Sample descriptive statistics

To check for the presence of multicollinearity in the variables, the Variance Inflation Factor (VIF) check is carried out; the outcomes are offered in Table 2. The most VIF worth of every variable is 2.165, the minimal worth is 1.279, and the common VIF worth is 1.680, which is way smaller than the check requirement of 10. Thus, the impact of multicollinearity might be ignored to some extent. The descriptive statistics for every variable are offered in Table 3. The most and minimal values of the pattern information range significantly from one variable to a different, indicating a fantastic deal of variability throughout areas. Notably, some values in Table 3 are unfavourable as a result of the management variable is logarithmic and is included in the regression.

Benchmark regression

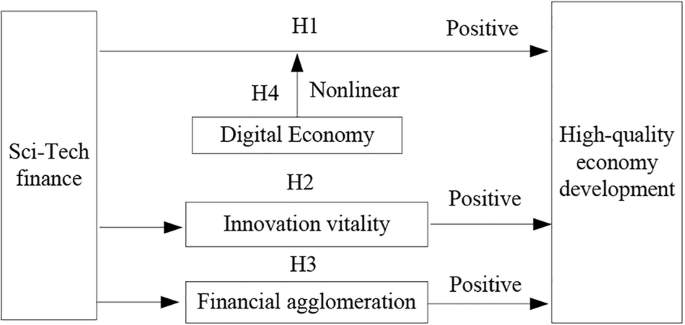

Benchmark regression fashions had been used to carefully appraise the connection between Sci-Tech finance and the development of high-quality financial development. Table 4 particulars the findings, the robustness of which was evaluated utilizing a city-based clustering strategy. The evaluation is segmented in this desk: columns (1) and (2) heart on nationwide pattern information regressions, controlling for each time and particular person metropolis results. Column (1) presents the findings with out management variables, whereas column (2) contains management variables. When each time and metropolis influences are managed, the regression end result for the nationwide pattern information is 0.295, which is statistically vital on the 1% significance degree. This discovering suggests a major correlation, in which a one-unit improve in Sci-Tech finance corresponds to a 0.295 unit improve in the index of high-quality financial development. Columns (3) to (5) current the regression outcomes based mostly on the subsamples of the jap, central, and western area respectively. The regression coefficient in the jap area is 0.199, and that in the central area is 0.2789, each of which have handed the importance check. The outcomes confirmed that the impression of regional Sci-Tech finance on high-quality financial development is the best in the central area, adopted by the jap area, whereas it’s not vital in the western area. The general financial and Sci-Tech finance ranges in the western area are comparatively low. Analysis based mostly on the Gini coefficient signifies that the Gini coefficient for the Sci-Tech finance index in the western area is larger than that in the jap area, implying vital inside disparities and pronounced polarization inside the Sci-Tech finance panorama of the western area. Specifically, provincial capital cities reminiscent of Guiyang, Chengdu, Xi’an, and Lanzhou have exhibited sturdy development, whereas different prefecture-level cities in the western area have lagged behind in Sci-Tech finance development, ensuing in substantial regional variations in the Sci-Tech finance development index. This disparity constitutes one of the important thing elements contributing to the insignificant regression outcomes noticed in samples from the western area. The regression outcomes of the samples point out that Hypothesis H1 has been verified.

Endogeneity points

IV methodology check

The endogeneity drawback ought to be totally taken into consideration in regression evaluation. In this examine, the sources of the endogeneity drawback are as follows: First, there may be the bias of omitted variables. Despite the thorough inclusion of varied elements reminiscent of authorities affect, open to the skin world, and human capital, and using each city-fixed and time-fixed results in the evaluation, there stays the likelihood that sure unseen variables might have an effect on the connection between Sci-Tech finance and the high-quality financial development, but usually are not accounted for. Another concern raised is the choice bias in the pattern. Focusing on 273 prefecture-level cities, the analysis strives to exclude cities with lacking information to mitigate this problem. However, regardless of efforts to compensate for minor information gaps by way of interpolation, the potential for pattern bias happens.

The examine makes use of 1984 postal historical past information as an instrumental variable to check the endogeneity drawback. The rationale behind this selection lies in two key observations. Historically, the postal service performed a vital position in laying down phone networks and served as a vital channel for remittances, considerably influencing monetary operations. The intertwining of monetary business development with the appearance of telecommunications, because of the in depth adoption of telephones, highlights the relevance of this historic context. Additionally, the historic information on fixed-line phone density and the dimensions of postal and telecommunication actions in cities have a negligible impact on the modern indices measuring financial high quality development throughout these cities. Therefore, it may be thought-about that selecting the per capita postal and telecommunications enterprise quantity in 1984 (PTBV) as an instrumental variable meets the 2 necessities of instrumental variable correlation and exogeneity. Some literature additionally makes use of the lagged one interval of the core explanatory variable as an instrumental variable. Since this examine is panel information and PTBV is cross-sectional information, due to this fact, the product of PTBV and the lagged one interval of the core explanatory variable is taken because the IV instrumental variable.

Table 5 demonstrates the outcomes from making use of the instrumental variable methodology, the place column (1) presents the regression outcomes of the primary stage and column (2) shows the regression outcomes of the second stage. The first stage exhibits an F-value of 23.030, exceedinging the edge of 10. This is in line with the benchmarks set by Cragg and Donald (1993) in addition to Stock and Yogo (2002). The end result of the Cragg-Donald Wald F statistic is 452.70. This determine exceeds the vital worth for the ten% significance degree, set at 16.38, thus refuting the unique speculation of “instrumental variables are weakly identified” (Stock and Yogo, 2002). This discovering confirms the check’s necessities are glad. Moreover, the p worth of Kleibergen-Paap rk LM statistic is 0.000, demonstrating the non-identifiable check’s outcomes are legitimate. The regression coefficient in column (2) is 1.102 and passes the 1% significance check, the evaluation signifies a major and optimistic correlation between Sci-Tech finance and high-quality financial development, echoing the benchmark regression findings. This signifies the robustness of the outcomes of this examine.

Considering lagged results

Considering the sustained and lagged impact of Sci-Tech finance on the high-quality financial development, this examine goals to mitigate potential endogeneity considerations by regressing the explanatory variables with a one-period lag, as illustrated in Table 6. Column (1) and columns (3) accounts for time-fixed results and particular person mounted results with out incorporating management variables, whereas columns (2) by way of (4) each embrace management variables. It might be seen that regardless of whether or not the management variables are added or not, the regression outcomes are considerably optimistic after lagging one interval and lagging two durations of the explanatory variables. These findings emphasize the impression of Sci-Tech finance on the high-quality development of the economy has a sure sustained impact and lagged impact.

Robustness assessments

Winsorization

To reduce the potential impact of information outliers, the pattern information is subjected to winsorization. In the 1% winsorization, values lower than the first percentile are changed with the worth on the 1st percentile, and values higher than the 99th percentile are changed with the worth on the 99th percentile. The outcomes of the 1% and 5% winsorization are offered in Table 7. After controlling for time-fixed results, city-fixed results, and management variables, the regression coefficient with a 1% discount was 0.355; whereas the regression coefficient with a 5% discount was 0.369, displaying no vital distinction from the coefficients of the unique benchmark regression. The outcomes verify the robustness of the pattern information.

Indicators of substitute variables

To additional confirm the reliability of the mannequin, we suggest substituting the indications of the dependent and unbiased variables for regression validation. The outcomes are summarized in Table 8. Column (1) presents the outcomes of the recalculation by changing one variable with the constituent indicators of the Sci-Tech finance index. Columns (2) and (3) current the outcomes obtained after changing the calculation strategies of the sub-indices with the measurement indicators of the high-quality financial development index. By altering the explanatory variables and the defined variables, the regression coefficients stay vital, indicating that Sci-Tech finance has a major selling impact on high-quality financial development and is strong and dependable.

Heterogeneity evaluation

To delve deeper into the impact of Sci-Tech finance on the development of high-quality financial development, this evaluation explores the position of Sci-Tech finance by way of three views: the extent of human capital, the diploma of innovation, and digital infrastructure. We using Fisher’s Permutation check by self-sampling (Bootstrap) 1000 occasions to calculate the P worth, indicating the variations in coefficient impacts throughout varied teams, as detailed in Table 9.

First, grouping by human capital degree, the regression outcomes for various teams in Sci-Tech finance on financial development are illustrated in Table 9. The information with larger human capital ranges, as offered in column (1), has a regression coefficient of 0.407, and passes the 1% significance check. In distinction, the info for teams with decrease human capital, indicated in column (2), doesn’t exhibit a major regression coefficient. The P worth for the check evaluating coefficient variations throughout these teams stands at 0.004, assembly the factors for the 1% significance degree. This highlights a major distinction in the impact of Sci-Tech finance on high-quality financial development, depending on the regional ranges of human capital. Specifically, areas endowed with a richer human capital base exhibit a higher profit from digital infrastructure, reminiscent of networks, in cultivating digital monetary inclusion (Niu et al., 2022). The evaluation confirms that areas with larger human capital ranges exhibit a extra vital regression coefficient than the mixture pattern, highlighting a extra vital impact of Sci-Tech finance on enhancing financial high quality in these areas. Conversely, in areas with low ranges of human capital, the impact of Sci-Tech finance on cultivating high-quality financial progress seems negligible. This underlines the vital position human capital performs in financial excellence, necessitating elevated funding in schooling to uplift regional human capital requirements.

Secondly, in exploring the impact of Sci-Tech finance on the development in direction of high-quality financial development, a distinction is made between areas based mostly on their innovation ranges. This distinction is measured by way of the attitude of approved invention patents per capita, which function a proxy for measuring innovation. Analysis is categorized into two cohorts, with findings detailed in Table 9. For areas labeled underneath the excessive innovation tier, as offered in column (3), the regression coefficient is noticed at 0.331, and statistically vital on the 5% degree. Conversely, the coefficient related to areas of decrease innovation, as demonstrated in column (4), the regression coefficient for areas with low ranges of innovation 0.020 however not vital. A comparability of coefficient variances between these teams yields a p worth of 0.024 at a 5% significance degree. This end result highlights a major distinction in how Sci-Tech finance catalyzes high-quality financial development throughout areas characterised by various innovation intensities. Specifically, the numerous regression coefficient in areas of excessive ranges of innovation means that Sci-Tech finance performs a extra vital position in cultivating high-quality financial outcomes in these areas. This is in distinction to areas with low ranges of innovation footprint, the place the impact of Sci-Tech finance on financial high quality is unfavourable. This distinction could also be attributed to the weak Sci-Tech basis and innovation capabilities.

Third, in analyzing the connection between digital infrastructure and financial development, analyzes had been segmented into two classes as offered in columns (5) and (6) of Table 9. The digital infrastructure index is a complete index calculated by the entropy methodology based mostly on the quantity of native information facilities, the protection charge of Internet customers, the protection charge of cellphones and so on. Analysis of regression outcomes signifies that the impact of Sci-Tech finance on the development in direction of a high-quality financial state is markedly extra vital in zones with in depth digital infrastructure, with a coefficient of 0.355 and passes the 1% significance check. In distinction, such impact seems negligible in areas with decrease digital infrastructure. The statistical check for coefficient distinction between these teams underlines a major distinction, highlighted by a p worth of 0.013 on the 5% significance degree, thereby confirming a moderating impact of digital infrastructure on the efficacy of Sci-Tech finance in cultivating financial excellence. The noticed distinction in regression coefficients, favoring areas with digital infrastructure, highlights the improved impact of Sci-Tech finance in such locales. This phenomenon accentuates the urgency for accelerated enhancements in digital infrastructure and cellular data community accessibility. Such strategic developments are important for catalyzing the confluence of Sci-Tech and monetary sectors, thereby amplifying the position of Sci-Tech finance in elevating the usual of financial development to a better high quality.

In abstract, the examine of the info signifies that the impact of Sci-Tech finance on enhancing financial high quality is notably extra vital in areas characterised by excessive human capital, a excessive diploma of innovation, and excessive degree digital infrastructure. This highlights the need for a custom-made strategy to the appliance of Sci-Tech finance, tailor-made to the precise situations of every area. In areas the place Sci-Tech finance performs a vital position in cultivating high-quality financial development, it’s essential not solely to leverage its potential to information this development successfully but in addition to deal with and bridge the gaps in areas the place its impact is much less vital. Accordingly, it’s attainable to additional notice the potential of Sci-Tech finance as a the place for advancing the trigger of high-quality financial progress.

Analysis of the impression mechanisms

Testing technique for mediating transmission mechanism

To additional discover the mediating transmission mechanism of Sci-Tech finance on high-quality financial development, quite a few research typically undertake the three-step mediating impact mannequin proposed by Wen and Ye (2014) to check whether or not the mediating impact exists and analyze the affect transmission position of the mediating variables. Specifically, step one is to look at the impression of Scifi on Quali, as proven in formulation (1); the second step is to investigate the impression of Scifi on the mediating variable ({M}_{it}), as proven in Eq. (4); and the third step is to include the mediating variables and the Scifi into the regression mannequin concurrently to check their impacts on Quali, as proven in Eq. (5).

$${M}_{it}={alpha }_{0}+{alpha }_{1}Scif{i}_{it}+{alpha }_{2}{X}_{it}+{mu }_{i}+{varphi }_{t}+{varepsilon }_{it}$$

(4)

$${Y}_{it}={beta }_{0}+{beta }_{1}Scif{i}_{it}+{beta }_{2}{M}_{it}+{beta }_{3}{X}_{it}+{mu }_{i}+{varphi }_{t}+{varepsilon }_{it}$$

(5)

However, when this methodology is utilized in economics, endogeneity points might happen, and the mediating variables might have reverse causality (Jiang, 2022). This examine adopts the next strategies to beat the shortcomings of the standard three-step check.

First, referring to the strategy for addressing the endogeneity problem of Sci-Tech finance in IV methodology check, the mediating mechanism variables, specifically, Innovit and Finagg are taken because the core explanatory variables for the evaluation, and the IV methodology is employed to confirm whether or not Innovit and Finagg are exogenous variables in the regression of Quali. Second, to beat the potential endogeneity affect of the mediating variables, in distinction to the standard evaluation methodology that adopts the OLS benchmark regression evaluation mannequin, the 2SLS mannequin is utilized for the regression evaluation in steps (4) and (5). The particular thought is that in the 2SLS regression mannequin of Scifi on the Quali, the affect mechanism variables are step by step included to look at whether or not the regression coefficient of Scifi turns into bigger or smaller after the addition of these mediating affect mechanism variables. (*273*) the regression coefficient of Scifi decreases after including a mediating affect mechanism variable, it signifies that this affect mechanism variable is a optimistic transmission mechanism by way of which Scifi impacts Quali. Conversely, a rise in the regression coefficient implies that the mediating affect mechanism variable is a unfavourable transmission mechanism.

Results of mechanism testing

First, the IV methodology is employed to confirm whether or not the mediating mechanism variables, specifically Innovit and Finagg, are exogenous variables in the regression of Quali. Table 10 presents the outcomes of the 2SLS regression evaluation.

Analyzing Innovit as an influential mechanism variable, the F-statistic worth in the primary stage is 73.160, exceeding the required threshold of 10 and thus passing the check requirement. The Cragg-Donald Wald F statistic yields a price of 1626.950, surpassing the vital worth of 16.38 at a ten% significance degree. In addition, the p worth of the Kleibergen-Paap rk LM statistic is 0.039, verifying the non-identifiable check outcomes. The second-stage regression coefficient of Innovit is 0.564 and is critical on the 1% degree, demonstrating that Innovit meets the factors for an exogenous variable.

Analyzing Finagg as an influential mechanism variable, the first-stage F-statistic is 186.89, which additionally exceeds the edge of 10 and satisfies the check necessities. The Cragg-Donald Wald F statistic outcomes in a price of 2305.14, exceeding the vital worth of 16.38 at a ten% significance degree. In addition, the p worth of the Kleibergen-Paap rk LM statistic is 0.093, confirming that the non-identifiable check outcomes are legitimate. The second-stage regression coefficient is 17.219, which is critical on the 1% degree, confirming that Finagg meets the necessities of an exogenous variable.

In abstract, Innovit and Finagg qualify as eligible exogenous variables.

In the second step, Innovit and Finagg are individually included into the regression mannequin. The ensuing 2SLS regression outcomes are offered in Table 11. Column (1) illustrates the regression of Scifi on Quali by 2SLS mannequin, deriving a regression coefficient of 1.102. Columns (2) and (3) display the regression outcomes of Scifi on Innovit and Finagg, respectively. The respective regression coefficients are 2.651, 0.045 and all of them cross the 1% significance check. This significance signifies that Sci-Tech finance impacts the mediating mechanism, Innovit and Finagg. Column (4) presents the 2SLS outcomes obtained after together with each Scifi and Innovit in the regression equation. The inclusion of Innovit as a variable reduces the coefficient of Scifi impression on Quali to 0.608, representing a 44.83% lower from the preliminary worth of 1.102. Similarly, column (5) shows the 2SLS outcomes after incorporating each Scifi and Finagg into the regression equation. The addition of Finagg as a variable outcomes in a coefficient of 0.788 for the impact of Scifi on Quali, marking a 28.49% discount from 1.102.

In abstract, these findings counsel that the 2 mediating mechanism variables, Innovit and Finagg, play a optimistic transmission position in the mechanism of the impact of Sci-Tech finance on the high-quality economy development. This implies that speculation H2 and H3 is verified.