enhance its market standing.

Summary of Key Indicators

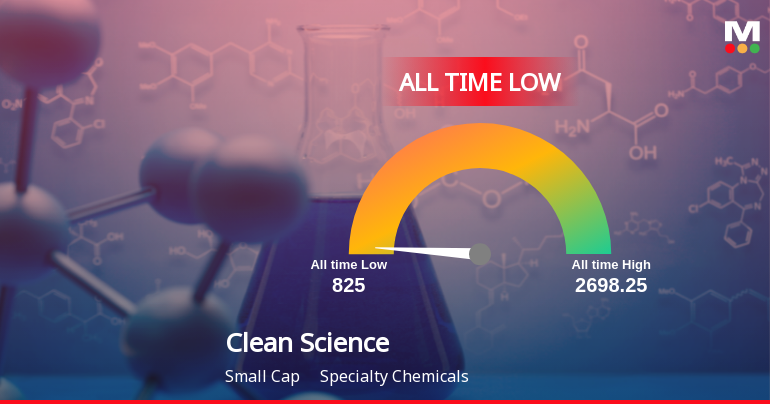

To summarise, Clean Science & Technology Ltd’s inventory has reached an all-time low of Rs.827 amid a backdrop of sustained underperformance, excessive volatility, and subdued monetary development. The firm’s current quarterly outcomes present declines in internet gross sales and earnings, whereas valuation metrics recommend a premium pricing that isn’t supported by earnings development. Institutional holdings stay vital, and the corporate maintains a conservative debt profile, however these elements haven’t translated into constructive market momentum.

The inventory’s Strong Sell ranking and low Mojo Score replicate the market’s cautious stance, with the corporate’s efficiency trailing each sector friends and broader indices over a number of time horizons.

Upgrade at particular charges, legitimate just for the subsequent few days. Claim Your Special Rate →