New York

—

If there’s one factor the White House, Wall Street and Silicon Valley can agree on, it’s that synthetic intelligence is a prime precedence.

Tech giants are pouring billions into new knowledge facilities and infrastructure to assist the know-how. The White House got here out with an AI action plan in July to spice up America’s management in the house, underscoring the tech’s significance to the administration. Wall Street retains pushing AI-related stocks like Nvidia (NVDA) to new data.

But President Donald Trump’s commerce struggle has raised questions on whether or not the administration’s insurance policies may work in opposition to its massive AI push. Certain tariffs may elevate the prices of supplies and elements essential to assist these AI fashions.

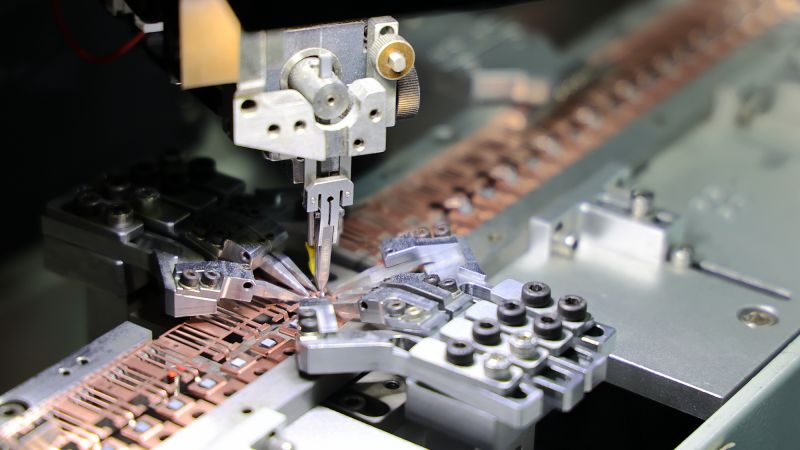

For instance, the president stated on August 6 that he would challenge a 100% tariff on semiconductors imports, though he added that corporations which have dedicated to increasing their manufacturing operations in the US could be exempt. (He didn’t give an actual timeline for when these tariffs would begin.) And in late July, he imposed a 50% tariff on copper, which is used in digital elements equivalent to printed circuit boards and chips.

But whereas tariffs may stoke uncertainty round prices, consultants say they gained’t sluggish technological developments, primarily as a result of the stakes are just too excessive to fall behind in the worldwide AI race.

For giant tech corporations like Meta and Microsoft, shedding in AI could be a larger worth to pay than any further prices from tariffs. Dallas Dolen, the US know-how, media and telecommunications lead for PricewaterhouseCoopers, stated some of these corporations doubtless view the AI increase as an “existential moment” for his or her companies.

“Cost, if you have enough money, is not the most important variable that you take into account when you’re told it’s an existential threat,” he stated to NCS.

When Meta, Microsoft and Google reported earnings in late July, one message rang loud and clear: Big Tech is spending massive on AI, and it’s beginning to repay.

Meta spent $17 billion in capital expenditures for the quarter that ended in June, and it noticed its earnings per share go up 38% in comparison with a 12 months in the past. Capital expenditures sometimes check with cash spent on issues like knowledge facilities and infrastructure, doubtless a signal that Meta is investing extra in the servers wanted to energy its burgeoning AI providers.

Wall Street cheered the outcomes; Meta shares (META) rose 9% in after-hours buying and selling when it posted the outcomes on July 30, and shares are up roughly 30% 12 months to this point.

Microsoft (MSFT) additionally posted robust outcomes because of its cloud computing enterprise. It spent $24.2 billion in capital expenditures throughout its most up-to-date quarter, and it plans to spend one other $30 billion in the approaching months, the corporate stated in late July. Microsoft turned the second firm to reach a $4 trillion valuation final month, following Nvidia, and its shares are up about 26% up to now this 12 months.

And Google guardian Alphabet elevated its capital expenditures for 2025 to $85 billion due to demand for its cloud merchandise. The company said its cloud providers are utilized by “nearly all gen AI unicorns,” referring to privately held corporations value $1 billion or extra in the generative synthetic intelligence house. Alphabet shares (GOOG) are up almost 7% 12 months to this point.

That further infrastructure could also be important; Goldman Sachs estimates that international energy demand from knowledge facilities will surge 50% by 2027 and 165% by 2030 in comparison with 2023 due to AI.

“We have barely scratched the surface of this 4th Industrial Revolution now playing out around the world led by the Big Tech stalwarts such as Nvidia, Microsoft, Palantir, Meta, Alphabet, and Amazon,” Wedbush Securities analyst Dan Ives stated in a analysis be aware following the corporations’ earnings outcomes.

Trump’s quickly altering tariff insurance policies have made it tough to estimate how precisely the levies may impression the price of constructing and working knowledge facilities.

But PwC’s Dolen stated he’s seen estimates indicating that tariffs may enhance development prices by 5% to 7%. The National Association of Manufacturers’ outlook survey additionally discovered that commerce uncertainties and elevated prices of uncooked supplies have been the highest enterprise challenges for producers in the primary quarter of 2025.

However, massive tech corporations are prone to eat any further prices associated to AI infrastructure as a result of “demand is so strong,” stated Michelle Brophy, director of analysis for tech, media and telecom at market intelligence agency AlphaSense.

It’s a completely different story for smaller corporations that don’t have billions to spend every quarter. They additionally sometimes have personal traders demanding a quick return on funding, and knowledge facilities are long-term bets that would take years to indicate worth in a significant means.

Between 2015 and 2020, it took one to 3 years on common to assemble a knowledge heart, based on industrial actual property providers agency CBRE. And a knowledge heart is helpful for 25 years to 30 years on common, McKinsey & Company senior associate Pankaj Sachdeva said in October 2024.

Because knowledge facilities are long-term tasks, “the degree of uncertainty will have a larger impact in terms of, you know, committing to something that will take multiple years to execute,” stated Laurence Ales, a professor of economics at Carnegie Mellon University.

It’s additionally unclear whether or not Trump’s semiconductor tariffs will elevate the price of future knowledge facilities. The president stated corporations which have “committed” to constructing in the US gained’t must pay a levy on semiconductors.

“But the good news for companies like Apple is, if you’re building in the United States, or have committed to build, without question, committed to build in the United States, there will be no charge,” he stated on August 6 throughout an occasion asserting Apple’s $100 billion initiative to provide iPhone elements in the US.

Trump didn’t specify which corporations could be exempt, however chipmaking giants Nvidia and TSMC have each stated they’d develop their US operations.

Experts consider extra collaboration between the White House and Silicon Valley is prone to come, presumably easing any potential tariff-induced prices for tech giants. Trump confirmed his willingness to barter with tech leaders earlier this week: He allowed Nvidia and AMD to promote their AI chips to China so long as they supply a 15% lower to the US authorities in trade for export licenses. And the White House is reportedly discussing taking a stake in chipmaker Intel.

Building AI infrastructure is a key a part of the White House’s AI motion plan, which incorporates coverage suggestions for streamlining permits for amenities like knowledge facilities and semiconductor manufacturing amenities.

The United States already has extra knowledge facilities than another nation, based on knowledge from Cloudscene, a platform that connects companies with cloud providers, compiled by Statista. Many of the world’s largest cloud suppliers, like Microsoft and Amazon, are American corporations.

“We need to be mindful that this is an area in which we have an advantage,” Matt Pearl, director of the strategic applied sciences program on the Center for International and Strategic Studies, stated to NCS. “And we don’t want to give that up.”