It appears like Clean Science and Technology Limited (NSE:CLEAN) is about to go ex-dividend within the subsequent 3 days. The ex-dividend date typically happens two days earlier than the file date, which is the day on which shareholders have to be on the corporate’s books with a view to obtain a dividend. The ex-dividend date is necessary as a result of any transaction on a inventory must have been settled earlier than the file date with a view to be eligible for a dividend. This signifies that buyers who buy Clean Science and Technology’s shares on or after the 4th of September is not going to obtain the dividend, which will probably be paid on the twenty sixth of September.

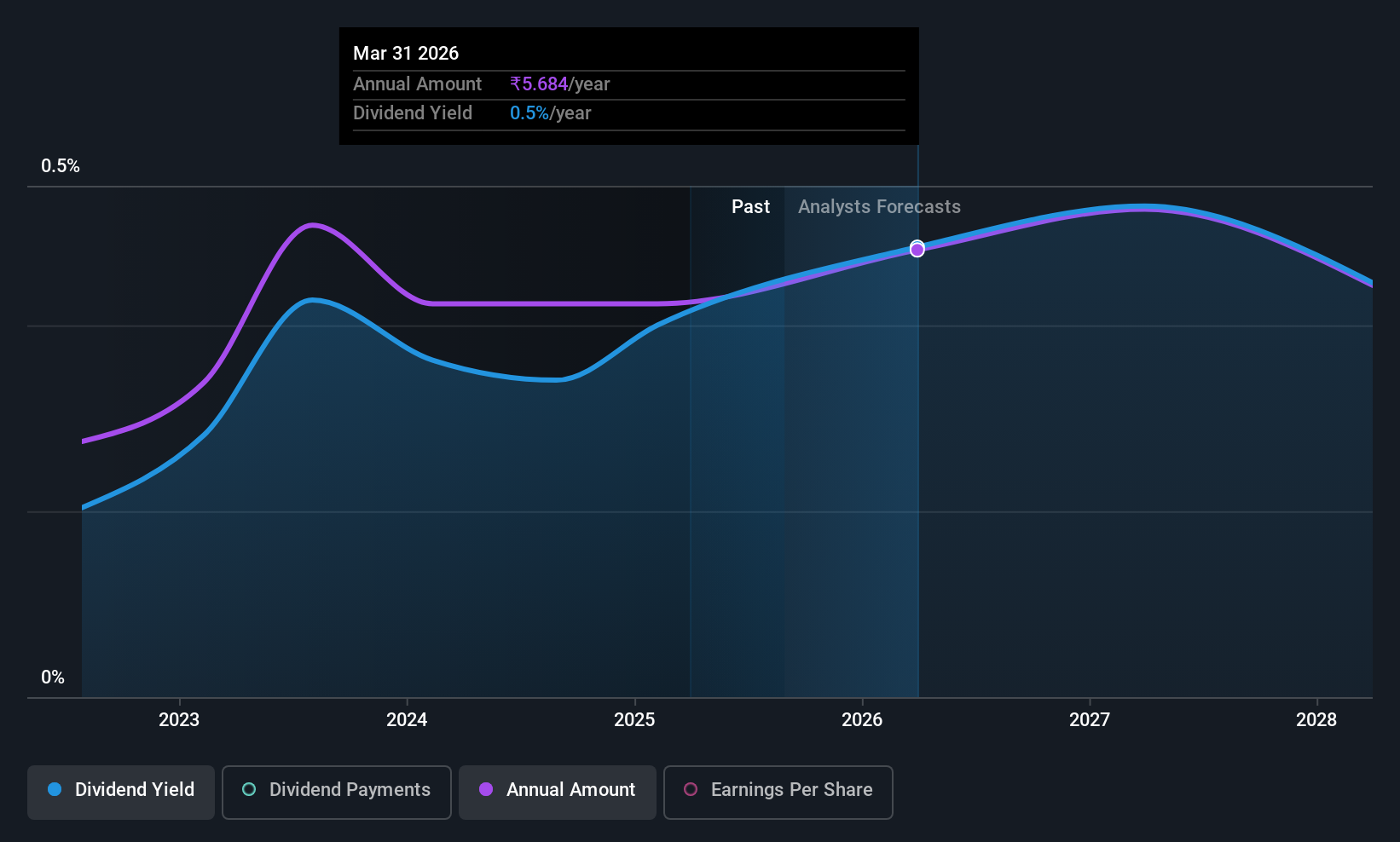

The firm’s subsequent dividend cost will probably be ₹4.00 per share, on the again of final 12 months when the corporate paid a complete of ₹6.00 to shareholders. Last 12 months’s whole dividend funds present that Clean Science and Technology has a trailing yield of 0.5% on the present share value of ₹1174.50. If you purchase this enterprise for its dividend, it’s best to have an thought of whether or not Clean Science and Technology’s dividend is dependable and sustainable. So we have to verify whether or not the dividend funds are lined, and if earnings are rising.

Dividends are often paid out of firm earnings, so if an organization pays out greater than it earned then its dividend is often at larger danger of being reduce. Clean Science and Technology paid out simply 24% of its revenue final 12 months, which we expect is conservatively low and leaves loads of margin for sudden circumstances. A helpful secondary verify might be to judge whether or not Clean Science and Technology generated sufficient free money stream to afford its dividend. Over the final 12 months it paid out 74% of its free money stream as dividends, throughout the standard vary for many firms.

It’s constructive to see that Clean Science and Technology’s dividend is roofed by each earnings and money stream, since that is typically an indication that the dividend is sustainable, and a decrease payout ratio often suggests a larger margin of security earlier than the dividend will get reduce.

See our latest analysis for Clean Science and Technology

Click here to see the company’s payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with persistently rising earnings per share typically make the perfect dividend shares, as they often discover it simpler to develop dividends per share. If earnings fall far sufficient, the corporate may very well be compelled to chop its dividend. For this cause, we’re glad to see Clean Science and Technology’s earnings per share have risen 14% each year over the past 5 years. Clean Science and Technology has a median payout ratio which suggests a stability between rising earnings and rewarding shareholders. This is an affordable mixture that might trace at some additional dividend will increase sooner or later.

Another key technique to measure an organization’s dividend prospects is by measuring its historic charge of dividend development. Clean Science and Technology has delivered 23% dividend development per 12 months on common over the previous three years. Both per-share earnings and dividends have each been rising quickly in latest instances, which is nice to see.

The Bottom Line

Has Clean Science and Technology acquired what it takes to take care of its dividend funds? Earnings per share have grown at a pleasant charge in latest instances and over the past 12 months, Clean Science and Technology paid out lower than half its earnings and a bit over half its free money stream. Overall we expect that is a horny mixture and worthy of additional analysis.

In mild of that, whereas Clean Science and Technology has an interesting dividend, it is price figuring out the dangers concerned with this inventory. For instance – Clean Science and Technology has 1 warning sign we expect you need to be conscious of.

If you are available in the market for robust dividend payers, we suggest checking our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market on daily basis to uncover alternatives.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High development Tech and AI Companies

Or construct your personal from over 50 metrics.

Have suggestions on this text? Concerned in regards to the content material? Get in touch with us immediately. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is normal in nature. We present commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t meant to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We purpose to carry you long-term targeted evaluation pushed by basic information. Note that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.