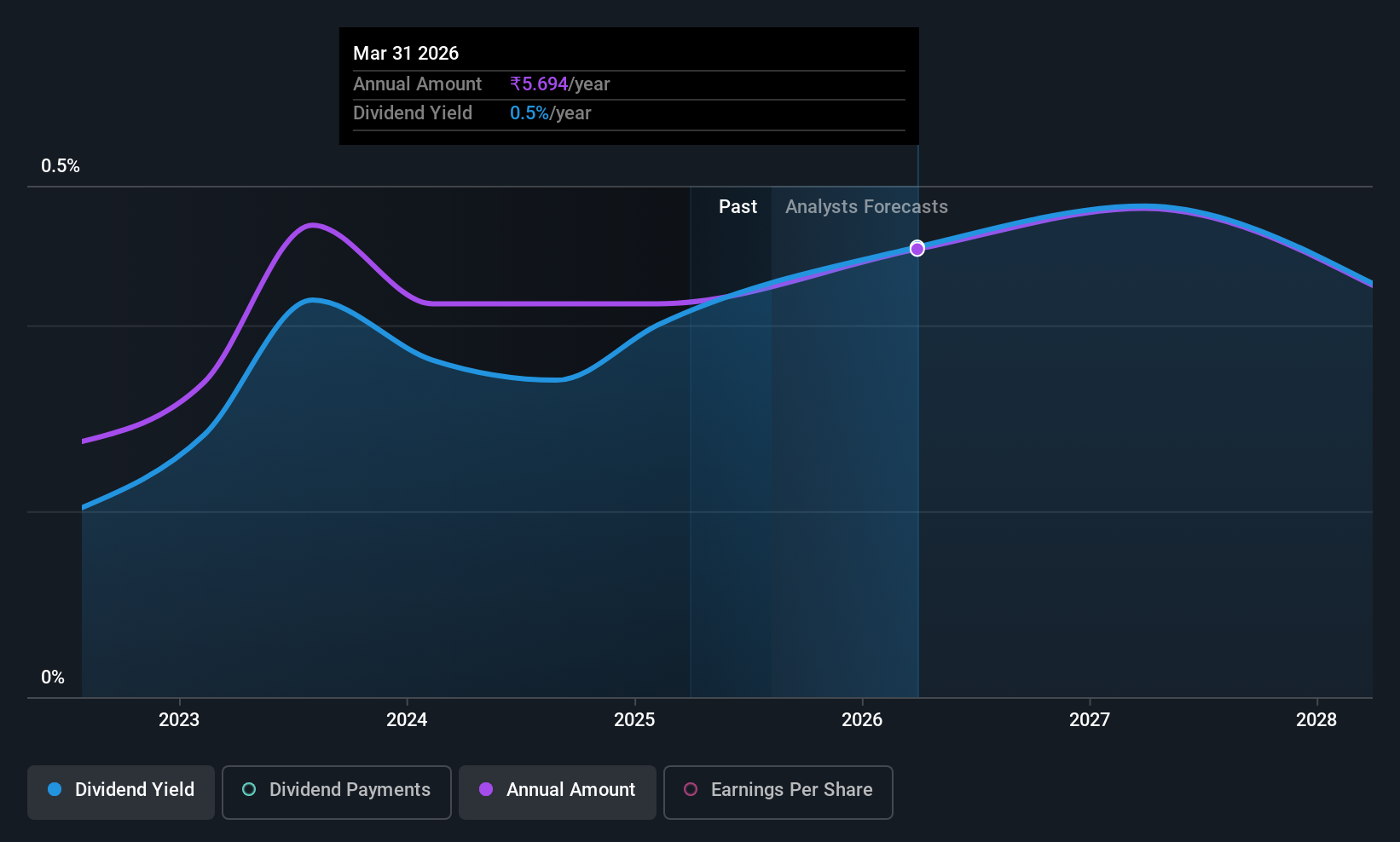

Clean Science and Technology Limited (NSE:CLEAN) has introduced that it will likely be rising its dividend from final yr’s comparable fee on the twenty sixth of September to ₹4.00. Despite this increase, the dividend yield of 0.5% is simply a modest enhance to shareholder returns.

Clean Science and Technology’s Future Dividend Projections Appear Well Covered By Earnings

It can be good for the yield to be larger, however we also needs to examine if larger ranges of dividend fee can be sustainable. But earlier than making this announcement, Clean Science and Technology’s earnings fairly simply coated the dividend. The enterprise is returning a big chunk of its money to shareholders, which suggests it’s not getting used to develop the enterprise.

The subsequent yr is about to see EPS develop by 108.6%. If the dividend continues on this path, the payout ratio might be 15% by subsequent yr, which we expect might be fairly sustainable going ahead.

Check out our latest analysis for Clean Science and Technology

Clean Science and Technology’s Dividend Has Lacked Consistency

Looking again, the dividend has been unstable however with a comparatively quick historical past, we expect it could be a bit early to attract conclusions about long run dividend sustainability. The dividend has gone from an annual complete of ₹3.25 in 2022 to the latest complete annual fee of ₹6.00. This works out to be a compound annual development charge (CAGR) of roughly 23% a yr over that point. Despite the fast development within the dividend over the previous variety of years, we have now seen the funds go down the previous as properly, in order that makes us cautious.

The Dividend Looks Likely To Grow

With a comparatively unstable dividend, it is much more vital to see if earnings per share is rising. It’s encouraging to see that Clean Science and Technology has been rising its earnings per share at 14% a yr over the previous 5 years. Clean Science and Technology positively has the potential to develop its dividend sooner or later with earnings on an uptrend and a low payout ratio.

In Summary

In abstract, whereas it is all the time good to see the dividend being raised, we do not suppose Clean Science and Technology’s funds are rock stable. The firm hasn’t been paying a really constant dividend over time, regardless of solely paying out a small portion of earnings. We would most likely look elsewhere for an earnings funding.

Market actions attest to how extremely valued a constant dividend coverage is in comparison with one which is extra unpredictable. Meanwhile, regardless of the significance of dividend funds, they aren’t the one elements our readers ought to know when assessing an organization. Taking the talk a bit additional, we have recognized 1 warning sign for Clean Science and Technology that traders must be aware of shifting ahead. If you’re a dividend investor, you may also need to have a look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market day by day to uncover alternatives.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High development Tech and AI Companies

Or construct your personal from over 50 metrics.

Have suggestions on this text? Concerned concerning the content material? Get in touch with us straight. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is common in nature. We present commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary scenario. We goal to carry you long-term centered evaluation pushed by elementary information. Note that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.