Clean Science and Technology (NSE:CLEAN) has had a tough three months with its share worth down 18%. However, inventory costs are normally pushed by an organization’s monetary efficiency over the long run, which on this case appears fairly promising. Specifically, we determined to review Clean Science and Technology’s ROE on this article.

Return on Equity or ROE is a check of how successfully an organization is rising its worth and managing traders’ cash. In different phrases, it’s a profitability ratio which measures the speed of return on the capital supplied by the corporate’s shareholders.

How To Calculate Return On Equity?

The system for ROE is:

Return on Equity = Net Profit (from persevering with operations) ÷ Shareholders’ Equity

So, primarily based on the above system, the ROE for Clean Science and Technology is:

19% = ₹2.7b ÷ ₹14b (Based on the trailing twelve months to June 2025).

The ‘return’ is the revenue the enterprise earned over the past 12 months. So, which means for each ₹1 of its shareholder’s investments, the corporate generates a revenue of ₹0.19.

See our latest analysis for Clean Science and Technology

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an environment friendly profit-generating gauge for a corporation’s future earnings. We now want to judge how a lot revenue the corporate reinvests or “retains” for future development which then provides us an concept in regards to the development potential of the corporate. Assuming all else is equal, corporations which have each the next return on fairness and increased revenue retention are normally those which have the next development fee when in comparison with corporations that do not have the identical options.

A Side By Side comparability of Clean Science and Technology’s Earnings Growth And 19% ROE

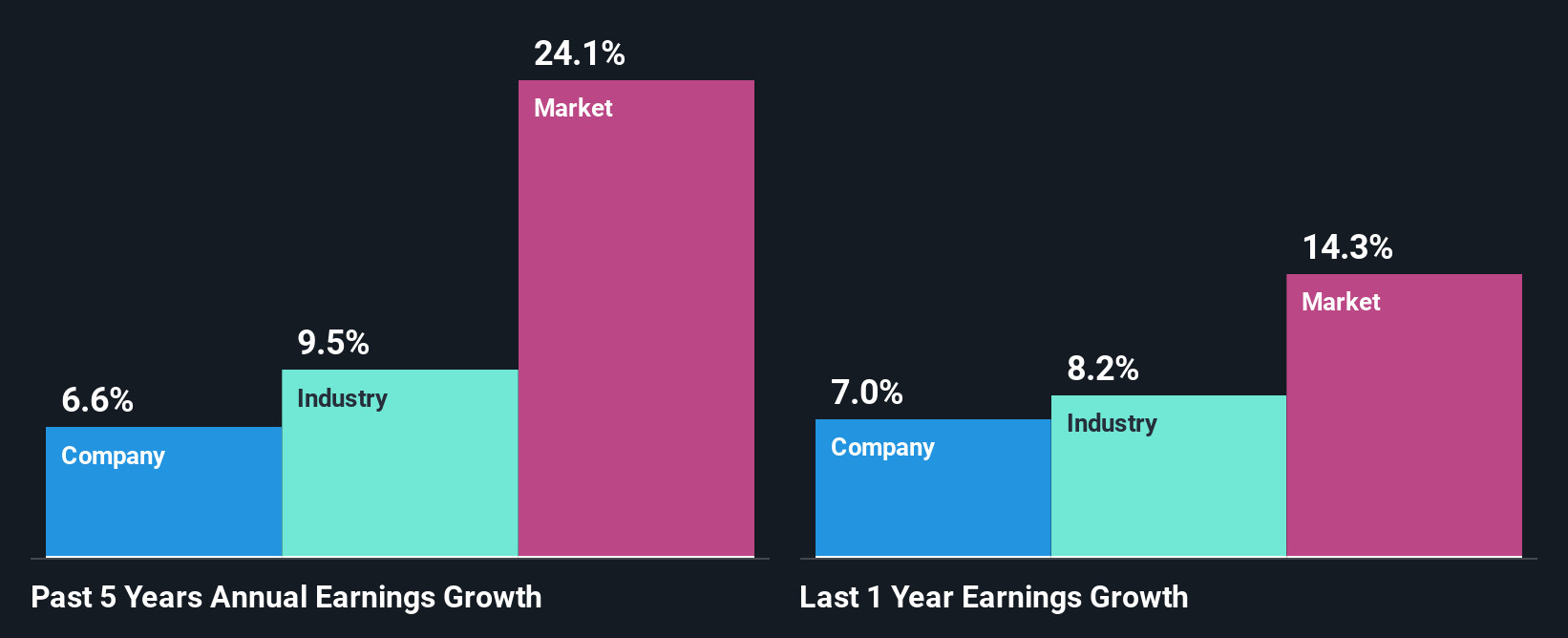

To start with, Clean Science and Technology appears to have a decent ROE. Especially when in comparison with the trade common of 10% the corporate’s ROE appears fairly spectacular. Probably because of this, Clean Science and Technology was capable of see a good development of 6.6% over the past 5 years.

Next, on evaluating with the trade web revenue development, we discovered that Clean Science and Technology’s reported development was decrease than the trade development of 9.5% over the previous couple of years, which isn’t one thing we prefer to see.

Earnings development is a large think about inventory valuation. What traders want to find out subsequent is that if the anticipated earnings development, or the shortage of it, is already constructed into the share worth. Doing so will assist them set up if the inventory’s future appears promising or ominous. One good indicator of anticipated earnings development is the P/E ratio which determines the value the market is prepared to pay for a inventory primarily based on its earnings prospects. So, you could need to check if Clean Science and Technology is trading on a high P/E or a low P/E, relative to its trade.

Is Clean Science and Technology Using Its Retained Earnings Effectively?

In Clean Science and Technology’s case, its respectable earnings development can most likely be defined by its low three-year median payout ratio of 21% (or a retention ratio of 79%), which means that the corporate is investing most of its income to develop its enterprise.

Additionally, Clean Science and Technology has paid dividends over a interval of three years which signifies that the corporate is fairly critical about sharing its income with shareholders. Existing analyst estimates counsel that the corporate’s future payout ratio is anticipated to drop to 12% over the subsequent three years. The indisputable fact that the corporate’s ROE is anticipated to rise to 23% over the identical interval is defined by the drop within the payout ratio.

Conclusion

On the entire, we really feel that Clean Science and Technology’s efficiency has been fairly good. Particularly, we like that the corporate is reinvesting closely into its enterprise, and at a excessive fee of return. As a consequence, the respectable development in its earnings is no surprise. With that stated, the newest trade analyst forecasts reveal that the corporate’s earnings are anticipated to speed up. To know extra in regards to the newest analysts predictions for the corporate, try this visualization of analyst forecasts for the company.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every single day to uncover alternatives.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High development Tech and AI Companies

Or construct your individual from over 50 metrics.

Have suggestions on this text? Concerned in regards to the content material? Get in touch with us immediately. Alternatively, e-mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is normal in nature. We present commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t supposed to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary scenario. We intention to carry you long-term centered evaluation pushed by elementary knowledge. Note that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.