Clean Science and Technology Limited (NSE:CLEAN) shareholders are most likely feeling just a little disillusioned, since its shares fell 7.1% to ₹938 within the week after its newest quarterly outcomes. It seems to be just like the outcomes have been a little bit of a unfavorable general. While revenues of ₹2.4b have been in keeping with analyst predictions, statutory earnings have been lower than anticipated, lacking estimates by 9.4% to hit ₹5.21 per share. This is a crucial time for buyers, as they will observe an organization’s efficiency in its report, have a look at what specialists are forecasting for subsequent 12 months, and see if there was any change to expectations for the enterprise. Readers will probably be glad to know we have aggregated the most recent statutory forecasts to see whether or not the analysts have modified their thoughts on Clean Science and Technology after the most recent outcomes.

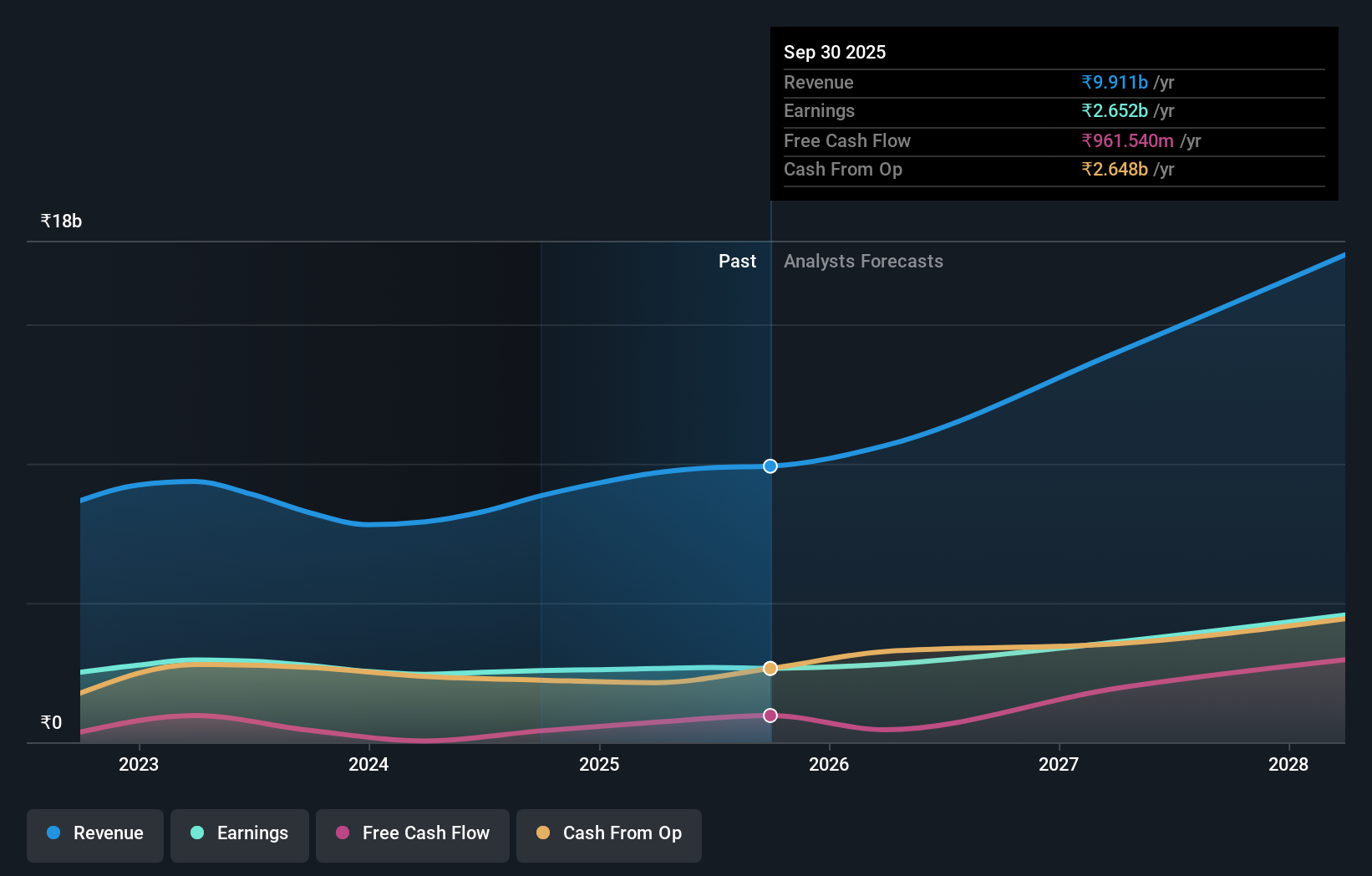

Taking under consideration the most recent outcomes, the present consensus from Clean Science and Technology’s twelve analysts is for revenues of ₹10.6b in 2026. This would mirror an okay 7.4% enhance on its income over the previous 12 months. Per-share earnings are anticipated to rise 3.8% to ₹25.91. Yet previous to the most recent earnings, the analysts had been anticipated revenues of ₹11.6b and earnings per share (EPS) of ₹30.15 in 2026. The analysts appear much less optimistic after the current outcomes, decreasing their income forecasts and making an actual minimize to earnings per share numbers.

View our latest analysis for Clean Science and Technology

The analysts made no main modifications to their value goal of ₹1,372, suggesting the downgrades usually are not anticipated to have a long-term affect on Clean Science and Technology’s valuation. The consensus value goal is simply a mean of particular person analyst targets, so – it might be useful to see how vast the vary of underlying estimates is. There are some variant perceptions on Clean Science and Technology, with essentially the most bullish analyst valuing it at ₹1,738 and essentially the most bearish at ₹1,002 per share. This reveals there may be nonetheless a little bit of variety in estimates, however analysts do not look like completely break up on the inventory as if it could be a hit or failure scenario.

Of course, one other method to take a look at these forecasts is to position them into context in opposition to the industry itself. It’s clear from the most recent estimates that Clean Science and Technology’s price of progress is predicted to speed up meaningfully, with the forecast 15% annualised income progress to the tip of 2026 noticeably sooner than its historic progress of 12% p.a. over the previous 5 years. Other comparable corporations within the trade (with analyst protection) are additionally forecast to develop their income at 13% per 12 months. Clean Science and Technology is predicted to develop at about the identical price as its trade, so it isn’t clear that we are able to draw any conclusions from its progress relative to opponents.

The Bottom Line

The most necessary factor to remove is that the analysts downgraded their earnings per share estimates, exhibiting that there was a transparent decline in sentiment following these outcomes. They additionally downgraded their income estimates, though as we noticed earlier, forecast progress is just anticipated to be about the identical as the broader trade. The consensus value goal held regular at ₹1,372, with the most recent estimates not sufficient to have an effect on their value targets.

Following on from that line of thought, we expect that the long-term prospects of the enterprise are way more related than subsequent 12 months’s earnings. At Simply Wall St, we’ve a full vary of analyst estimates for Clean Science and Technology going out to 2028, and you may see them free on our platform here..

Even so, bear in mind that Clean Science and Technology is showing 1 warning sign in our investment analysis , it’s best to find out about…

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every single day to uncover alternatives.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High progress Tech and AI Companies

Or construct your personal from over 50 metrics.

Have suggestions on this text? Concerned concerning the content material? Get in touch with us immediately. Alternatively, electronic mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is normal in nature. We present commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We goal to deliver you long-term targeted evaluation pushed by elementary information. Note that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.