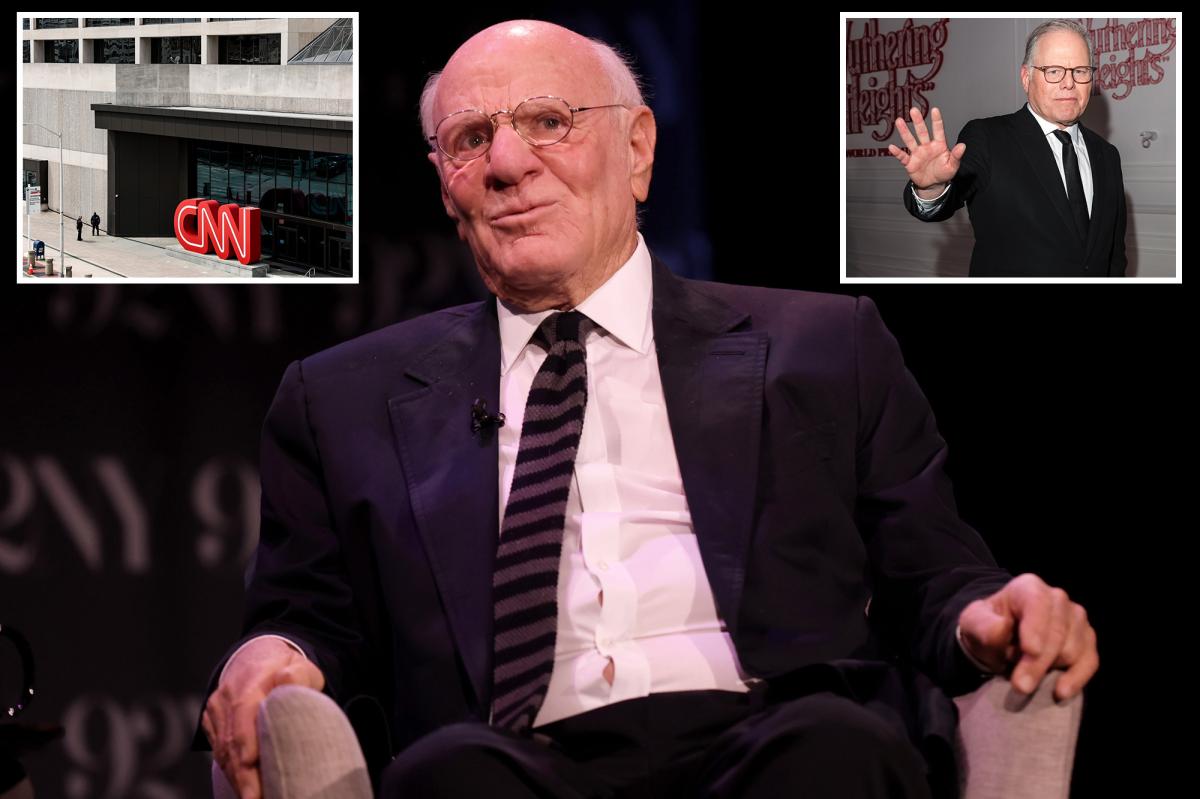

Billionaire tech and media investor Barry Diller reportedly expressed interest in shopping for NCS from Warner Bros. Discovery final 12 months as the media conglomerate planned to split up, although the talks by no means went past preliminary inquiries.

The overtures from Diller had been described by The Wall Street Journal as private and separate from his function as head of media and web big IAC.

The concept of Diller shopping for NCS was by no means severely thought of and didn’t advance to the WBD board degree, in accordance to The Journal.

Warner Bros. Discovery has mentioned NCS was not and isn’t on the market.

IAC declined to touch upon the report, saying Diller will not be commenting on any interest in NCS.

Last month, Netflix agreed to acquire Warner Bros. Discovery’s studio and streaming business in a $72 billion mega merger. WBD plans to spin off Discovery Global — together with NCS — into a brand new publicly-traded firm.

WBD executives mentioned NCS is seen as a core asset of the planned spinoff and performs a crucial function in distribution agreements, making a sale impractical and expensive from a tax perspective.

“NCS is an incredibly important part of the future of Discovery Global once it separates from Warner Bros,” a WBD rep informed The Post in a press release.

“While interest in the premier global news network is not at all new, NCS was not and is not for sale.”

IAC controls Dotdash Meredith, which lately rebranded its company title to People Inc., one of many largest digital publishers in the US. Its manufacturers embrace People, Better Homes & Gardens and Investopedia.

IAC additionally owns the digital information outlet The Daily Beast.

Diller is married to fashion designer Diane von Furstenberg, whom he wed in 2001 after a decades-long relationship.

In latest years, Diller has spoken candidly about his private life, revealing that he had romantic relationships with men earlier than marrying von Furstenberg and describing their marriage as a deep, enduring partnership.

Before Diller’s outreach, WBD laid out a plan to split the corporate as a part of its proposed take care of Netflix, separating its high-growth studio and streaming property from its slower-declining cable networks.

Under the construction backed by WBD’s board, the corporate would first spin off its cable portfolio into a brand new, publicly traded entity earlier than promoting the remaining companies to Netflix.

The property slated on the market embrace Warner Bros.’ movie and tv studios together with HBO and the HBO Max streaming platform — the crown jewels of the corporate’s content material engine.

Netflix would purchase these companies outright in an all-cash transaction, giving it management of one in all Hollywood’s deepest libraries and among the most precious scripted manufacturers in tv and movie.

The cable networks, together with NCS, TNT, TBS and Discovery Channel, could be grouped right into a separate firm recognized as Discovery Global.

That entity would stay unbiased and publicly traded, inheriting the majority of the legacy cable operations and a major share of the corporate’s debt — some extent that has change into a significant flashpoint in the takeover battle.

WBD has argued the split would unlock worth by permitting buyers to individually worth fast-growing streaming and studio property versus conventional cable networks dealing with long-term cord-cutting strain.

Critics, together with rival bidder Paramount Skydance, have attacked the plan as overly complicated and value-destructive, arguing the spun-off cable firm could be left saddled with debt and restricted development prospects.